The Coronavirus pandemic and paying the gas fee on the Ethereum blockchain are two things that are poles apart. However, the struggle to overcome both problems has been the same. And, that’s exactly where Solana enters the picture. In fact, crypto-billionaire Sam Bankman-Fried called Solana, the next big blockchain of 2022.

Notably, Solana promises to deliver the best of Ethereum but faster and at a fraction of the cost. However, it is important to note that 2021 saw a significant uptick in meme coins like Dogecoin and Shiba Inu too. While these coins got a lot of attention and coverage, Solana was comparatively quite under the radar.

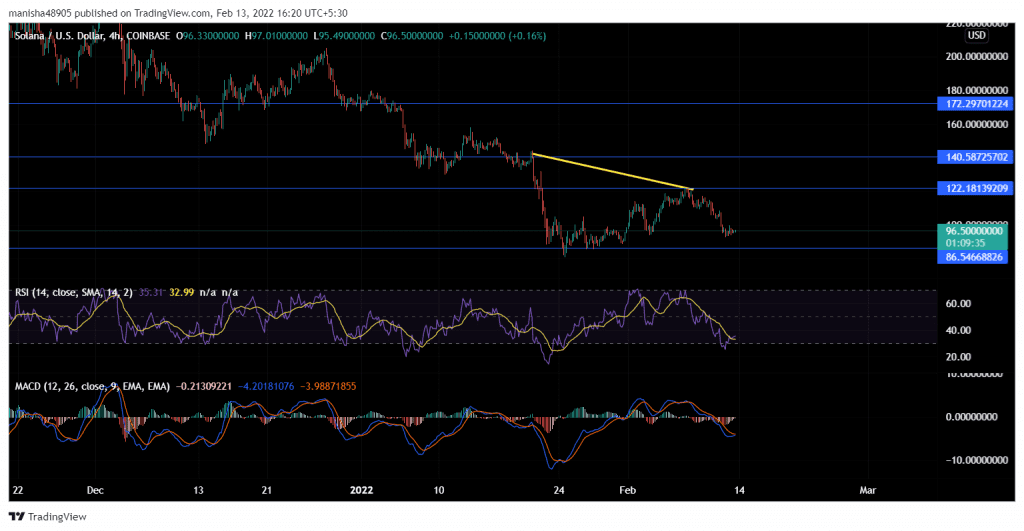

A look at the price trajectory

Solana got its fair share of fame as an “Ethereum-killer” when it climbed up from an inexpensive $1.5 to $230 in November 2021. At the time of writing, the coin was trading at $96.51. The bears seemed to have taken the lead for now. If SOL fails to bring in demand, the coin might go down further to its one-month-long support of $86.54.

However, if bulls find victory, the token might go up high to face another resistance at $122. This would be an area where SOL might see investors going long. However, for a sustained rally, $140 needs to be flipped into support. Thereafter, the token can move upwards to face its four-month-long resistance at $172.

On the attached chart, the RSI and MACD favoured the sellers. Even so, consolidation in its press time price range can’t be ruled out.

Really an Ethereum killer?

While Ethereum is slowly moving to Proof of Stake, Solana, from its inception, has been using Proof of Stake consensus along with Proof of History. That is to say, Solana is very fast and can process around 50,000 transactions per second at an average cost of $0.00025 per transaction.

Moreover, smart contracts in Solana are read-only and stateless. As of right now, there are about 400 projects on Solana. Interestingly, it has a great community of investors and developers. In fact, the founders and employees are very vocal and have a high interaction rate with SOL’s users.

All this goes to say that developers have been considering Solana for its technical likability. For instance, at the time of writing, the total value locked on Solana stood at $7.86 billion with more than 50 decentralized applications building on it. This is a sign of the blockchain having immense potential to grow and investors are believing in it.

Gas fee concern

Even though the Ethereum network has been trying every trick in the book to scale better, the gas fee remains a hurdle. This is one of the main reasons why a large number of developers shifted to the Solana blockchain in 2021. In fact, at press time, Ethereum’s average gas fee stood at 43 gwei while Solana’s was just $0.00025 per transaction.

All is not well?

While everything for Solana may look like a fairy tale, it is important to remember that Solana is not as decentralized as it should be. In fact, becoming a validator on the Solana network is really difficult. The barrier to entry is very high. Plus, most of the coins are also held in just a few accounts of the founders, team, and VCs. Surprisingly, the public holds a very small percentage of coins.

Not to forget, Solana has no explicit roadmap. For this reason, investors who are willing to go long might consider looking into the project with more skepticism. The development activity looked a little complacent, for instance, at the time of writing. For now, a rally straight to $200 can’t really be expected. Retail SOL buyers may take a call accordingly.