This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

When bitcoin tumbles, Bitcoiners get poorer. They don’t have fewer sats in their (hardware) wallets but can get radically less stuff with those sats — hence “poorer.” Poorer Bitcoiners can do fewer things in the world; they have less command over the world’s economic resources. If you think Bitcoiners have something practical to contribute to the world, this is a bad thing.

Some things, like spreading ideas and learning, can be done without funds, but most important things require capital.

When bitcoin tumbles, the press, the skeptics and the haters have a field day (“see, bubble! Corruption! Risky scam!”).

When bitcoin tumbles, the idea that it is in any shape or form a reasonable asset to hold against a clownish world seems less persuasive. For all their flaws, at least my dollar cash, my euros or my credit card — suffering from inflation and the occasional censored transaction — don’t explode like this!

It should be obvious, then, that a falling BTCUSD is bad for Bitcoin. Still, the most vocal Bitcoiners tend to disagree: falling bitcoin prices purge the weak and over-levered, and it lets the rest of us stack and learn in peace.

Here is the contrarian case laid out in more detail.

Story Time: How Falling Exchange Rates Hurt Bitcoiners

A few months back, I spent 500,000 sats on an expense for a trip. “What?!” Says the purist. ”You should never spend your bitcoin!” Yah-yah, but if you never spend it, its use case never grows and, anyway, it made most sense given my financial situation at the time (anyone else irresponsibly overweight bitcoin?) Given what came to pass thereafter, who’ll blame me?

I got a few nights in a decent AirBnB with some friends. I could have gotten about two weeks’ worth of groceries or something like two years of Nik Bhatia’s excellent subscription, “The Bitcoin Layer.” When I first wrote this draft, that was down to about a single night, probably just one week’s worth of groceries, and just over six quarters of Bhatia’s unencumbered writing. Inflation might be a bitch, but then what do we call a BTCUSD crash?

Now, after yet another bitcoin price debacle, those 500,000 sats probably get me a single hostel bed or two and would barely have covered what I just spent to add some basic items to my empty post-travel fridge.

Inflation is terrible and unfair, but it is slow, often predictable and fairly manageable with even the smallest of efforts (often automatically adjusted through indexation in wage contracts or other recurring transactions). Bitcoin is fast, unpredictable and entirely unmanageable to the average person. That’s what makes it such a poor money at present. It’s pretty unusable in its main duties (carrying economic value across time and space), and that’s before considering the altogether artificial hassle of paper, tax and capital gains. Perhaps that’s part of the inevitable growing pain. Humans are ingenious types; we adapt and learn and make institutional arrangements that fit our environments. But it’s at times like these that I’m not so sure. That mountain we’re climbing looks awfully steep.

I never thought I would say it, but the bureaucratic monstrosity that is the euro proved a better store of value over this same time period — the USD even more so, as I pay some portion of my expenses in even weaker currencies than the almighty dollar. Between the two weeks of pulling some sats-denominated savings and spending them, I didn’t lose 25% of what they could get me, but only some minor fluctuation around a pretty steady downward trend. My flat’s rent, which is adjusted to official monthly inflation metrics, was in June about 3.5% more expensive in local currency than in March, about 7% more expensive in euros, and about 50% more expensive in bitcoin (had I paid it with bitcoin two weeks later, it would have been another 41% expensive still — rent steadily increased, dollar recuperated somewhat, and bitcoin collapsed even further). Some store of value, eh?

This isn’t a critique of bitcoin but a form of basic internal housekeeping. Hardcore Bitcoiners and the newly infatuated like to say that price is irrelevant, that bitcoin is amazing at any price, that the revolution is inevitable and gradual regardless of what silly traders are doing with the silly BTCUSD tickers. Purchases go one way, bro.

But you have to get to that future somehow, and having newbies rekt on 50% drawdowns and businesses saying “no thanks, give me d-o-l-l-a-r-s!” isn’t exactly helping.

