The government of India has listed a cryptocurrency bill to be taken up in the upcoming session of parliament that starts next week. The bill seeks to prohibit cryptocurrencies with some exceptions. It will also create a facilitative framework for a digital rupee to be issued by the Reserve Bank of India (RBI).

Indian Government Pushes for Crypto Legislation Before Year-End

The Indian government has listed a cryptocurrency bill to be taken up in the winter session of Lok Sabha, the lower house of India’s parliament, according to the legislative agenda for the upcoming session released Tuesday.

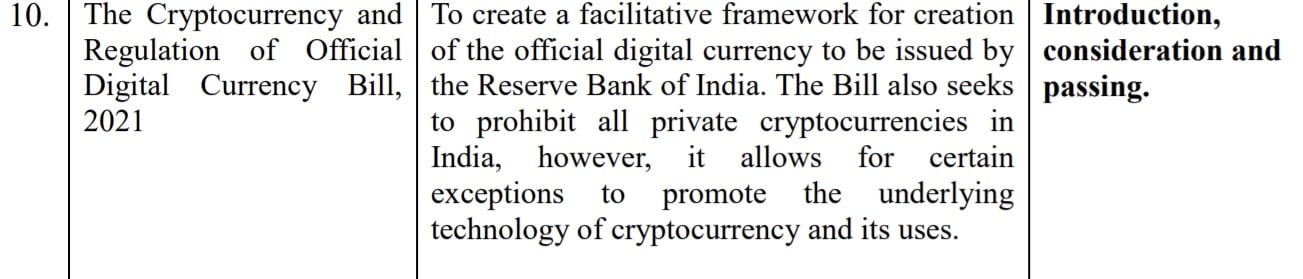

The title of the bill is “The Cryptocurrency and Regulation of Official Digital Currency Bill 2021.” The government expects it to be introduced and passed in the same parliamentary session, which is set to commence on Monday, Nov. 29, and will conclude on Dec. 23.

According to the government’s description, the bill aims “To create a facilitative framework for creation of the official digital currency to be issued by the Reserve Bank of India. The bill also seeks to prohibit all private cryptocurrencies in India, however, it allows for certain exceptions to promote the underlying technology of cryptocurrency and its uses.”

This is the second time the Indian government has listed a cryptocurrency bill to be taken up in parliament. In January, the government listed a crypto bill for the budget session. However, it was not taken up. The title of the bill and the accompanying description for the winter session are exactly the same as the listing for the budget session of parliament.

Tanvi Ratna, CEO of Policy 4.0, commented on the news of the Indian government listing the crypto bill Tuesday:

Yes, it’s expected that the government will pass legislation in this session itself. However, it may not be a complete legislation.

She added: “Operational & implementation questions are likely to be debated in the budget session only.”

Ratna believes that cryptocurrencies like bitcoin (BTC) or ether (ETH) could be allowed in some form. Noting that “The exemptions that are being mentioned are ones routed through GIFT City,” she clarified:

Private cryptocurrencies are not privacy coins but non-rupee currencies. It is expected that some basic coins such as BTC, ETH etc could be allowed in some form.

A senior government official told Reuters Tuesday that the plan is to ban private crypto assets ultimately while paving the way for a new central bank digital currency (CBDC).

The RBI has previously said that it is working on a digital rupee, which is expected to be launched in phases. The central bank has repeatedly said that it has major concerns about cryptocurrency.

However, since the current crypto bill has not been made public, Indian crypto experts have urged investors not to panic sell.

The only bill that has been made public is the original one drafted by the inter-ministerial committee (IMC) headed by former Finance Secretary Subhash Chandra Garg. Published in July 2019, the title of that bill was “Banning of Cryptocurrency & Regulation of Official Digital Currency Bill 2019,” which is slightly different from the one listed to be taken up in the upcoming session of parliament.

The bill drafted by the Garg committee has been seen as outdated as the crypto ecosystem has significantly evolved since the bill was published. Even Garg himself admitted that when the bill was drafted, crypto was viewed more of a currency, rather than an asset. He now believes that crypto assets should be regulated. “Regulate, control cryptocurrencies but allow the crypto assets, encourage the crypto services,” the former finance secretary said in May.

Last week, Indian Prime Minister Narendra Modi urged all democratic countries to work together on bitcoin and cryptocurrencies to ensure that they do not fall into the wrong hands. He also chaired a comprehensive meeting on crypto. Furthermore, India’s Parliamentary Standing Committee on Finance held a meeting with representatives from the crypto industry.

Do you think India will ban cryptocurrencies like bitcoin and ether? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer