- BTC breaks $40k resistance level.

- Bitcoin trades over $41K.

- BTC price performance remains good prior to US executive order.

The bullish market favors Bitcoin once again as it trades over $41k, breaking free from its $40k resistance level. Furthermore, BTC is now trading almost $30 billion in the past 24 hours, an amount that justifies the overwhelming number of investors of BTC. This performance of the coin recorded a 24-hour growth rate of over +8%.

Meanwhile, the news about the American President Joe Biden signing an executive order about Bitcoin and cryptocurrencies also impacts the recent price performance of the coin. It is said that Biden will sign the executive order this week. The order is expected to address the issues faced by digital assets or cryptocurrencies in the country.

In terms of the ongoing crisis between Russia and Ukraine, both countries are now heavily mass adopting the use of digital assets. Ukraine, for example, opened a public address for different types of cryptos. These public addresses are open to all interested people that are willing to donate some of their cryptos to the country. The cryptos such as BTC, USDT, TRON, DOT, and BNB are some of the cryptos accepted by the country.

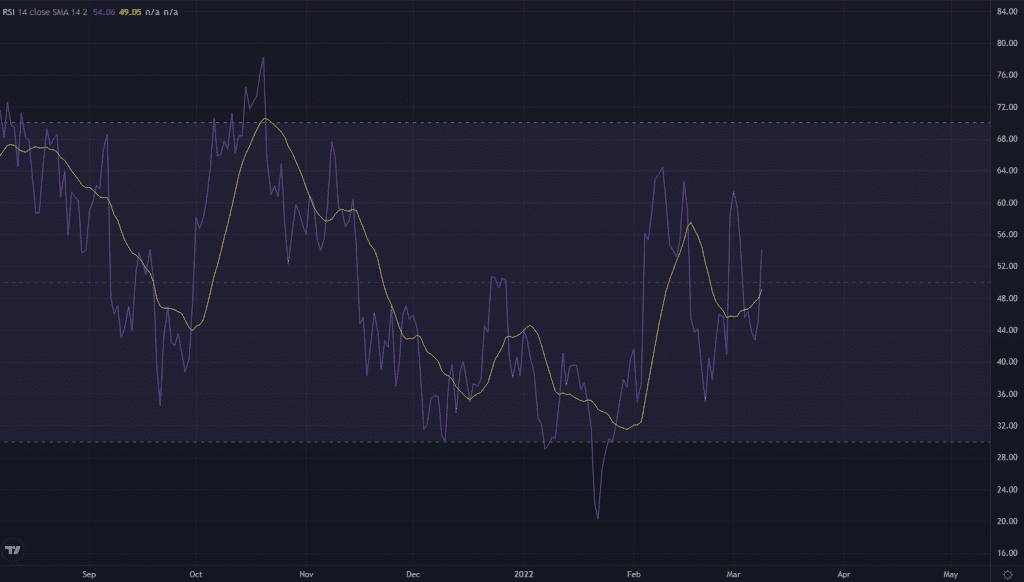

On the other hand, BTC chart performance continues to move in the right direction.

As seen in the chart above, the crypto’s relative strength index (RSI) keeps moving within the 70-30 level. This means that the crypto is neither overbought nor oversold. As a result, traders and investors can trade without the fear of any major price reversal. However, if the RSI of the crypto breaks the 70-30 level, it will be a different story.

Disclaimer: The views and opinions expressed in this article are solely the author’s and do not necessarily reflect the views of CoinQuora. No information in this article should be interpreted as investment advice. CoinQuora encourages all users to do their own research before investing in cryptocurrencies.