Coinbase is one of the leading exchanges when it comes to buying and selling cryptocurrencies. If you have Bitcoin, Ethereum, or Litecoin on Coinbase, you may want to know how to withdraw money from Coinbase. In this guide, we’ll walk you through the steps of withdrawing money from Coinbase.

What Will You Need to Follow This Tutorial?

You need to have a few things with you before you use this article to set up your withdrawal process on Coinbase. Use this simple checklist to get you ready for the process.

- A verified Coinbase Account

- A payment method, like a bank account or credit card

- An updated version of the Coinbase app is available if you are accessing Coinbase on your smartphone

How to Get Money Out of Coinbase

At first sight, the idea of making a withdrawal on Coinbase may seem overwhelming. However, the key is to understand that withdrawing money from Coinbase is a three-step process.

The first step is to convert your crypto assets into fiat. The second step is setting up a payment method where you can deposit your cash once you withdraw it, and the final step is withdrawing the fiat. Let’s explore the step-by-step instructions for each of these three processes, to ensure you have an easy time making withdrawals from your Coinbase wallet to the bank.

Step 1: Convert Crypto to Fiat on Coinbase

The process of converting crypto to cash on Coinbase is a simple one. Here is a step-by-step summary of how to exchange crypto for cash on Coinbase.

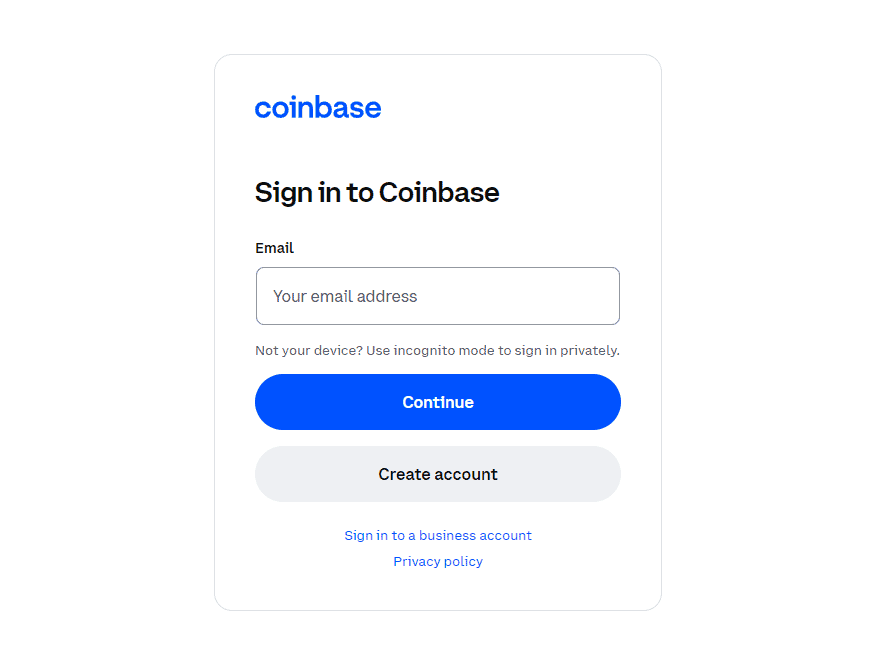

- Log in to your Coinbase account.

