- IMF says that the greater integration between crypto and the Asian equity markets, post the pandemic, could pose stability risks to financial systems.

- It mentions that the growing volatility correlation between Bitcoin and equity could mean greater spillover across the two markets

On Sunday, August 21, the International Monetary Fund (IMF) published a detailed blog post explaining how cryptocurrencies have been getting increasingly correlated to the Asia equity markets and why it could be a sign of growing concern.

During the 2020-2021 mega bull run in the crypto market, Asian investors participated in huge numbers in the crypto space. This includes retail as well as institutional investors from parts of India, Vietnam, and Thailand. As a result, cryptocurrencies have shown greater integration with the traditional financial systems of Asia.

IMF explains that before the pandemic, cryptocurrencies were largely insulated from the financial system. Bitcoin and crypto had little correlation to Asian equities thus not posing any major stability risks to the financial system. However, the picture has changed in the last two years, noted the IMF.

Due to easy access to cheap borrowing, crypto trading soared with million of traders across Asia joining the crypto bandwagon. Asian investors participated in big numbers during the crypto bull run of 2021 taking the crypto market cap to more than $3 trillion.

The IMF expresses concerns that although the financial system stayed insulated from crypto in the past, it may not be the case going ahead. It notes that there’s every chance of the contagion spreading between crypto and the traditional financial markets. The IMF adds:

Large losses on crypto may drive these investors to rebalance their portfolios, possibly causing financial-market volatility or even default on traditional liabilities.

Volatility correlation between crypto and Asian equities

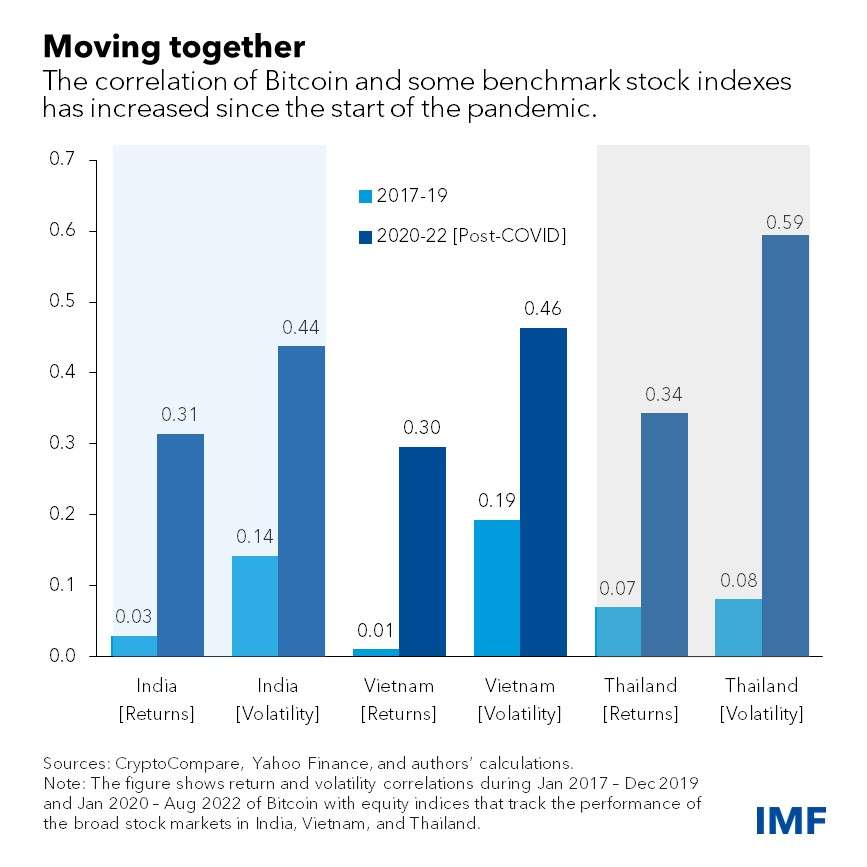

The IMF notes that before the pandemic, the returns and the volatility correlations between Bitcoin and the Asian equity market were low. However, they have increased significantly since 2020. Take a look at the below chart from the IMF to understand this correlation.

