Uniswap, at press time, had accumulated a seven-day trading volume of $9.7 billion. In doing so, it has continued to dominate the DEX space. In fact, Uniswap’s daily trading volume just exceeded Coinbase recently. This further goes on to illustrate the growing prominence of DEXs in the space.

Despite such growth, however, is Uniswap well-equipped to ward off challenges from close competitors such as Curve Finance?

Only way is UP

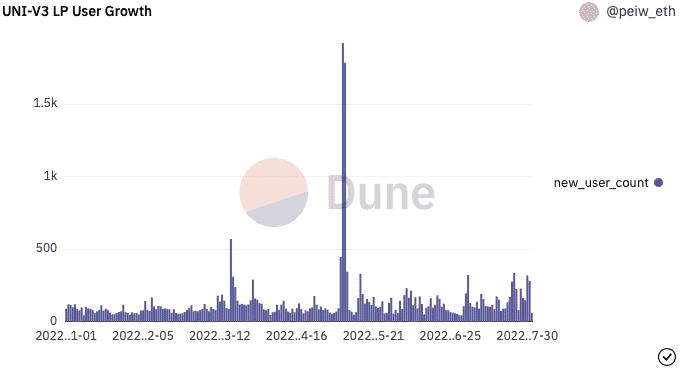

Recent on-chain data has emerged that goes on to solidify Uniswap’s dominance in the market. Despite the Q2 ambush, Uniswap set a 2022 milestone of 1920 new users on the protocol in May. On 7 and 8 May, there were almost 2K new users, but the number fell drastically as ETH’s price fell drastically.

However, user growth was prevalent across July as network activity grew multifold during this period. The average user has since increased to 100 too, with the same growing steadily.

There are almost 6 million users who swapped tokens. Almost 1/3rd of them (1.92 million) used Uniswap V3 and 96% of them (1.86 million) only swapped. Only 3% of the Uniswap V3 swap users provided liquidity. 2-% of the total liquidity providers only provided liquidity and did not use the swap feature.

NFT trades on Uniswap V3 have registered significant growth since the onset of the third quarter. The trading volume here crossed 533k in mid-July, setting a new record recently.

Furthermore, the week in question coincided with Blockchain.com launching the UNI token on its platform. Meanwhile, UNI has also seen an acceleration in whale accumulation recently. According to Whale Stats, UNI also flipped INU as the most traded token among the top 500 Ethereum whales.

Where’s the token in all this?

At the time of writing, UNI was trading at around $8.25 after bull activity contributed to a 22.5% hike this week. This puts UNI around 150% up from its lowest ebb this year. Even so, UNI did see a rare decline this week as it dipped by 5.64% in 24 hours.