Just a week can completely change the entire outcome in the cryptocurrency market. A report posted on 7 June, revealed that digital assets witnessed inflows last week despite the bearish run. This inflow amounted to $100 million bringing the total assets under management (AuM) to $39.8 billion.

But, the said inflow didn’t stay for long…

Bleeding heavily…

The cryptocurrency market is undergoing a heavy correction phase that saw the market quit the ‘Trillion’ zone. At press time, the overall market stood at the $959.7 billion mark after suffering a 14% correction in 24 hours.

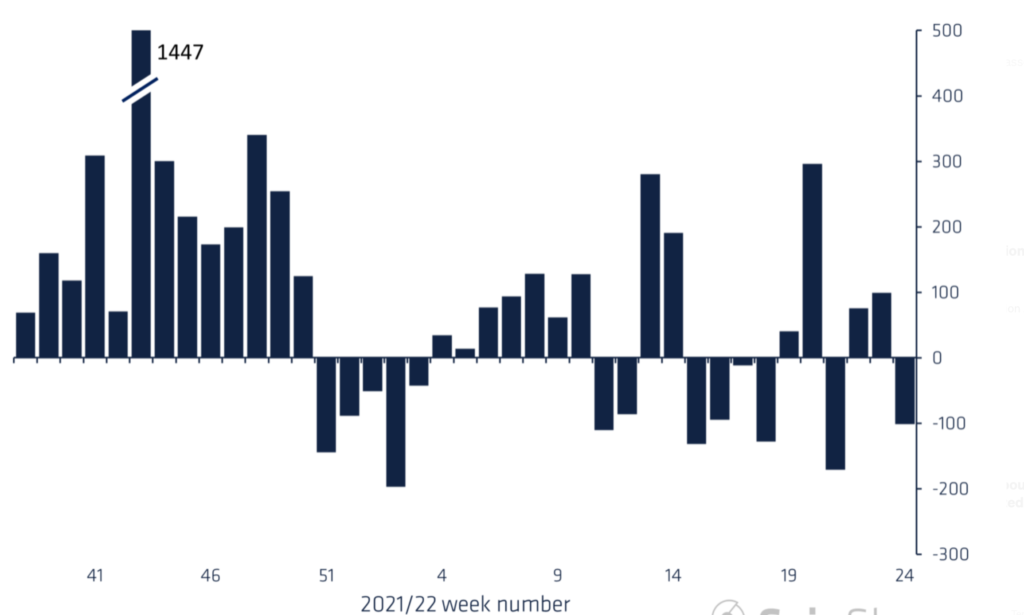

As expected, digital assets saw outflows of $102 million last week as per CoinShares’ latest Digital Asset Fund Flows Weekly report. Given the negative sentiment across crypto, the blog noted:

“Digital asset investment products flows remain choppy in anticipation of hawkish monetary policy, with steady daily outflows last week totalling US$102m.”

Here’s a graphical representation:

Source: CoinShares

Geographically speaking, the majority of outflows focused on the Americas, totaling $98 million with Europe seeing just $2 million outflows.

Stairway to Hell?

Surely, looks like it.

Bitcoin saw outflows totaling $57 million last week bringing month-to-date outflows to $91 million. Interestingly, despite these outflows, short-bitcoin investment products also saw minor outflows totaling $0.2 million. Nevertheless, the total AuM stood much lower at $55 million compared to $27 billion for long-long bitcoin investment products.

According to the blog, an important factor led to BTC’s demise:

“What has pushed Bitcoin into a “crypto winter” over the last 6 months can by and large be explained as a direct result of an increasingly hawkish rhetoric from the US Federal Reserve.”

Even Terra’s fiasco helped to aggravate this grim scenario. Anyway, moving on to the altcoins now…

Ethereum, the largest altcoin saw another week of outflows totaling $41 million bringing total year-to-date outflows to $387 million (4.4% of AuM). Well, ETH saw a constant departure in the past as well. One of the reasons why the total AuM fell from its peak of $23 billion in November 2021 to $8.7 billion today.

That said, Solana (SOL) recorded a small uptick coming in at about $400,000. Whereas, Litecoin (LTC), Cardano (ADA) and XRP, each saw $200,000 worth of inflow. But it didn’t really help altcoins’ fate as the blog asserted:

“Aside from Multi-asset investments products, which saw US$4.7m of outflows last week, investors steered clear of adding to altcoin positions.”

Overall, it is going to take a significant amount of time for cryptos to overcome these huge obstacles and recover.