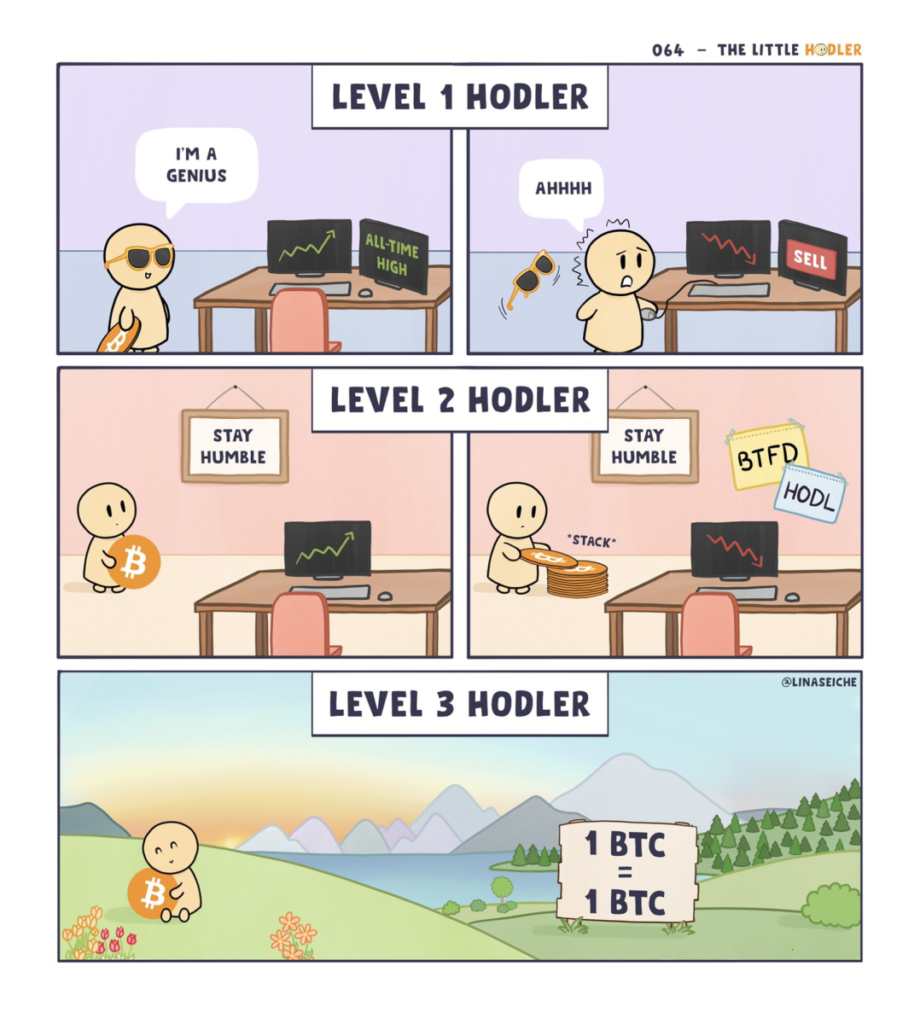

(Cartoon/Lina Seiche)

Like goldbugs have long insisted about an ounce of gold staying the same, 1 BTC might equal 1 BTC but its economic value can still shift. In reality, prices adjust; as economic actors, human beings care about what money gets you, not what the denomination of that unit is. What, do you think Venezuelans consider “1 bolívar equals 1 bolívar” to be a profound statement?

When everything is priced in dollars, what “1 BTC” gets you is subject to ever-shifting bitcoin prices, with the nominal “1” in that unit being unimportant. Six months ago, 1 BTC got you a new Tesla Model 3 Performance with some extra fancy gadgets. When I first wrote this first draft, that same saving only got you a new Ford EcoSports. Now it gets you a couple-years-old used car with 80,000 miles behind it. But 1 BTC still equals 1 BTC, right?

