FTX Token (FTT) has been increasing since Jan 24 and is showing several bullish signs. However, there is a stark contrast between the price action and technical indicator readings.

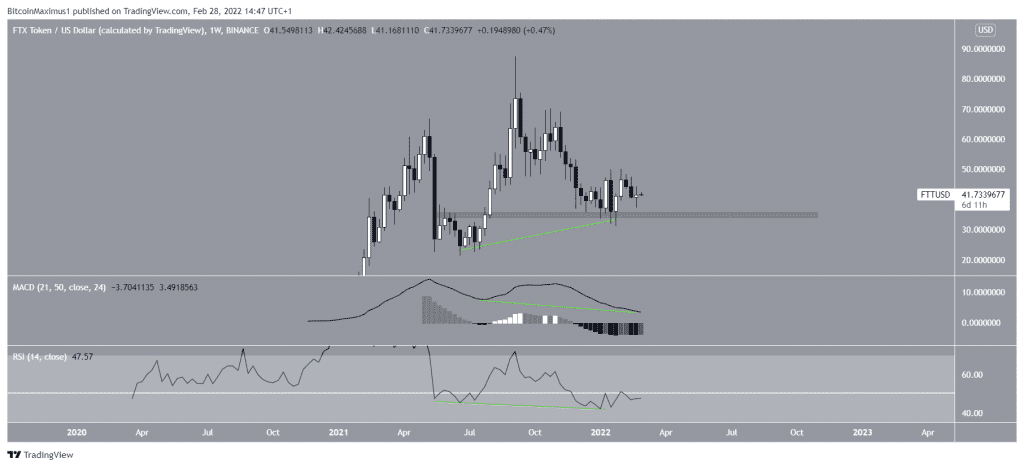

FTT has been falling since reaching an all-time high price of $87.3 on Sept 7. However, the decrease stopped once FTT bounced at the $35 horizontal support area on Jan 24.

Despite the bounce, technical indicators are showing mixed signs. On the bullish side, both the RSI and MACD have generated very significant hidden bullish divergences (green line). Such divergences are a strong sign of trend continuation. Since the underlying trend is bullish, a continuation of this upward movement would be likely.

However, both indicators are still decreasing, which is a bearish sign.

Cryptocurrency trader @CryptoPoseidonn tweeted a chart of FTT, stating that if the price manages to move above $63, a new all-time high would be expected.

Due to the mixed readings from the weekly time-frame, a look at lower time-frames is required in order to determine if FTT will indeed increase towards a new all-time high.

FTT breaks out

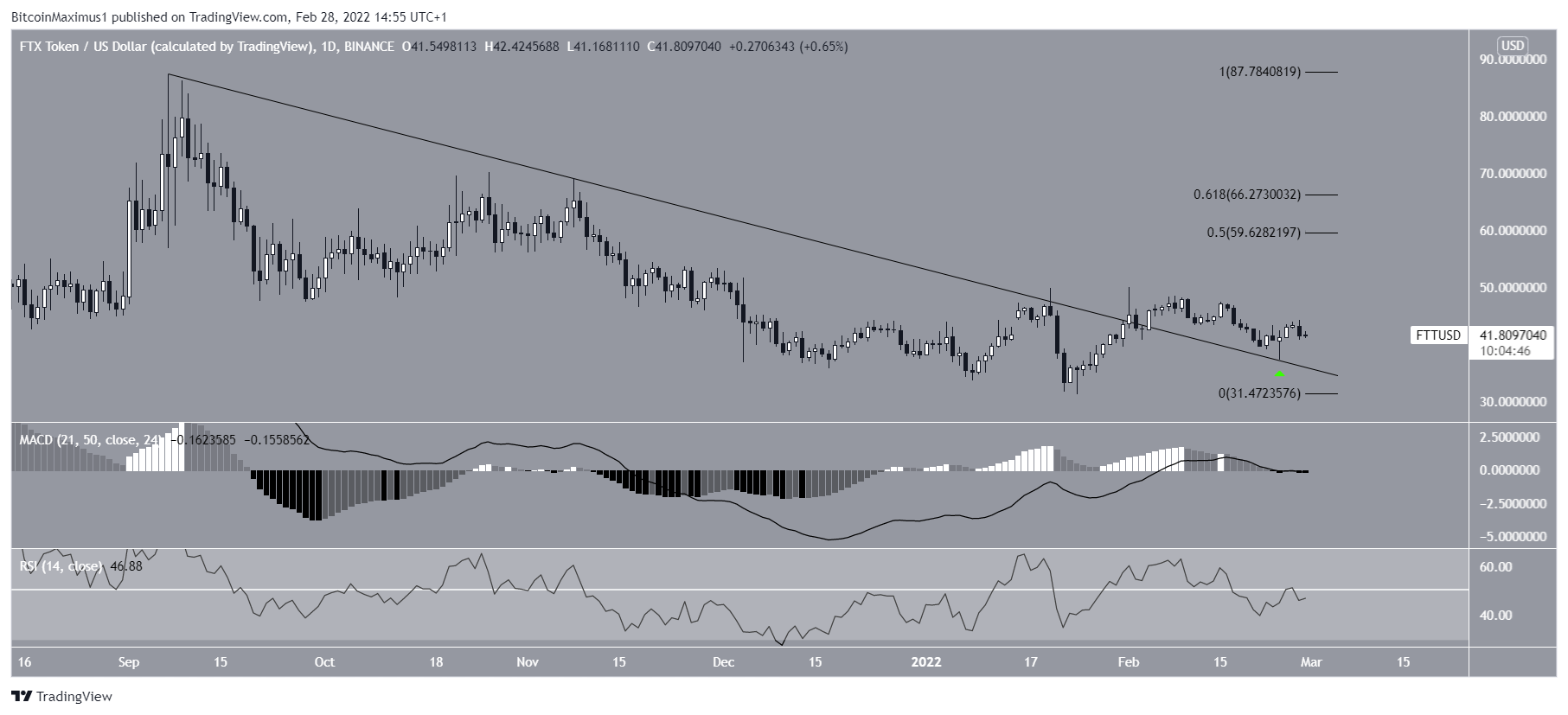

The daily chart shows that FTT has broken out from a descending resistance line that had been in place since the aforementioned all-time high.

Afterwards, it validated this line as support on Feb 24 (green icon). The price has been moving upwards since.

However, the daily time-frame also fails to confirm the direction of the trend, since technical indicators and the price action give contrasting readings.

While the FTT price action is bullish, technical indicators are bearish. Both the RSI and MACD are decreasing, the former being below 50 while the latter negative.

However, both indicators are very close to their respective bullish thresholds. Therefore, a slight price increase would cause both of them to turn bullish.

If the upward movement continues, the main resistance area would be between $59.5 and $66.2, created by the 0.5-0.618 Fib retracement resistance levels.

The six-hour time-frame shows that FTT is trading inside a descending parallel channel. This is usually a corrective pattern, meaning that a breakout from it would be the most likely scenario.

However, similarly to both the weekly and daily time-frame, technical indicators are neutral/bearish, providing some ambiguity as to the direction of the trend.

Wave count analysis

Finally, the wave count supports the possibility that the price will increase. The FTT price decrease resembles an A-B-C corrective structure, in which waves A:C had a nearly 1:1 ratio.

Also, the overlap between the Feb 2022 high and Sept 2021 lows (red line) suggests that the decrease was corrective.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.