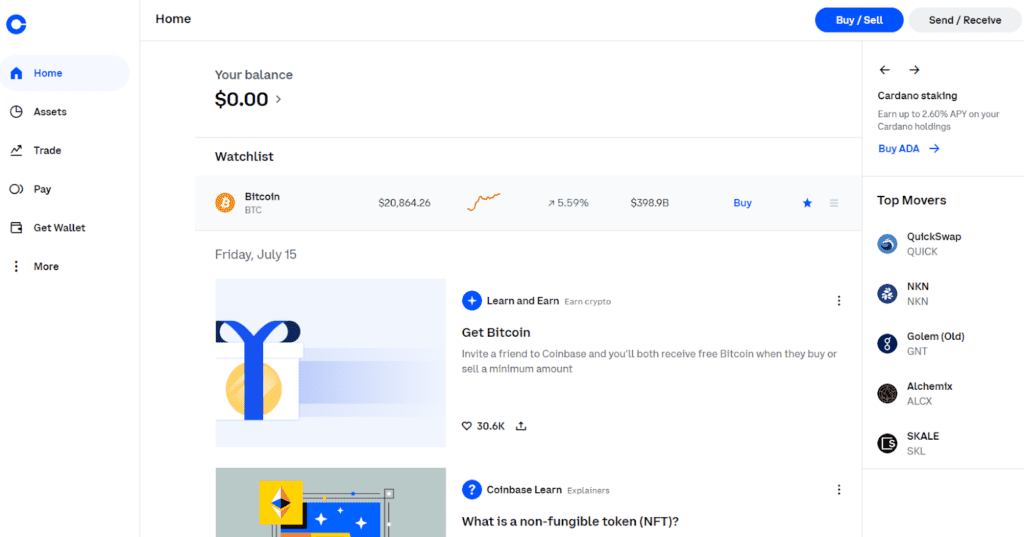

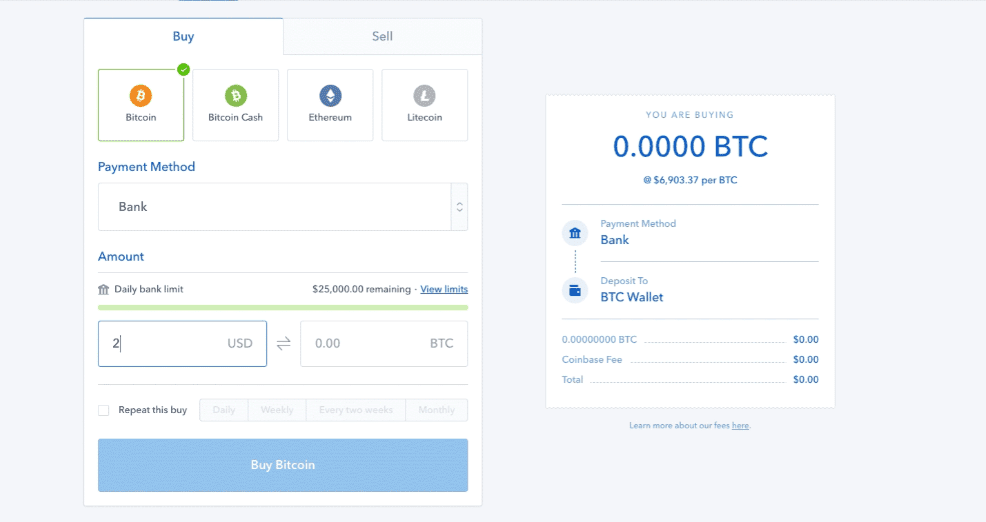

- Click the Trade button on the navigation bar or the Buy/Sell button at the top right corner of your screen.

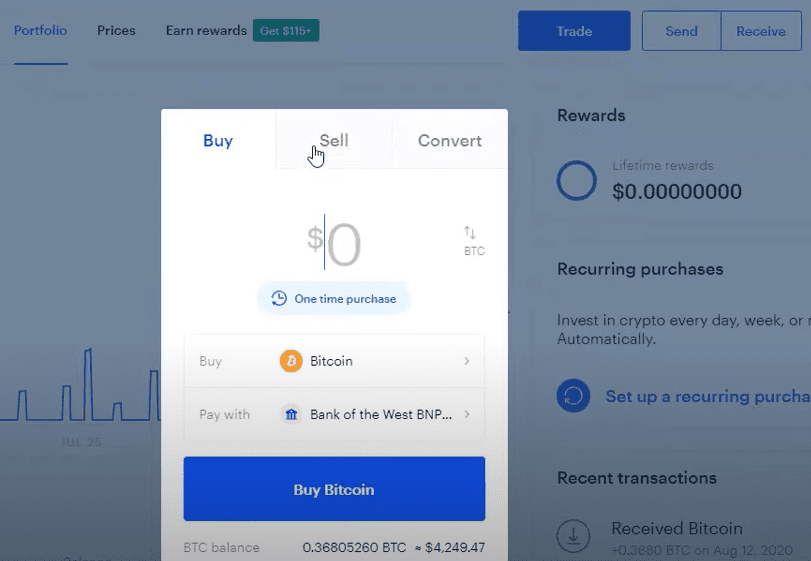

- A Sell tab will appear, with a field where you can enter the amount of crypto that you want to exchange for fiat, the particular crypto asset that you want to trade, and the fiat currency you want to withdraw in.

- Click on the Preview Sell button to complete the sale.

