Table of contents

Introduction

Decentralized finance (DeFi) started gaining traction in 2020 and has since amassed over $240 billion in market capitalization. DeFi was made possible with blockchain technology which has grown exponentially due to it breaking the jinx of dependence on intermediaries.

As a result, DeFi has proven to be essential for every cryptocurrency developer as it depends on smart contract protocols, offering better returns and options than traditional banks. DeFi instruments are often fully automated, permissionless, peer-to-peer, mutualized, however, there are lots of barriers hindering the usability and these barriers make it difficult for retail investors to partake and take advantage of the numerous fresh generated value within the ecosystem.

The complex investment structure of DeFi has made it even more difficult for newbies to understand and dive into it. More so, many platforms are becoming more complex and inaccessible. Thus, lots of expert traders like scammers take advantage of their technical know-how of DeFi to enrich themselves, leaving normal traders with little or no rewards.

A DeFi asset management platform — HyperDex claims it is bringing innovative investment solutions to help the average investor protect their leveraged position and fellow investment platforms who want to expand their offering to their own clients.

HyperDex asserts that it is equipped to overcome the numerous barriers hindering effective and efficient finance. It will do so by enabling both professional and new investors to effortlessly and conveniently seize the value generated by DeFi by routing investors’ crypto assets into several HyperDex products using algorithmic trading strategies and staking.

HyperDex: Making DeFi Accessible for Mass Adoption

HyperDex is a DeFi asset management platform that simplifies the process of investing in DeFi. It offers three (3) types of investments: fixed income, algorithm trading, and race trading. These investment products come in the form of ‘Cubes,’ similar to the liquidity pool on a DeFi Exchange which enables users to pick from a variety of strategies that fit their risk tolerance.

Some of these cubes have the tendency to become “Hypercubes” as they allow the simultaneous investment of the underlying cube’s asset and the Hyper Token (HYP).

HyperDex aims to reduce the risks associated with DeFi by providing a passive strategy for investors that do not have the experience, time, knowledge to benefit from the vast opportunities in DeFi. This platform aims to be the hub for anyone owning crypto assets to easily invest in DeFi through the platform, with or without prior DeFi knowledge.

HyperDex aspires to build a powerful, decentralized platform for financial asset management. HyperDex wants to reach out to people from all walks of life, regardless of their financial situation or geographic location, and offer them the benefits of DeFi. For many, HyperDex will be the start of a journey that will help them become more knowledgeable investors and aficionados.

The Origin of HyperDex Finance

The HyperDex initiative began in early 2021, with linked businesses forming in September of that year. The HyperDex project is legally and financially structured through a DeFi bank. The crew behind this project says it has substantial forex trading and software development (basic C++, Python experience, Solidity, and more).

The team became fascinated by crypto cross pairs while trading forex, which began to behave in a similar way to forex pairs. They also opted to start an Ethereum mining farm in Canada because of their technical skills, which have been processing blocks since August 2017. They have created unique algorithms based on statistical arbitrage over the previous 17 years to profit from the main forex pair fluctuations.

Since debuting, HyperDex has completed the solidity code for each smart contract that supports the services, and undertaken the first round of funding. It has also launched a beta platform app with the first related website, and Certik has audited and issued a certificate for each smart contract.

The project has raised $400k USD with another committed retail $500k coming soon. The team is currently working with several companies such as Execuzen, Sheesha, Blockwall capital, among others. Meanwhile, Suvi Rinkinen from Starter and Mattew D’angelo (King of Lemurs project, Cake Monster, etc.) are the advisors for HyperDex. Its key partners are Defied Bank, Starter.xyz, and Empire Global Partners.

HYP Token

HyperDex’s native token is the Hyper Token (HYP), a BEP-20 token based on the Binance Smart Chain (BSC). Its worth comes from the production of transactional demand from a diverse set of users. The HYP coin was designed to improve the HyperDex platform’s usability and productivity.

Users will be able to enjoy a superior DeFi experience at comparatively cheap transaction fees, while simultaneously benefiting from the platform’s growth, thanks to the introduction of the native HYP token. HYP also serves as a suitable reward token for HyperDex, making it more appealing to investors at an early stage.

Furthermore, HYP Tokens promote early adoption while also ensuring that the user base remains stable. This happens because tokens are expected to gain in value over time, resulting in decreased carry-costs while utilizing the token.

HYP token can be used to create HyperCubes alongside receiving rewards from the farm and referral program. Users must swap selected crypto assets through the token swap or a DEX. An initial supply of HYP tokens is minted and sold in a series of rounds, whereby an equivalent amount of sold tokens is also distributed to HyperDex. The amount of HYP tokens initially minted will not exceed 200,000,000.

In addition, users may stake liquidity into HyperDeX Token Swap pools in return for a percentage of the swap fees. This can be done by staking two tokens into the respective liquidity pool in return for an LP token.

Overview of the HyperDex Cube Model

Cube Flow

Each HyperDex investment opportunity is placed in a container to distinguish the strategy chosen and the expiration date — ‘Cubes’ are the name for these containers. Cubes are comparable to decentralized exchange liquidity pools in how they work.

Users select a specific investing strategy and create predicted income by selecting a specific cube, which is always known without any hidden fees or market mechanisms. It is the user’s responsibility to research and comprehend the specifics of each cube.