No. A bitcoin is not still a bitcoin since those who would sell me anything of material value index their bitcoin sales to the dollar and not to a specific number of sats. That might be a fault with them that in time must change, but so far seems to be the way of the non-bitcoinized world. Unit of account is the required trophy for a Bitcoinizing world.

Sats Devaluation

Following the May blow-up from $45k to $30k, Nico Antuna Cooper wrote what most Bitcoiners chanted in public or in private: “Why the bitcoin price doesn’t matter:”

“The difference between Bitcoin and everything else is that the price of bitcoin doesn’t matter. Over the long term the price of bitcoin has gone up, yes, but the value proposition of bitcoin as hard, non-confiscatable and truly decentralized money is really what matters.”

Think about that statement for a minute. Money’s sole purpose is to coordinate consumption and production in the real world. It’s to move value from one place to another, across time, and to transact between people who therefore don’t have to trust one another. Money’s price is its purchasing power, how much real stuff it can get you. But Cooper, echoing sentiments of most Bitcoiners, claims that the price of bitcoin doesn’t matter. What you can get for bitcoin and therefore how it stores value across time is somehow inessential.

Cooper continues by saying that bitcoin’s value proposition isn’t as an asset that appreciates, but rather as a “hard, non-confiscatable and truly decentralized money.” True, but irrelevant. Yes, those things are what Bitcoiners treasure about bitcoin and how Bitcoin, the monetary network, can revolutionize the world. But bitcoin, the asset, can only do those things if the network’s total value packs some financial punch. At a sub-$1 trillion market cap — now sub-$400 billion — it doesn’t. With an asset tumbling in real-world market value, it doesn’t.

Put differently: the HODL mindset requires you to believe that -25% weekend drops — or -70% over seven months — in your net wealth is fine. Dandy fine. Time in the market beats timing the market, or some other fashionable Warren Buffet quote.

An asset’s price is a gauge of its success. Almost trivially so: an asset rises in price when buyers (i.e., those who want it) outnumber or out-money sellers (i.e., those who don’t want it). So in the recent seven-month period, fewer people or cumulatively less-wealthy people have wanted bitcoin. Tell me again how that’s good for Bitcoin?

Honey badger should care because price knows something you don’t and because a tumbling bitcoin price is the greatest vote-of-no-confidence any market economy could ever deliver. Sellers are dominating the market, saying, “We don’t want you.”

It’s because markets know something that it’s so hopelessly asinine for “trad-econ” profiles like Nouriel Roubini, Warren Buffet, Paul Krugman or Nassim Taleb to confidently claim that bitcoin is an overvalued bubble at x, y or z price. “Hurray,” cheers the Bitcoin crowd when we’re shitting on the haters.

Since the principle works in reverse too, it’s equally asinine to say that bitcoin is undervalued at $29,000 or $45,000 (what about $18,000?), like many prominent Bitcoiners are fond of doing. But how could it be? Markets know something. For you to say that markets are wrong reflects a quantity of hubris I don’t even want to contemplate. Yeah, really? Good luck with that.

Another piece in Bitcoin Magazine from last month stated confidently that:

“Bitcoin as a monetary tool allows everybody to have the same opportunity — accumulate and save as much money as possible and preserve any amount of wealth, large or small, without the worry of confiscation or inflation, i.e., the way money should be.”

In the last seven months or less, it’s true that a holder of bitcoin didn’t lose purchasing power to outright confiscation or inflation. But holding bitcoin stripped them of worldly value as they lost purchasing power nonetheless. Sellers of goods and services — those things we wish to acquire, today and tomorrow and the days and weeks thereafter — charged us many more sats after the crypto crash than before. And then yet some more again. How is 1 sat prior still equal to 1 sat now? Did bitcoin (hyper-)inflate against the dollar?

The promise is: you’re not going to be debased, that “people can plan for that in a much more logical way: they know that they won’t be debased out of their wealth.” And then they are anyway.