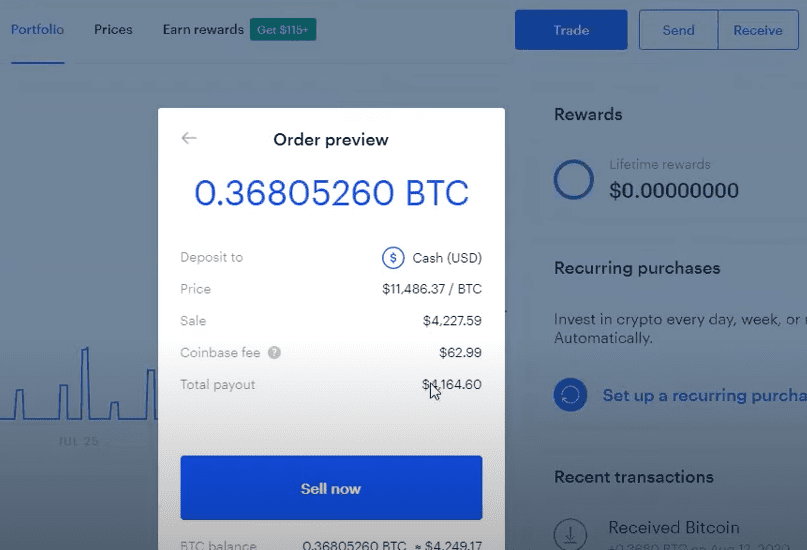

If your transaction is successful, you should be able to see a confirmation message when you click on the Preview Sell option. This option opens a pop-up window with your sale’s confirmation message. The message lets you know how much fiat you have received from your transaction and the transaction fees incurred during the selling process.

Step 2: Add a Payment Method to Coinbase

Coinbase supports a variety of payment options. Some of these options, like PayPal, are selectively available depending on your geographical location when you add the payment option. Others, like debit cards, may not have geographical limitations.

There are also minor differences in the process required for adding different payment methods. However, adding a payment method to Coinbase is an effortless process, and the steps below will guide you through how to add your preferred payment method to the platform.

How to Add a Bank Account to Coinbase Automatically

A bank account is one of the payment methods supported on Coinbase. Here’s a breakdown of the procedure you need to follow to add your bank account to Coinbase for an instant withdrawal.

