The Three Arrow Capital (3AC) collapse has come barely one month after the Terra collapse. Both of these crypto giants crashing in such a short time frame has put the market in one of its most volatile positions yet. The Luna collapse had reverberated through the market and 3AC had taken a lot of heat coming off this. This report focuses on the events that led to the eventual demise of one of crypto’s leading firms and the lessons it has left.

The Collapse Of 3AC

The Luna collapse had at first seemed isolated bar investors losing billions of dollars. However, the weeks following the collapse would show that its impacts were farther spread than initially expected. One of those caught in the crossfire had been 3AC.

The crypto fund had been directly in the crosshairs of the Luna crash with exposure of more than $200 million and speculated to be as high as $450 million. At first, the firm had appeared to bounce back from the Luna collapse but it would be soon obvious that 3AC was in a more perilous position than investors thought.

Related Reading | What Bear Market? NFT Volume Continues To Grow Despite Crypto Decline

Founder and CIO Su Zhu, who had been vocal about his belief in the super cycle where nothing really crashes would soon be proven wrong with the market and the firm would take the hit with him. With the Luna crash, the losses that 3AC had taken had put pressure on the crypto firm. And as the market had failed to recover properly, 3AC would soon find itself being liquidated of its undercollateralized loans by a large undisclosed lender.

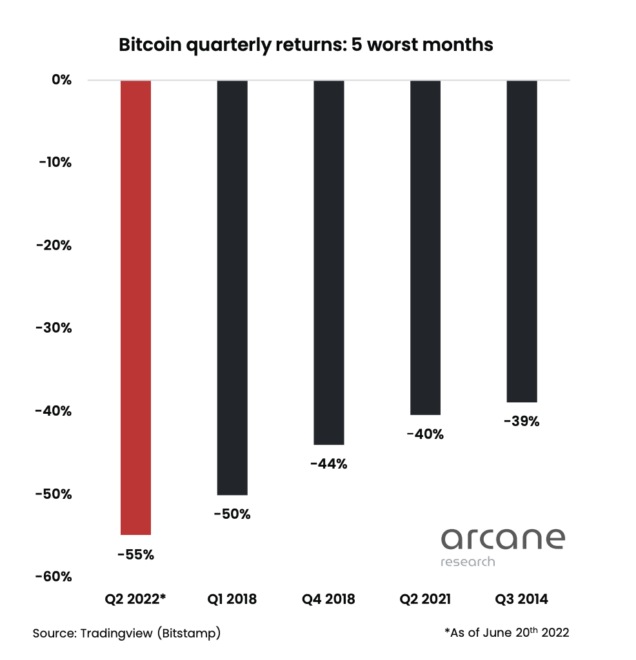

BTC performance worsens in 5 months | Source: Arcane Research

Other liquidations would follow as crypto exchanges such as Bitmex and FTX had liquidated the crypto firm. BlockFi and Genesis had also revealed that liquidations and mitigations of losses are ongoing with Genesis saying the losses would be netted against its balance sheet. After liquidations, Bitumen is apparently still being owed $6 million by 3AC.

Lessons Learnt From The Collapse

The 3AC collapse had brought to the fore a lot of important investment precautions that should be taken. With the bull market, a lot of caution had been thrown to the wind since everything was repeatedly ‘pumping’ and as such, everyone was making money.

Related Reading | Think You’re Down Bad? This Ethereum Wallet Got Liquidated Over 71,800 ETH

However, when dealing with a volatile market such as the cryptocurrency market, risk management, prudent planning, and wariness cannot be overemphasized. They help both small and large investors make smarter decisions instead of going off based on conviction and confidence in a project.

3AC suffers from LUNA crash | Source: LUNAUSD on TradingView.com

The collapse had left various parties that were involved with 3AC in various levels of debt. Eventually, these debts would have to be taken on as a loss by these parties but it remains to be seen how they handle the debt. But with the collapse of two market giants in such a short time, the implications are expected to be vast and substantially negative.

As the events continue to unfold, investors would be best served to take a defensive position when it comes to their portfolios. Once the effects of the 3AC collapse are being felt in the market, it is expected that the already pressured markets would succumb further to the bears.

Featured image from Business 2 Community, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…