Decentraland (MANA), the 47th-ranked coin by market cap, continued to move in proximity to its long-term support level. But with the market starting to look overheated, can MANA price ignite any hopes for HODLers?

The global crypto market cap, in tandem with Bitcoin price action, has led to a larger consolidation for most of the top crypto assets. Decentraland native token, MANA, is one such token that awaits breakout.

Decentraland Price Action in a Mess

At the time of writing, the third-largest metaverse token by market capitalization, Decentraland, traded at $0.6063, noting a mere 0.12% gain on its daily chart.

Upon zooming out, it could be seen that Decentraland price tested the long-term $0.6000 support, which has acted as a crucial price level since March 2021.

Daily RSI shows a continuously falling buying pressure with sellers governing the token’s trajectory. At press time, the daily RSI for MANA was in the oversold zone and followed the larger bearish trend line.

Trade volumes maintained low numbers demonstrating disinterest from the retail side. Over the last 24 hours, MANA trade volumes were down by over 15% and stood at $81 million.

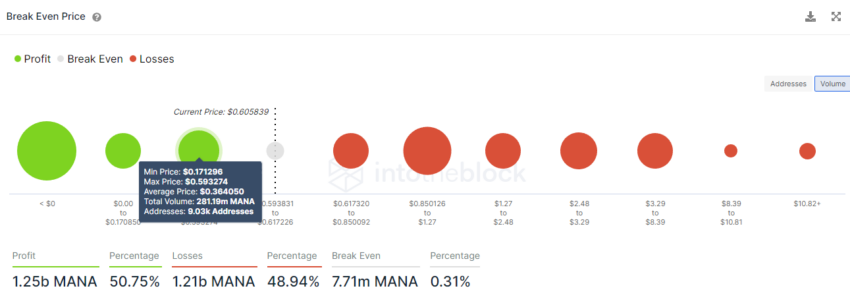

The break-even price shows the next key support at $0.3600, a fall below that could trigger heavy losses for Decentraland holders. At the $0.3600 price level, 281 million MANA is held by over 9K addresses which would be in a loss if the price fell below it.

HODLers still holding, but underwater

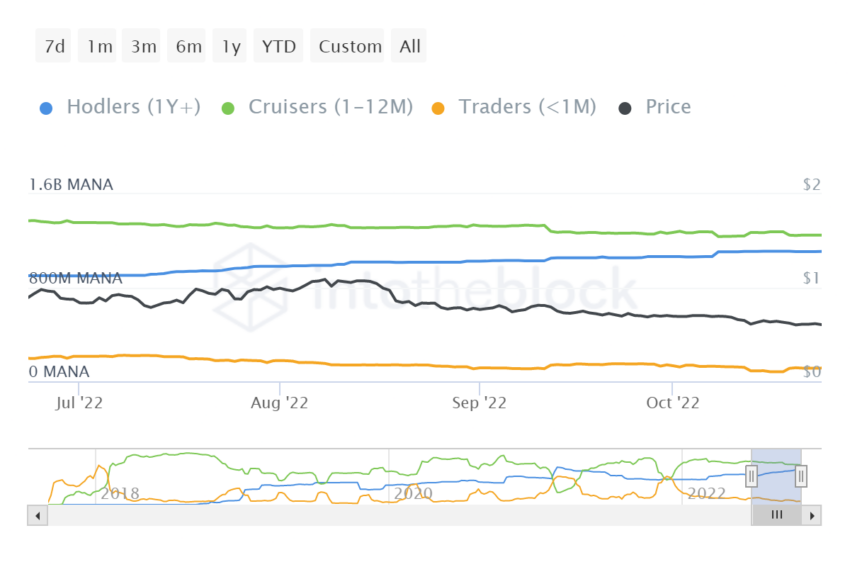

Decentraland holders were underwater, with 84% of holders at a loss at the press time price level. Nonetheless, over the last 30-days, holder addresses have seen a 5.07% uptick presenting a slight rise in HODLers.

On the other hand, trader addresses had dropped by 23.68%, presenting that retailers were more cautious of their moves in the market.

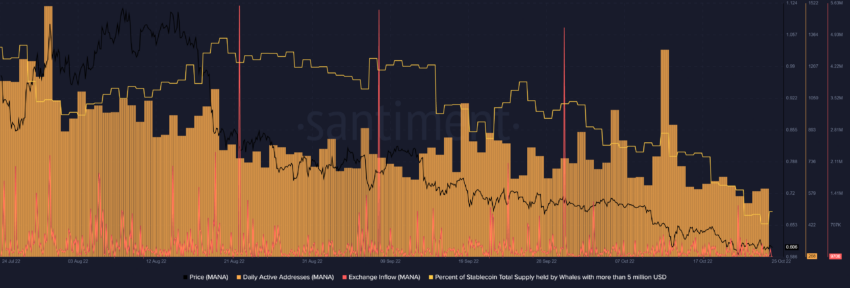

Daily active addresses showed no major uptick. On the other hand, a slight rise in the percentage of total supply held by whales with more than $5 million was a positive trend, but it can’t produce enough momentum to push MANA price higher.

Furthermore, a notable uptick in exchange inflows could lead to a sell-off, pushing the price below MANA key support level at the $0.6000 mark.

If the bearish thesis fails to pan out and retail volumes push the Decentraland price, the next key resistance could be at the $0.6850 mark.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.