Investors these days have one eye on the news and the other on TradingView, trying to guess how the headlines will change Bitcoin’s candles. That said, some useful clues can come from watching the feeding patterns of Bitcoin whales.

Color me green!

At last for the bulls, Bitcoin is above the $43,000-mark! It might have seemed that the best time to #BuyTheDip was when Bitcoin’s price was below $36,000. However, whales aren’t quite done with their shopping for the season, as data from Santiment showed.

In fact, the first days of March have seen more than 13,000 Bitcoin transactions involving more than $1 million.

🐳 While #Bitcoin hovers between $43k and $45k and traders await the next big swing, whales are becoming increasingly active in making massive transactions. In the last three days, there have been 13,400 $BTC transactions exceeding $1M in value. 👀 https://t.co/6IWkSLGtTZ pic.twitter.com/cUlzd20iak

— Santiment (@santimentfeed) March 3, 2022

At press time, Bitcoin was being chomped up at $43,312.13, having rallied by a grand 24.51% in the past seven days. Additionally, most of the top 50 cryptos were in the green as well.

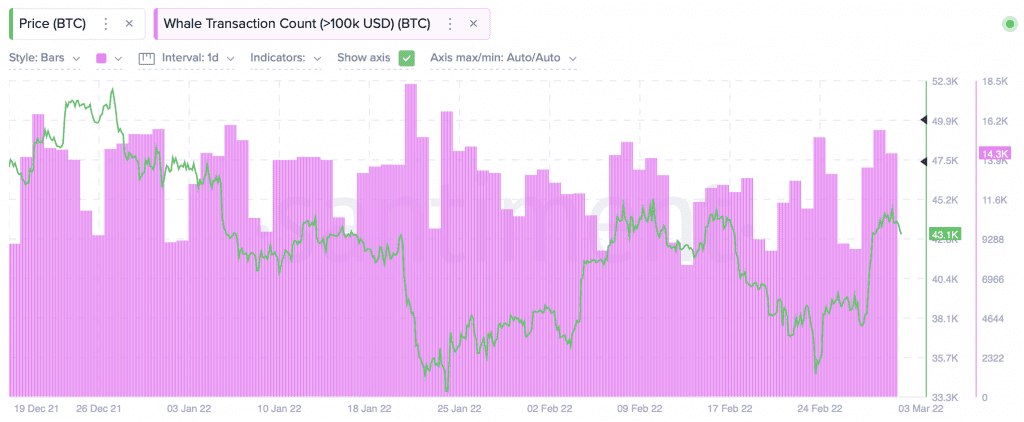

What about the other fish in the sea, you ask? Well, whale transactions over $100,000 also saw a spike as Bitcoin’s price rose again with more than 14,000 such transactions on 2 March alone.

Source: Santiment

However, it’s important to note that even when Bitcoin’s price has been floundering, Glassnode reported,

“The current market does not appear to have lost confidence in Bitcoin as a macro asset.”

New address, who dis?

Looking at the changing number of Bitcoin addresses can also serve to show investor interests. To that end, we can note a sharp spike in active addresses as Bitcoin rose above the psychological price of $40,000 once again.

For context, active addresses were well below 60,000 even when there was still an opportunity to buy the king coin at its lowest in February. This suggests there was some loss of faith in the asset – which is now coming back.

Source: Santiment

However, it’s premature to declare this story has a happy ending. A look at weighted sentiment on 2 March showed that it was at -1.53, a low last seen around the time of the May 2021 crash.

In fact, a macro look reveals that many of the retail traders are yet to make a decisive move. An increase in price might boost their confidence. Furthermore, a major demand from retail traders can help suppress the selling pressure.

Source: Santiment

On the other hand, negative sentiments sometimes have the potential to trigger a rally. Ergo, more experienced traders are probably turning on their push alerts even as you read this now.