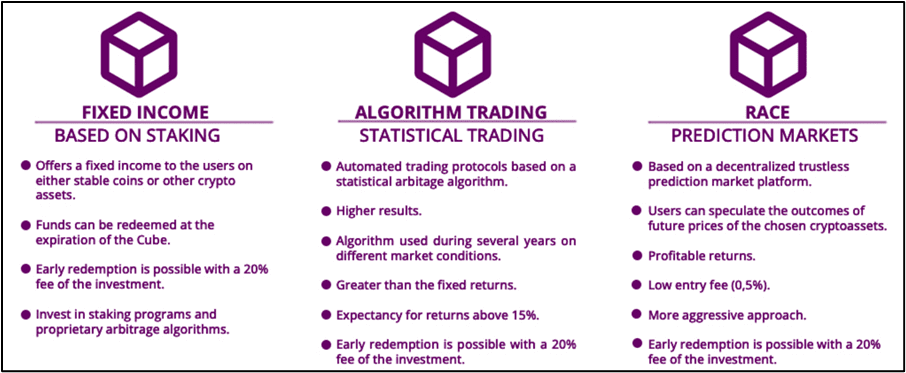

HyperDex offers three investment techniques, each with its own set of returns and risks:

- Fixed Income

- Algorithm Trading

- Race Trading

Fixed Income

Fixed Income Cubes are investment techniques that provide consumers with a fixed income on stablecoins or other crypto assets. Fixed Income Cubes are available in a range of expiration dates and returns for users to pick from. Users are responsible for reading and comprehending each cube’s extra terms, such as pay-back rules and early redemption fines.

The team expects people who reached a considerable amount of profit trading “Long” in crypto to place their stable coin gains partially on the side for a secure, predictable reward. Fixed income investments are also for institutional investors from traditional financial settings.

Algorithm Trading

Algo Trading Cubes are trading protocols that are automated and based on a statistical arbitrage algorithm. Algo-trading cubes try to increase results by finding market inconsistencies among the most popular crypto assets. HyperDex’s algo-trading is a proprietary algorithm that has been successfully employed in varied market conditions for numerous years. It has a completely automated trade execution system.

Race Trading

HyperDex’s Race Trading cube allows users to speculate on the result of future prices of selected crypto assets. Once users predict the future price, HyperDex race cube automatically calculates important information for the user’s stops, position in the market (long/short) together with proper leverage per the risk selected by the user.

The race trading investment is best for traders aiming to speculate in either direction on a fast market move by knowing already at entry what to expect in terms of profits and loss. They don’t need to calculate on their own the proper leverage, stop loss, and target exit for their position.

To summarize, users simply have to pick one of the three (3) investment strategies called ‘cubes’. Then proceed to select specific parameters related to the selected investment strategy and deposit respective assets into the selected ‘cube.’

Then again, they may deposit additional HYP tokens with their investment to increase overall returns. Finally, the user receives a profit upon expiration if the cube earns a return.

HyperCubes

Users can upgrade any Cube into a HyperCube to maximize their profits. HyperCubes are enhanced versions of regular Cubes that provide larger returns as well as HYP Tokens as additional incentives. Users must risk an equivalent number of HYP Tokens ranging from 10-100 percent of their initial investment to upgrade a Cube.

When the Cube is finished, it transforms into a HyperCube, resulting in larger benefits for the original basic return as well as double profits by obtaining additional HYP rewards. A respective HyperCube may be created for each investment type to receive extra benefits that eventually increase overall returns.

These benefits include:

● Fixed Income HyperCube: increased return on initial investment + 20% return on deposited HYP tokens

● Algo Trading HyperCube: additional return in HYP tokens equivalent to the original investment’s return

● Race Trading HyperCube: additional return in HYP tokens equivalent to the original investment’s return

The entire ecosystem benefits when a Cube is upgraded to a HyperCube. To begin with, each HyperCube switch boosts the user’s yield. Furthermore, each exchange converted into HYP immediately results in a higher HYP price due to the liquidity pool’s inherent function.

Other Dapps

Token Swap

The token swap, which can be accessed through the HyperDex website, is used to obtain HYP tokens. Users will be able to exchange selected crypto assets for HYP there, with more pairs to be added over time. Users can also put money into the token swap and get a percentage of the fees that are earned over time. A 0.25 percent fee will be applied to each swap, with 0.17 percent going to liquidity providers and 0.08 percent going to the HyperDex platform.

Farm

Users may deposit additional liquidity into the farm after obtaining LP tokens to receive even more HYP incentives. Farm participants are rewarded at a predetermined rate of 20% annually, which is distributed among all participants staking LP tokens.

Referral

Referrers who successfully recommend other users to HyperDex may earn additional HYP prizes. To be successful in referring a user, they must use your unique referral code and purchase a cube. If the referred user invests in the cube successfully, they will receive a bonus of 3–5% on their initial investment. Meanwhile, following the referred user’s first cube investment, the referring user gets an additional 3–5%, which is minted and dispersed.

Token Sale Phases

Minting

After the pre-sale phase, tokens will be minted every time a user’s profit is due. To mint tokens and prevent inflation or deflation issues, HyperCube’s profits will be minting only the Hyper Tokens expected from the percentage reward.

Pre-Sale Distribution

Roadmap

HyperDex’s plans include:

● Q1 2022: Platform’s loan and lending, Major DEX listing

● Q2 2022: New markets Cubes

● Q3 2022: P2P Loan exchange

● Q4 2022: Development on other blockchains (e.g. Cardano, Fantom, etc.)

Conclusion

HyperDex’s mission is to be the first decentralized finance investment platform for digital assets that are comparable to standard financial products. Using the platforms’ cube financial instruments will give investors various options on how they invest, learn from other traders, hedge their own position, participate in incubation, and a lot more.

The HyperDex platform is for anyone owning digital assets in the form of cryptocurrency or stable coins. HyperDex is building a platform that will effectively operate as a DeFi gateway for all types of investors, whether they have prior DeFi experience or not.