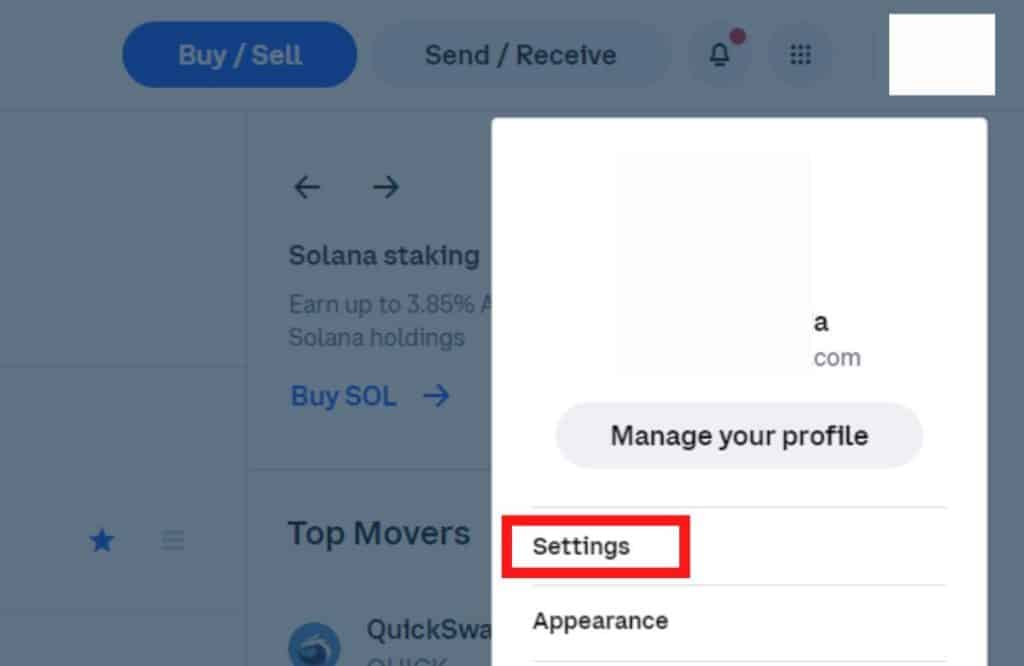

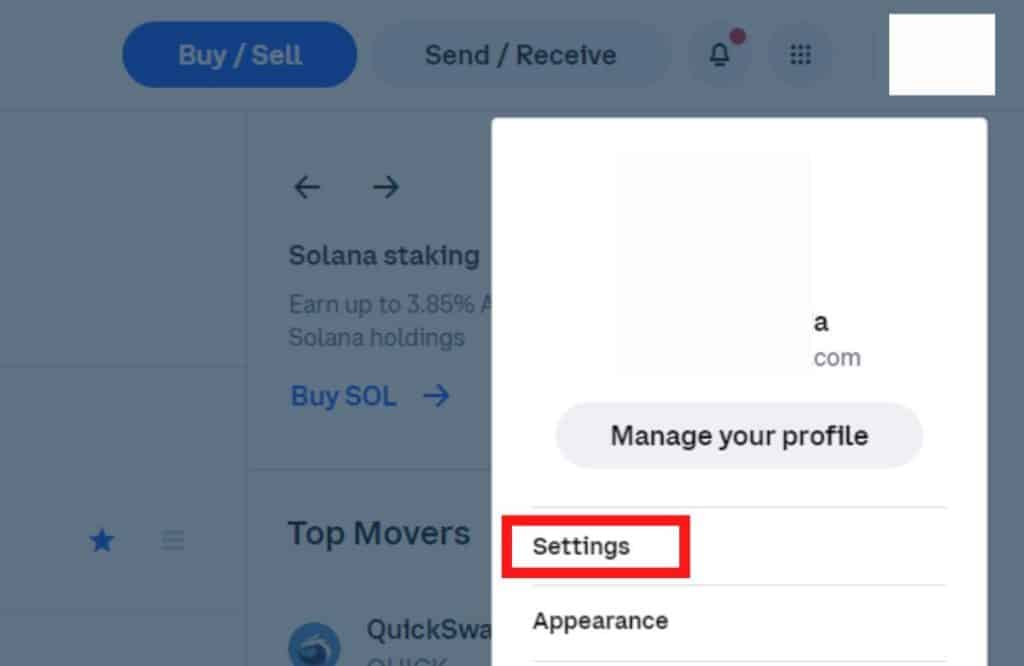

- Log in to your Coinbase account and click on your profile picture; select the Settings option in the drop-down menu.

