- Coinbase Pro buyers stepped up to buy Bitcoin at $20,000; data suggests mass buying.

- Coinbase Premium returned to positive territory for the first time since May 2022, suggesting heightened demand for Bitcoin.

- Analysts watch out for a lower high and a higher low in Bitcoin price before predicting the next move for the asset.

Bitcoin price closed Q2 2022 below the $20,000 mark after a last-minute attempt by bulls to escape 40% monthly losses. Bitcoin bottoming signals are everywhere, according to on-chain analyst Will Clemente. Bitcoin price could see months of capitulation before recovery.

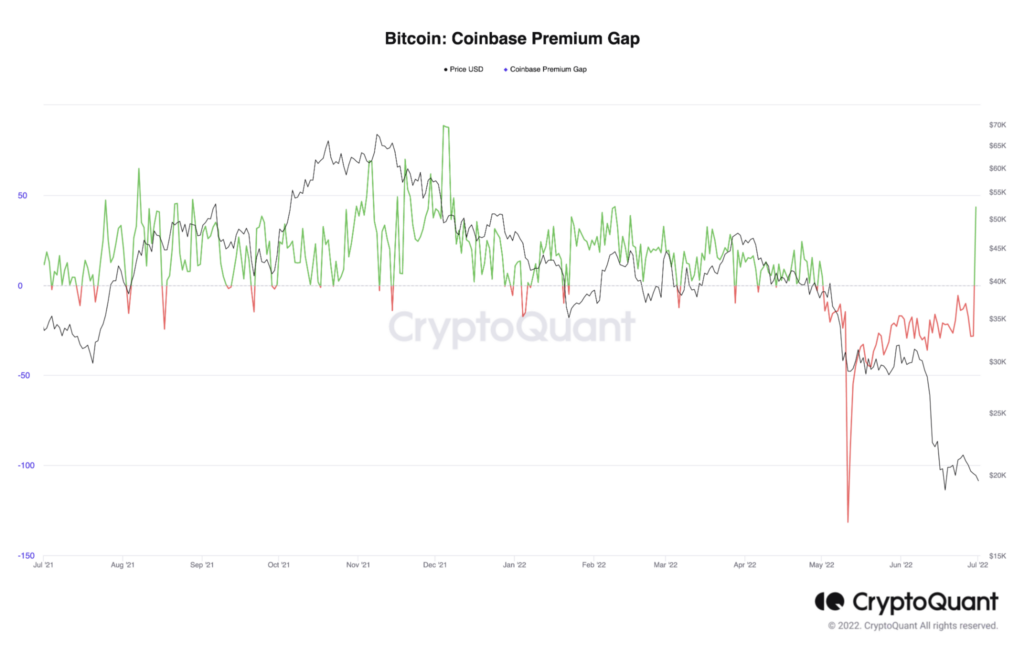

On Coinbase Pro, there was evidence of Bitcoin “buy” at the $20,000 level. Based on data from the on-chain analytics platform CryptoQuant, Coinbase Premium entered positive territory for the first time since May 2022.

Coinbase Premium is the difference between Bitcoin price on Binance and Coinbase’s institutional arm, Coinbase Pro. When Coinbase Premium is positive, it implies traders are paying a higher price for Bitcoin on Coinbase’s platform for institutions. This suggests higher demand for Bitcoin among institutional investors.

CryptoQuant uses “Coinbase Premium Gap” to identify the buying pressure on Bitcoin from US investors. The last value was 43.41, indicating strong buying pressure from institutional investors.

Contrary to popular opinion, market participants are scooping up Bitcoin and increasing their BTC allocation. Based on data from crypto intelligence platform Glassnode, the smallest and largest Bitcoin holders are both in the buying mode close to the $20,000 level.

Market participants with a balance of 10 Bitcoin or less, labeled as shrimps and crabs, are accumulating BTC since the price dropped below the $20,000 level. Checkmatey, a pseudonymous crypto analyst tweeted:

“Shrimp are adding to the $BTC balance at the greatest rate since the 2017 ATH. Same price, different trend direction. I do not underestimate the smarts not a conviction of the little guy in Bitcoin.”0

Bitcoin holders with 10 to 1,000 BTC are likely to be the worst hit segment of market participants, suffering the negative effects of deleveraging and margin calls.

Ki Young Ju, the CEO of analytics firm CryptoQuant, observed that stablecoin reserves across exchanges are worth half the Bitcoin reserve. The CryptoQuant CEO concluded that the $25 billion worth of stablecoin reserves could pour into Bitcoin, pushing the asset back into recovery mode soon.

At the time of writing, Bitcoin’s price continued to range below $20,000. Analysts are watching out for a lower high at $21,800 or a higher low at $18,600 to decide the direction of Bitcoin’s price trend.