With a straight face, you can’t say that the problem with the dollar system is that it slowly erodes your purchasing power, and at the same time happily embrace a collapse in BTCUSD because it allows you to stack at lower prices or whatever. This is either disingenuous or schizophrenic. If a depreciating exchange rate between dollars and real goods and services is bad for those who hold and use dollars, then a depreciating exchange rate between bitcoin and real goods and services is also bad for those who hold bitcoin.

Bitcoin gradually making its choppy way from $60,000 to $20,000 is still a non-confiscatable and decentralized thing, but it’s not a “hard” money — and barely a money at all. Its quantitative scarcity — i.e., the number of sats outstanding — remained “hard” and unaltered (but not unchanged since 34,000 blocks were processed since then, creating more than 200,000 new bitcoin). But it’s not “hard” because its worldly scarcity was cut almost in half, twice in a row. And it’s not that money-like because fewer people want it (and with less urgency) today than they did half a year ago. . What users of a money can engage with is the prices of goods and services in that money.

I’ve heard prominent Bitcoiners say, “Bitcoin is antifragile,” stealing Taleb’s term and, I presume, content to rub it in his face. For antifragile things, any and all volatility is good, because the thing emerges stronger. That has some ring to it and is at some level the meaning of antifragility. But other things that are antifragile, like biospheres or human immune systems or — explicitly citing Taleb — the restaurant business, show us upper limits.

Taleb’s phrase for that is “absorbing barriers.” The immune system gets stronger when it gets stressed, but at some level of stress it breaks and the person it aims to protect dies. A single restaurant closing is quickly replaced by another, redistributing the use of the capital, labor and land that wasn’t valued enough by consumers. But in 2020 to 2022, a political class drunk on fiat money and fighting invisible COVID-19 enemies made a massive dent into many cities’ restaurant businesses, permanently damaging most of it. Not so good.

Bitcoin, the protocol, seems pretty antifragile. Bitcoin, the money, isn’t.

Bitcoin isn’t money — but it could be (and probably should be).

With a long enough time horizon, provided that this isn’t the end of our monetary experiment, bitcoin’s dollar price can only go bananas because we have another system alongside it. The only way in hell it can be “dandy fine” after the last six months-plus of chaos is that there’s another monetary system from which we can plunge more of our regular earnings to get our hands on cheap corn. Another monetary network that can prop up the quantity side of your sats stack, picking up your transaction slack and instead let you HODL your coins in relative peace. Because man’s gotta eat and we’ve got fiat bills to pay. We can live in a bitcoin world because we’re subsidized — saved — by the dollar system we hate so much.

What happens when we no longer have that safety net of dollar-denominated incomes, stable(ish) prices and a money system that still goes bananas over a single weekend? What happens when bitcoin tries to stand on its own two legs?

Feeling conflicted about it, Bitcoiners celebrated the institutional capital when it arrived — the traders and fast-moving speculative money when they delivered bitcoin’s latest 10x in 2020 to 2021. But now we’re coming to regret their presence as the liquidity spigot that propelled those funds is drying up and the fast-moving speculative guys move along.

Bitcoin’s dollar price matters because nobody prices things in sats. Since retailers adjust selling price to the BTCUSD rate, the holder of BTC carries all the downside risk, the pain of which we’re now learning to live with.

You can ostensibly buy anything for bitcoin, sure, but you’re not really buying it “for bitcoin.” Stuff from retailers left and right, some everyday things in El Salvador or select houses in Dubai and Portugal make the news and they indicate some amazing adoption of this still-young asset. But you haven’t gotten anywhere, really. None of the things you can buy for bitcoin were priced in bitcoin. That means your BTC didn’t hold any value; you took a short-term gamble from your entry price to your exit price, with a frantic sliver of hope that you overtook price appreciation in the Portuguese home you were eying up or the groceries in the store getting nominally pricier.

Had the home seller or supermarket priced their goods in sats, a shift in BTCUSD would be irrelevant, like the “1BTC = 1BTC” crowd says. But they price their wares in dollars and ask you to fork over more sats when the exchange rate moves against you (and fewer sats only when it moves in your favor). That means you’re not holding money, but a high-risk asset.