Courtesy: IMF

As seen, the returns correlation between Bitcoin and the equity market has jumped 10x after the pandemic. This hints at limited risk diversification benefits for crypto. Similarly, the volatility correlations have also jumped 3x which indicates the possibility of a spillover of risk sentiment across crypto and equity markets.

IMF explains that the greater interconnectedness between crypto and Asian equity markets could be due to several reasons. This includes greater acceptance of crypto platforms and investment vehicles, growing adoption by retail and institutional players, as well as the growth in crypto OTC markets. The IMF writes:

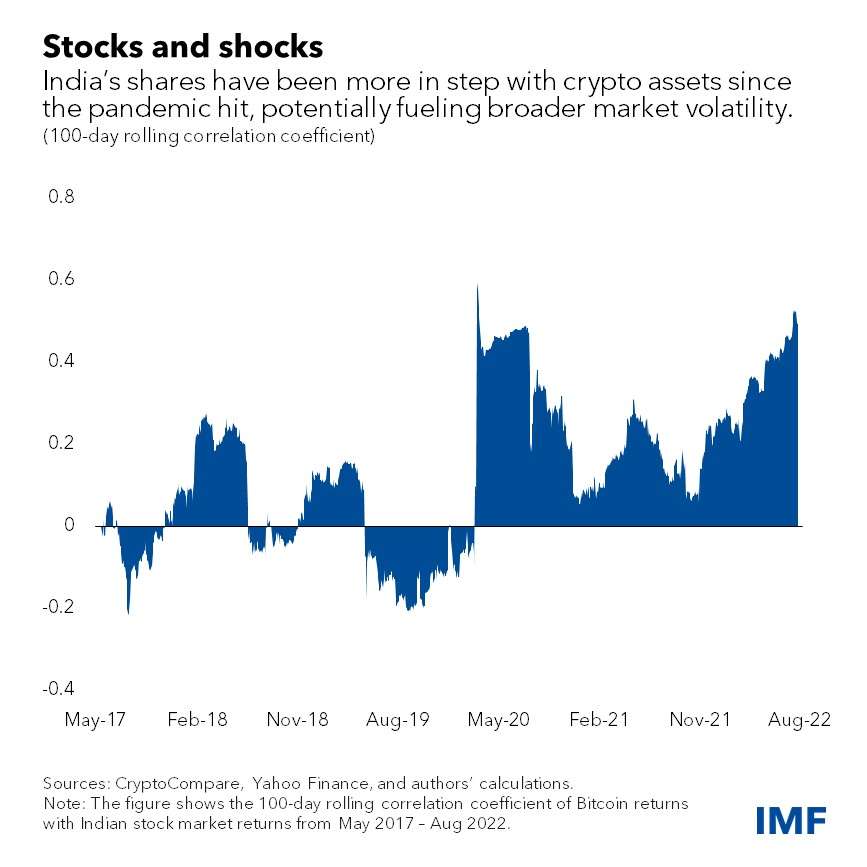

Using the spillover methodology developed in our January Global Financial Stability Note, we also find that the rise in crypto-equity correlations in Asia has been accompanied by a sharp rise in crypto-equity volatility spillovers in India, Vietnam, and Thailand. This indicates a growing interconnectedness between the two asset classes that permits the transmission of shocks that can impact financial markets.

Courtesy: IMF

As the adoption of digital assets grows in Asia, investors could be more sensitive to the risks posed by cryptocurrencies. The IMF praises the recent regulatory actions undertaken by the governments of India, Vietnam, and Thailand.

Related: Former IMF chief economist says governments are using CBDCs to divert attention from crypto