This is an opinion editorial by Margarita Groisman, a technology engineer invested in the power of Bitcoin to help people around the world.

Many remember the intensity and incredible spirit of the people of Hong Kong during the 2019 protests that went viral all over our screens. Thousands of everyday citizens took to the streets to protest Chinese use of excessive force and an aggressive legislative takeover that went against Hong Kong’s Basic Law. Beginning in March 2019 with a sit-in at government headquarters following an amendment to the extradition policy to mainland China, the demonstrations went on and on with mounting grievances.

Hong Kong, once a beacon of free economic activity, a center of trade and commerce, and a democratic and free state with a level of sovereign control, would be rapidly taken over by mainland China.

The outbreak of COVID-19 largely ended the protests, and the west turned away from the plight of the people of Hong Kong. A 2020 document out of Beijing declared that “comprehensive jurisdiction” would be achieved by the Chinese Communist Party (CCP) over Hong Kong, with people’s observance of COVID-19 restrictions giving China the ability to quickly sweep away opposition using force and without the interference of foreign powers.

Freedoms that those in the West take for granted, such as the right to protest and to free speech, no longer exist in Hong Kong with all forms of political opposition now silenced. The new National Security Law, designed to prevent “secession, foreign interference, terrorism and subversion against the central government” was passed in May 2020, bypassing the local legislative process and allowing China to take unprecedented control of Hong Kong.

Hong Kong’s once-enshrined Basic Law, granting it a “capitalist system and way of life” and granting “a high degree of autonomy,” including executive, legislative and independent judicial powers for 50 years, has been broken and ended by the will of the CCP.

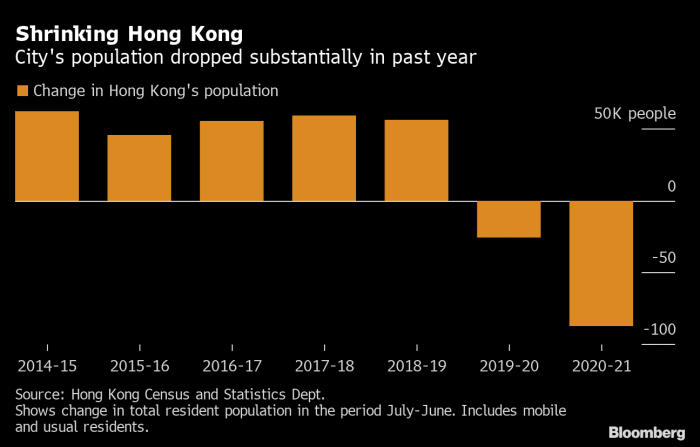

Since then, we’ve seen a mass exodus of the people of Hong Kong as basic freedoms that the residents used to enjoy have virtually all been taken away. We’ve also seen a weakening of the economic strength of Hong Kong

COVID-19 And Continued Suppression Of Freedom In Hong Kong

While Hong Kong has implemented a stringent response to the COVID-19 pandemic with a “zero-COVID” policy, in March 2022, it reported one of the highest Covid death rates in the world.

This fascinating Atlantic article described the situation in Hong Kong, where COVID-19 has been used by the government to justify and demand absolute control of the population. Hong Kong faced extreme and consistent shutdowns and continues to dramatically fail and yet ceaselessly defends a zero-covid policy:

“With opposition voices silenced, Hong Kong’s rulers claimed they could more efficiently govern. But in the city legislature, overhauled last year to ensure that nationalism and obedience are valued over competence and political know-how, suggestions on how to tame the outbreak have included the wildly impractical (using cruise ships as temporary isolation facilities) and the patently absurd (dropping fresh food into Hong Kong by drone). Even this newfound sense of urgency on the part of lawmakers and the government has emerged only after Chinese President Xi Jinping spoke last month of the ‘overriding mission’ to bring the current outbreak under control.”

“‘Hong Kong’s pandemic response definitely shows the NSL [national-security law] new order is not only about election and activists, but extends to all realms of life,’ Ho-Fung Hung, a professor at Johns Hopkins School of Advanced International Studies and the author of the forthcoming book City on the Edge: Hong Kong Under Chinese Rule, told me by email.”

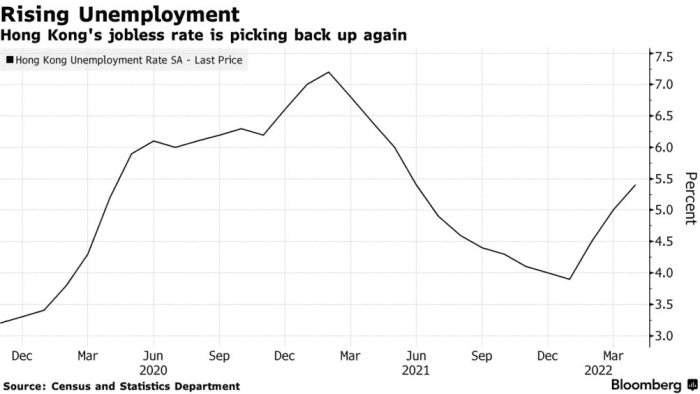

This strategy has had significant effects on unemployment and financial troubles for the city:

Hong Kong’s Dollar Is Pegged To The U.S. Dollar

Despite all of the authoritarian changes, Hong Kong still operates on a currency pegged to the U.S. dollar. The Hong Kong Monetary Authority aims to keep the currency trading at HK$7.75 to HK$7.85 per $1. But as the U.S. has begun to raise interest rates, and Hong Kong lost significant liquidity even as the city fought to maintain its peg. In fact, just between May and July, the balance of Hong Kong dollars shrank by more than half.