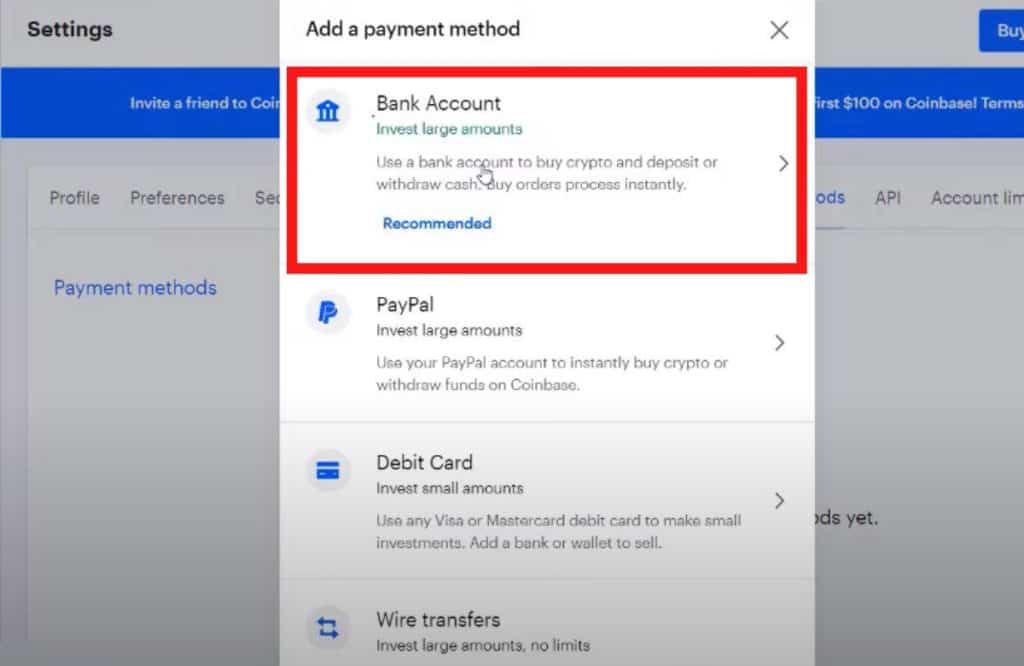

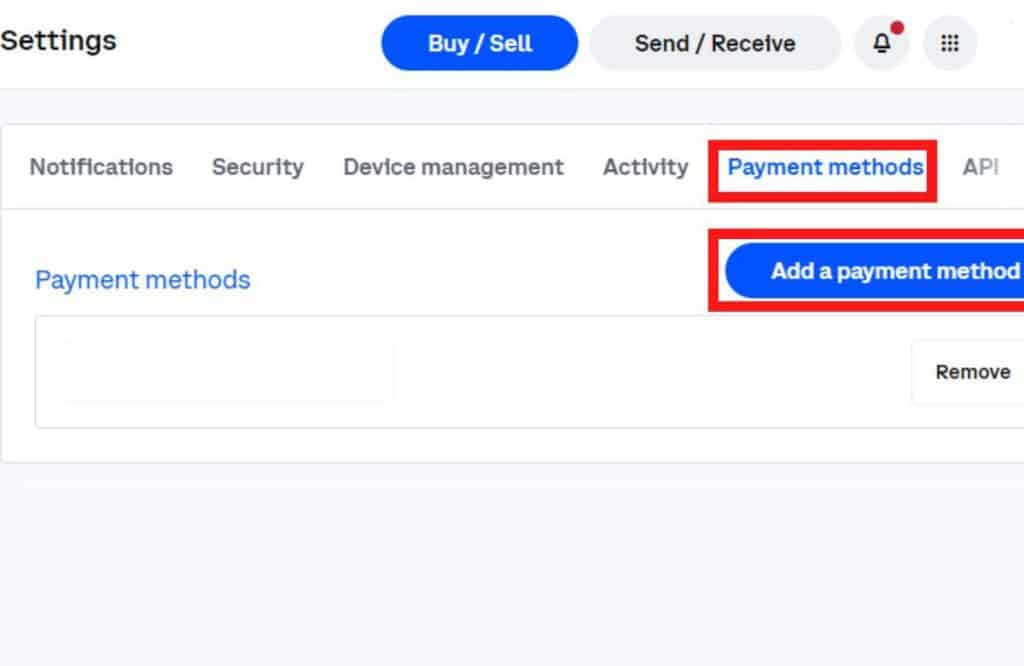

- Click Payment Methods then Add Payment Method option, select the Bank option and click Continue.

- This opens a window with logos for various banks. Find your bank and select it. Alternatively, type in your bank’s name in the search field and select it.

- Fill in the necessary details that Coinbase asks for, including your bank account number, pin, and any other security questions that may pop up. Once this is done, your account will be automatically linked to Coinbase.

How to Add a Bank Account to Coinbase Manually

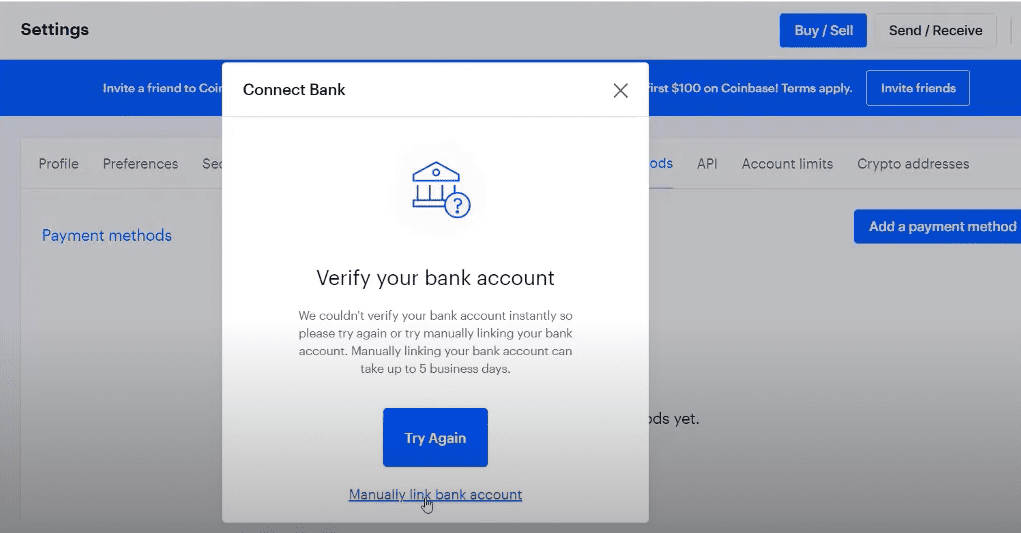

If your bank is not among the list of banks listed on Coinbase, you will need to add it manually using a deposit verification process by following the steps below.

- Follow steps 1 and 2 in the How to Add a Bank Account to Coinbase section above.

- When the window appears, scroll down to find the “Manually link bank account” option and click on it.

- In the new prompt that appears, click on Get Started.

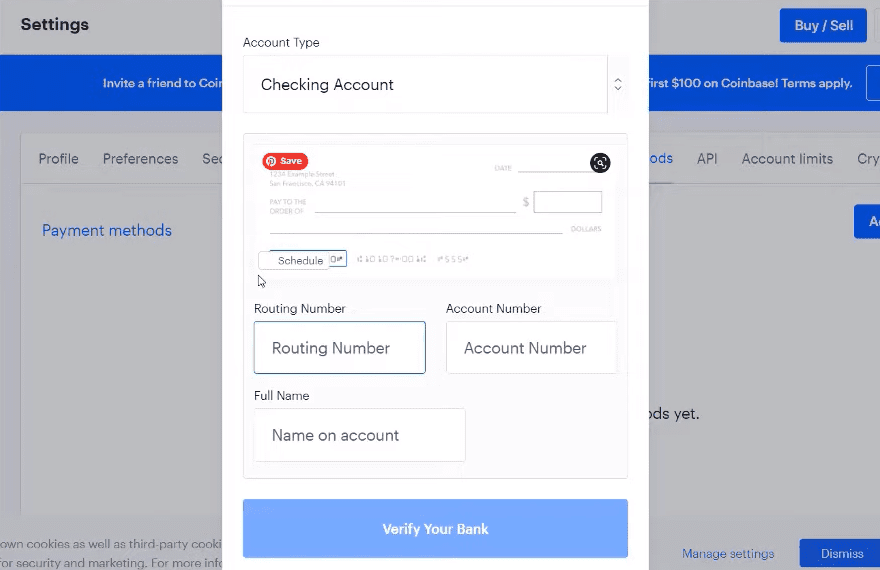

- Fill in your bank’s routing number, the account owner’s name for the account you intend to link, the account number, the type of account, whether it is a savings or checking account, and click Verify Account.

- This will send two small deposits to your bank account within two to three business days. After this period, visit your Payments Method page, and verify these deposits by selecting Verify for your bank account and entering only the number of cents on your bank’s statement. For instance, if your bank statement reads $2.50, enter 50, and your account-linking process will be complete.

How to Add a Debit Card to Coinbase

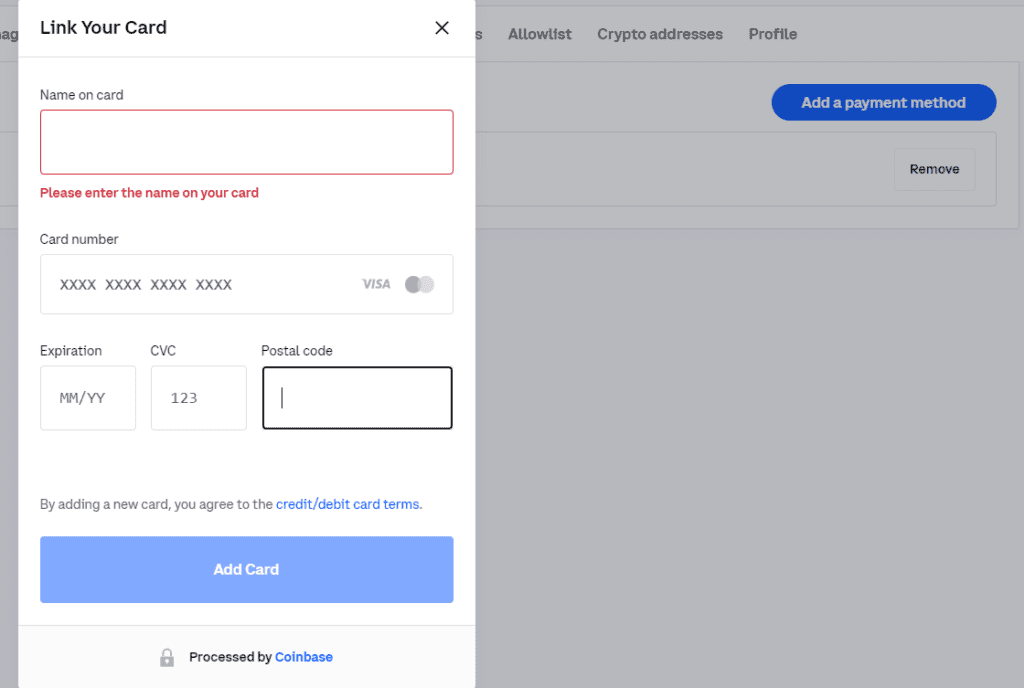

Coinbase accepts Visa and MasterCard as payment methods. The platform can also support other prepaid cards, but that would require you to submit a billing address associated with the card, which makes the process a bit complicated. So, here are the steps to help you link your Visa or Mastercard to Coinbase.

