The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

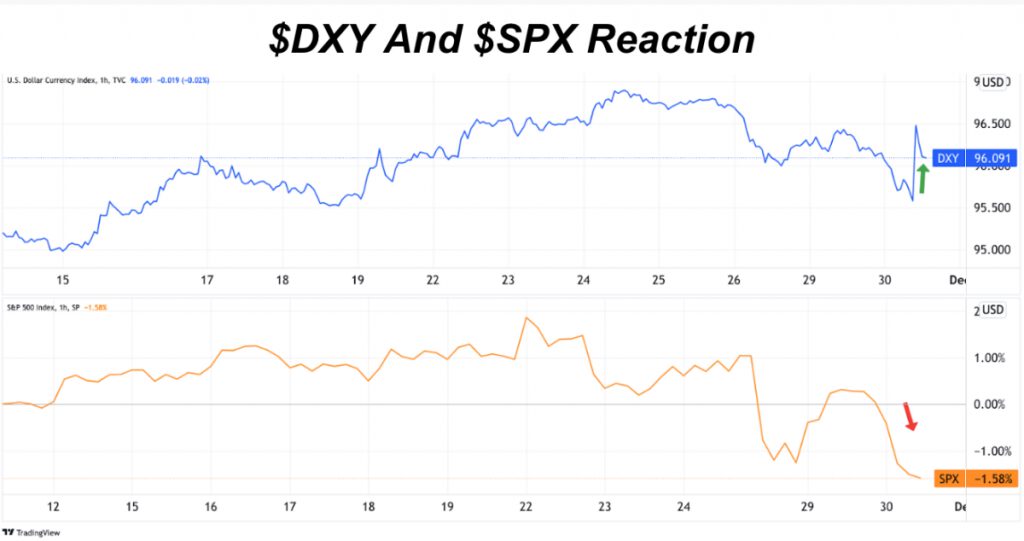

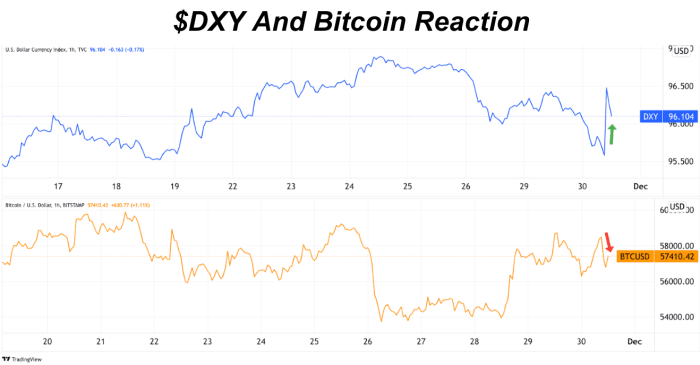

In the Daily Dive #102, we highlighted the rising DXY (U.S. Dollar Currency Index) in 2021 and the negative impact it can have on bitcoin’s price. Today, with Federal Reserve Board Chair, Jerome Powell, talking about the rising risk of persistently high inflation in the United States and a potential accelerated taper, DXY, SPX and bitcoin markets immediately reacted. The DXY jumped over 1% with both the S&P 500 Index and bitcoin falling in tandem.

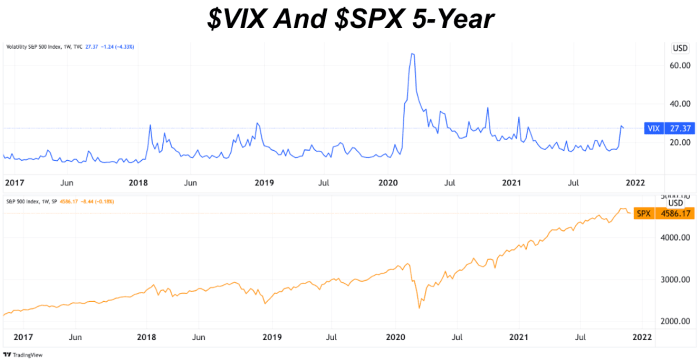

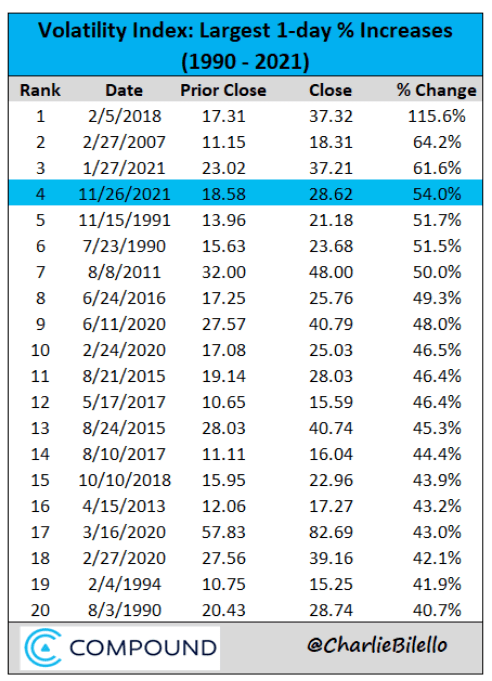

Over the last few days, we’re seeing rising and elevated market volatility as well with the VIX spiking over 54% last Friday, which is the fourth largest one-day percentage increase in its history. This is a cautious sign for investors to expect volatility in the near term.

Source: Charlie Bilello, Compound

The Federal Reserve’s position is an incredibly difficult one: the choice between saving the bond market or sustaining the U.S. economy. An accelerated taper brings us closer to interest rate hikes which are the only way to help fixed-income investors saddled with real negative yielding U.S. debt, as inflation runs hot over 6%.

On the other hand, expectations of accelerated tapering with plans for interest rate hikes will drive down asset prices as extra liquidity in the system winds down and the cost of capital increases, negatively affecting current equity valuations. The SPX fell 1% in 15 minutes on yesterday’s announcement.