“For example, the gap between the Hong Kong Interbank Offered Rate (Hibor) and its US counterpart (dollar Libor) widened significantly after the Fed began its aggressive rate hikes, because liquidity in Hong Kong was still very ample. (Hibor and Libor represent a daily average of what banks say they would charge to lend to one another.) That gap makes it attractive for traders to borrow in Hong Kong dollars to buy US dollars to earn the higher yield. That so-called carry trade can push the local currency toward its weak end of HK$7.85, prompting the HKMA to intervene.”

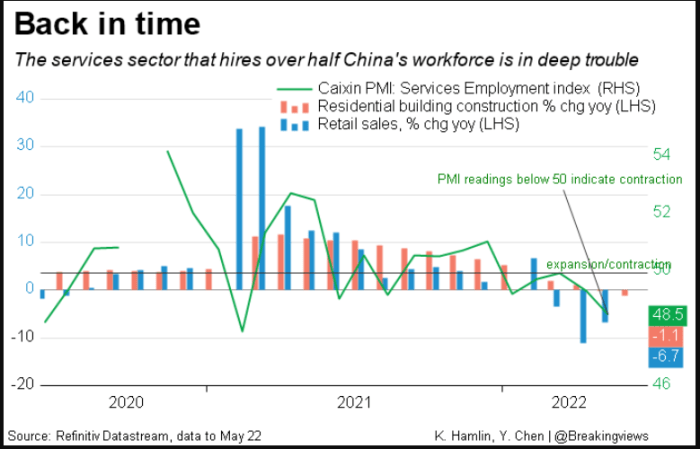

In some ways, this means that Hong Kong is caught between the political control of the Chinese Communist Party and financial reliance on the U.S. dollar and fiscal policy. Despite Hong Kong seeing a stable currency, as Hong Kong’s inflation rate for 2021 was 1.57%, a 1.32% increase from 2020, it saw a significant uptick in borrowing costs due to this significant selloff. And while the peg to the U.S. dollar allows Hong Kong to at least financially remain semi-autonomous, the combination of the population decline hitting real estate prices in Hong Kong so significantly due to a demand dropoff and the increased borrowing costs to maintain the peg has hit the economy hard. Hong Kong faced very significant COVID-19 restrictions, and as a result, joblessness is somewhat mirroring the trends within China.

Speaking to Bloomberg, George Magnus, an economist and associate at the University of Oxford China Centre, made it very clear: “It’s China’s choice whether it wants to keep the peg in place.”

And it seems clear that the CCP now holds soft power over the local government of Hong Kong and could possibly decide to move Hong Kong under complete economic control. Especially as China and Russia work together to create a new reserve currency and the long-term future of the reserve capacity of the dollar depending on the Federal Reserve’s success in curbing rising inflation, it seems that Hong Kong’s days of financial autonomy may be limited.

Is Bitcoin A Way Out For Hong Kong?

Interestingly enough, considering this precarious financial and political position, Hong Kong was listed as the most “crypto-ready” country in 2022.

This statistic was determined by “factors such as crypto ATM installations, pro-crypto regulations, startup culture and a fair tax regime signal a country’s readiness to adopt cryptocurrencies.” Considering these factors, a Forex Suggest study revealed Hong Kong’s position as the best-prepared country for widespread cryptocurrency adoption, with a crypto-readiness score of 8.6,” per CoinTelegraph. And as previously reported in Bitcoin Magazine, Hong Kong saw an uptick in bitcoin trading during the 2019 protests, showing a need for an effective peer-to-peer exchange that would not be controlled by the government of Hong Kong (now a pawn of the CCP).

Those who stay in Hong Kong stay because it is their home. But as China strengthens its control more and more over the region, COVID-19 restrictions seem to be never-ending, and even the most basic of freedoms for the population of the city continue to be eliminated. Hong Kong’s long-term outlook is looking increasingly bleak.

This will become increasingly clear if China moves Hong Kong to a currency tied to the yuan or one under a Chinese-state-sponsored digital currency. In fact, China has already made efforts to move Hong Kong under the state-sponsored e-CNY, or the CCPS, a centralized digital currency. After all, “Experts close to the People’s Bank of China and state-owned bank officials believe, however, that e-CNY will ultimately contribute to the yuan’s internationalization in the long term,” per Carnegie Endowment Scholar Robert Greene.

This would signal a complete end to Hong Kong’s autonomy.

The people of Hong Kong have few options left available to them in terms of hope of regional autonomy or any sort of freedoms given to individuals. If citizens are to act quickly, they could choose to move toward a different path than the one they are currently tumbling down. If the incredible talent and intelligence of the people of Hong Kong adopt the Lightning Network to conduct peer-to-peer exchange on top of Bitcoin, for instance, they could perhaps chart a difficult but promising path out of the complete control of China.

The alternative is the current path that Hong Kong is one, where it loses regional autonomy, individual freedoms and the ability to make its own destiny.

This is a guest post by Margarita Groisman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.