- Log in to your Coinbase account and click on your profile picture; select the Settings option in the drop-down menu.

- Click on the Add Payment Method option, select the Debit Card option and click Continue.

- Submit the requested debit card information to allow Coinbase to send two temporary debits to your card.

- Visit your card’s online banking activity to identify the two debits and enter their amounts on Coinbase to complete the verification process.

Step 3: Transfer Money From Coinbase to Bank

With your crypto assets already converted to cash and your payment method set up, withdrawing funds from Coinbase becomes very easy. These steps will help you navigate the Coinbase withdrawal process to get your cash.

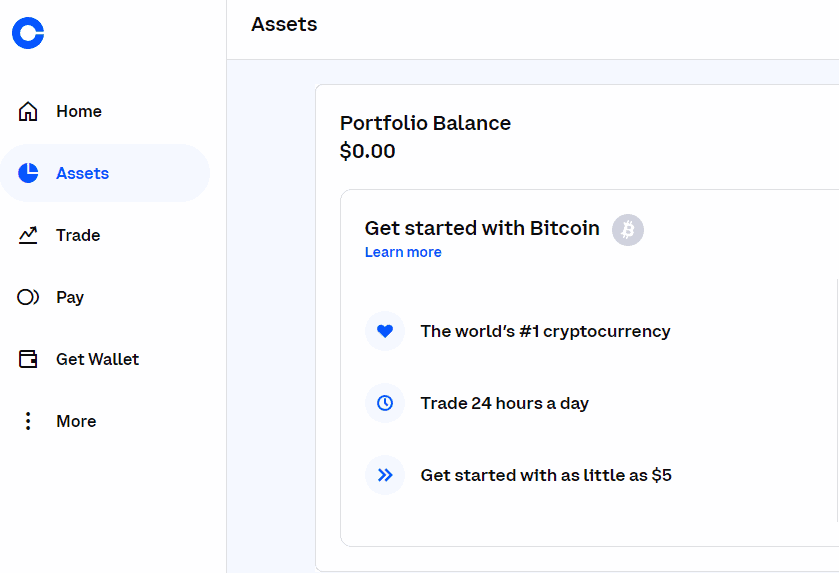

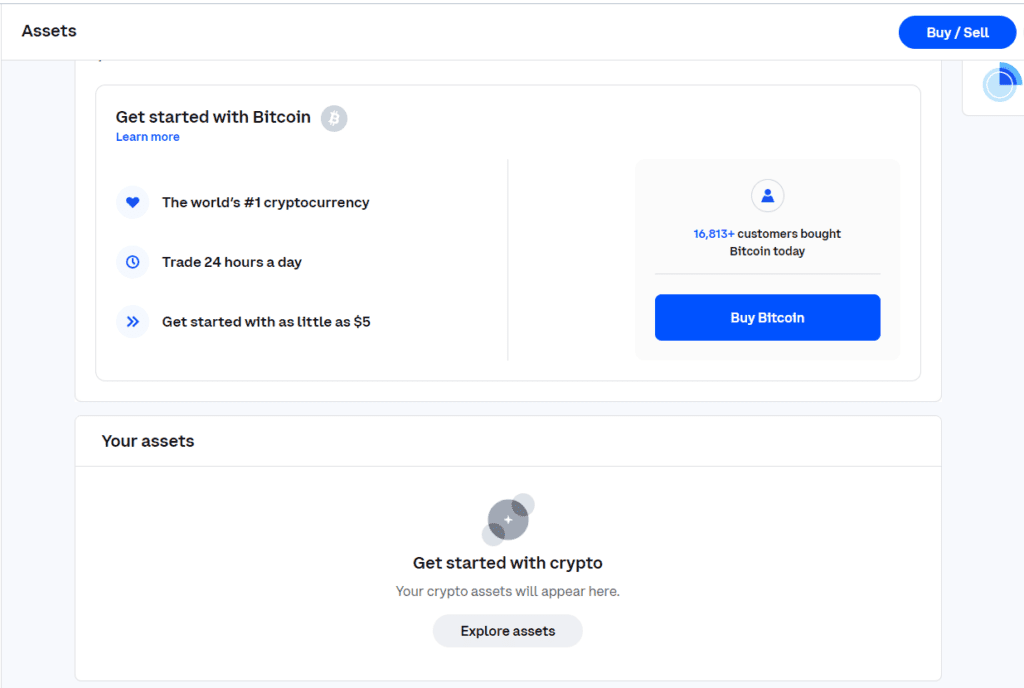

- On your Coinbase account, go to your Portfolio page.