Which, of course, is how financial markets have priced it.

You Can’t Escape Risk: When Taleb Was Right

He said it so stupidly, tucked away in an otherwise laughable article, but he pointed to the risk-carrying problem of bitcoin adoption. I discussed it at length in an article last year titled “You Cannot Eat Bitcoin”:

[Taleb] writes that for a person to purchase consumption goods with bitcoin, she must have an income in bitcoin; but for her to receive (parts of) her salary in bitcoin, the employer must receive at least some bitcoin in revenue; and the seller of consumption goods must obtain at least some raw materials in bitcoin. Of course, this is terribly wrong; yet, he’s also profoundly right – in an almost trivial way. Unless currencies are fixed against one another or redeemable in the same outside money, purchasing and selling items in a currency different from the one in which you pay your expenses or earn your incomes exposes you to exchange rate risk.”

Much to the ire of bitcoiners and libertarians alike, Taleb has a point: when you opt into any monetary network, you’re not just making an isolated transaction between yourself and whoever sold you the money, but a bet on the future exchange rate of that money vis-à-vis other items.

What we need are high prices, wealthy bitcoiners and a greater tolerance for variation in real income. For Bitcoin to work, truly revolutionarily work as its own independent thing rather than a patchy add-on to a faltering dollar system, people must carry the price risk that’s been artificially purged from the legacy system.

What the goldbug argument above shows is that you cannot escape market risk. For thirty years, inflation-targeting central banks have tried by keeping the CPI-genie in the 2% bottle — unleashing property booms and busts, financial mayhem, an economy of zombie corporations and runaway public deficits.

For bitcoin to work as money, its users need to embrace the market risks that otherwise get hidden in the fog.

On a recent “Fed Watch” podcast, Tone Vays says that “Bitcoin was built for this, but the price keeps going down.” Let’s rule out the uncomfortable option that we were wrong about this technology’s potential (if we are, then anything we say or hypothesize is moot). In the case that we’re not wrong, last year’s price run-up was too much, too early — but like Vays says, that makes no sense at all given the hostile macro environment we found ourselves in during the last six months or so. Bitcoin was made for this shit.

Perhaps, then, the institutional adoption and financialization of bitcoin was a curse, not a blessing? They opened the floodgates from the worst recoils of the fucked-up monetary system bitcoin tries to supplant.

Conclusion

I want Bitcoiners to be rich and happy. Now they are poor(er) and neurotic. Skittish. Is the dream dead? Did I make a huge financial mistake?

The dream is for bitcoin to be the world’s money, its go-to holding for cash balances. The safest and most secure asset.

Getting there requires the BTCUSD price to go up. It either goes up because people are embracing the new world (adoption) or people are embracing the new world because the price goes up (speculation). There’s always a little bit of both and they probably feed on each other. But it lets us confidently say that we’re going in the wrong direction when bitcoin’s exchange rate is falling. As Saifedean Ammous points out in his interview in the Moon issue: “It’s only a steady increase in value over time that will make Bitcoin more mainstream.”

Maybe some people learn when bitcoin collapses in their face. Maybe some leverage leaves the overstretched system (presumably only to return when the prospects look happier, and we repeat the cycle).

But it also puts off more of those normies that widespread bitcoin adoption requires and fuels the ammunition of its haters.

The world Bitcoiners dream of is an uncensorable network without discretionary monetary policy. That requires Bitcoin to work for vastly more people, and on its own — not just for the comparatively few or as a tack-on to the dollar, inheriting fiat weaknesses and suffering from the expected bouts of insanity.

At lower BTCUSD, Bitcoiners are poorer. We need them rich.

At rapidly collapsing BTCUSD rates, even fewer people are inclined to price their goods and services in sats. We need more of them to.

Bitcoin’s tumbling dollar price is the market saying “you’re not good enough,” when we need it to say “this revolution will greatly improve the world.”

To all the diamond-handed honey badgers out there: you really should care.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.