As the global cryptocurrency market is growing further each day, governments around the world are working harder to bring the industry under a regulatory regime. While some countries have managed to enact efficient regulations to cultivate the industry in a safe manner, others have created more uncertainty through opposing stances, and often skeptical stances.

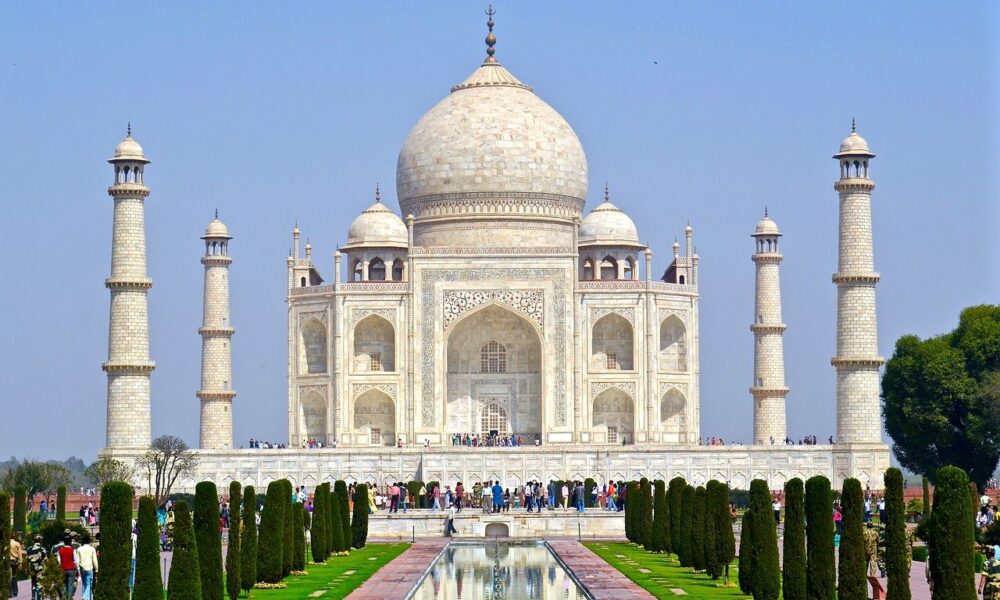

A similar scenario can be seen playing out in India, even as a definitive regulatory framework is yet to be released. However, when the country had first expressed a desire to do so late last year, its Finance Minister Nirmala Sithraman had claimed that rules would be structured in a manner that doesn’t hinder innovation.

Yet, local news media has recently reported that around 30-50 Indian-origin cryptocurrency companies are now operating in friendlier jurisdictions abroad, namely Dubai and Singapore. Both city-states are considered crypto havens worldwide due to their efficient yet broad crypto regulations.

In its report, The Economic Times further noted that this trend had first started to emerge in 2018 when the country’s central bank had decided to ban all forms of cryptocurrencies. While this stance was soon reversed amidst significant opposition, an environment of fear and uncertainty has continued to remain.

Moreover, India’s recent moves regarding the industry have been of no help, and have only accelerated the migration. In fact, industry proponents appear more fearful as Sithraman continues to project a skeptical and confusing stance over the matter. Additionally, a 30% tax on all cryptocurrency income was also imposed recently, which has only added to the industry woes, even as the minister has argued that this does not indicate that the asset class has been legalized.

This is even as top crypto projects today like leading layer 2 solution Polygon, which too operates from Dubai, have Indian origins, while domestic exchanges are also witnessing immense growth and investments.

On the other hand, however, Dubai has been capitalizing greatly on the growing sector, with an expectation of 1,000 operational crypto businesses in the coming year. To facilitate this interest, Dubai recently created a Free Trade Zone for cryptocurrency businesses, while the Dubai World Trade Center (DWTC) is in process of turning into a comprehensive zone and regulator for digital assets, products, operators, and exchanges.

Leading cryptocurrency exchange Binance, which is often stuck in regulatory limbo worldwide, has already struck an agreement with DWTC in a bid to become operational as an international virtual asset ecosystem