- Navigate down the page till you get to your assets section.

- Under this section, find the asset page of the fiat you obtained when you converted your crypto asset in this article’s Part 1: How to Convert Crypto to Fiat in the Coinbase section.

- Once you are on the asset page, click the Withdraw tab, enter the amount of fiat you want to withdraw, and click the Withdraw button.

- In the tab that follows, select the payment method you linked in this article’s Part 2: How to Add a Payment Method on Coinbase section to complete the process.

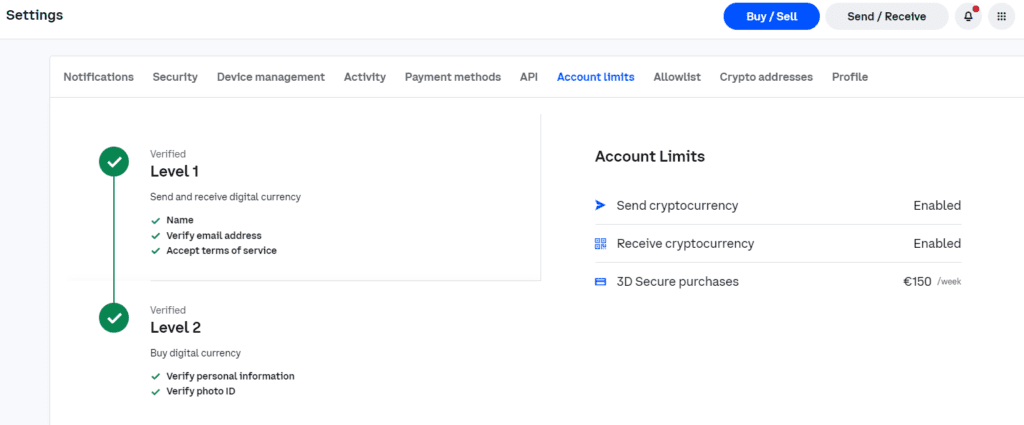

How to Increase Withdrawal Limits on Coinbase

Coinbase has a minimum and maximum withdrawal amount. The minimum amount of money you can pull out of the platform fluctuates depending on exchange rates, but it rarely exceeds $0.10. The maximum withdrawal amount set for Coinbase pro account holders is $50,000 per day.

However, if you feel your withdrawals might exceed this limit, you can apply to be considered for higher withdrawal limits. Here’s a walkthrough on how to raise your withdrawal limits on Coinbase.

- Log in to your Coinbase account.

- Navigate to your profile picture icon and click on it.

- Click on the Settings option and select the Account limits option in the drop-down menu that appears.

- Under the Withdrawal Amount section, click on Increase Limits.

You will see four fields that you need to fill in like the desired daily total withdrawal limit field, where you enter the total value you will withdraw daily.

There’s also the Why are you requesting a higher limit section, that requires you to cite why you need a higher withdrawal limit. In this section, provide a simple but detailed explanation because it will help to convince the Coinbase team to consider your request.

You also need to fill in the Bank Statement field, which shows the validity of your transactions.

And the last field is an option LinkedIn profile URL where you enter a link to your LinkedIn profile.

- Once you fill this in, click the Submit button to send your request.

Withdrawing Funds From Coinbase Has Never Been Easier

Pulling funds from your Coinbase account to your bank account gets so much easier when you break down the process into its three distinct parts, converting crypto assets to fiat, adding a payment method, and the actual withdrawal process.

Did you try using this article as a tutorial to withdraw money from your Coinbase account? If you did, how was the experience, and was there anything you feel we left out that would have helped you more? Let us know in the comment section and we will see what we can whip up for you.

FAQs

How Long Does a Coinbase Withdrawal Take?

It generally takes one to five business days to cash out your funds from Coinbase. The platform notifies you of the withdrawal time related to your transaction on the Trade Confirmation page that appears before your withdrawal order is submitted.

Does Coinbase Have a Minimum Withdrawal Amount?

Yes. Coinbase has a minimum withdrawal amount of $0.01. This limit can, however, fluctuate depending on crypto exchange rates. But it is always on the lower side to ensure you can access as little as possible from your investments on the platform.

Are There Any Fees on Coinbase?

Coinbase charges a 1% fee when you convert your crypto to cash or withdraw it. There is also a standard network fee that facilitates the processing of your transactions on the crypto network.