The new second-generation ASIC crypto mining chips from Intel may well rival, and in many cases beat, existing leaders in the market.

Intel, the semiconductor giant, recently stepped onto the crypto industry with the big reveal of its new application-specific integrated circuit (ASIC) miner. At the ISSCC 2022 conference, Intel presented its prototype BMZ1 bitcoin (BTC) miner, however, that was only a prototype and not the product that it plans to ship out to new customers.

Enter, the second-gen Bonanza Miner chips (BMZ2) — shrouded in mystery — these will actually be shipped out to customers. With Intel’s second-gen miner launching soon after the BMZ1, most were caught off guard with the BMZ2’s performance, efficiency, and price.

Second-generation Intel crypto miner makes a comeback

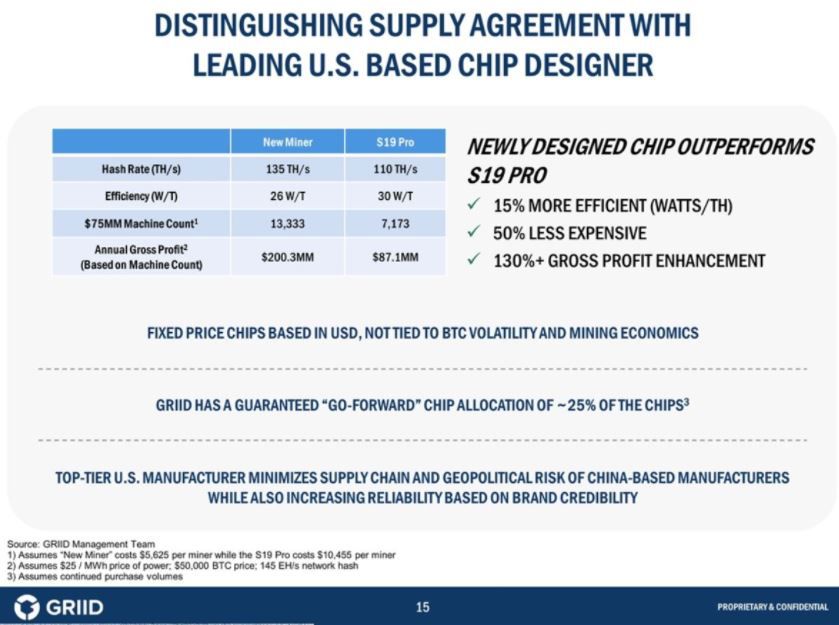

When comparing the Intel prototype that was on show at ISCC to what it’ll be distributing to its customers like GRIDD, Argo Blockchain, and BLOCK (formerly Square, led by Jack Dorsey), it can barely compete. A new SEC filing by GRIID, a Bitcoin mining and infrastructure company, has revealed some specifications of the new miner.

An analysis done by Tom’s hardware showed that:

According to the listing, BMZ2’s performance weighs in at 135 TH/s with 26 J/THs of efficiency. Additionally, the miner is roughly half the cost of a competing Bitmain S19 Pro while being 15% more efficient, rivaling the best hardware on the market from competing companies.

This means that the Intel BMZ2 outperforms almost all other miners except for the S19j XP, which only wins “by a small margin.” Additionally, it’s 15% more efficient than other top systems, with “peak performance for the BMZ2 system [weighing] in at a competitive 135 TH/s. A bit of basic math reveals the system runs at approximately, 3510W.”

As shown in the above graph, the BMZ2 models clearly outperform the prototype BMZ1 and are only second to the Bitmain Antminer S19j XP. However, when looking at bang for your buck, GRIDD says the new intel miner costs about $5,625. Although GRIDD more than likely benefits from volume pricing, it’s still half the cost of the $10,455 Bitmain S19J Pro.

A competitive edge

Besides being able to give a better price than most, with Intel being the world’s largest semiconductor manufacturer they don’t have to deal with price fluctuations like Bitmain, and other Bitcoin hardware providers. These companies generally adjust prices based on Bitcoin’s spot trading price and projected payoff time.

Intel, on the other hand, has a fixed pricing per unit that isn’t affected by Bitcoin prices and since it’s based in the U.S. it can sell miners to U.S. organizations at a much cheaper rate. This is due to the 25% tariffs that are placed on products that originate from China, and since it’s banned mining, Chinese companies will need to export.

These phenomena have put Intel in a very advantageous position since the ban now makes the U.S. one of the primary places to sell crypto miners. When looking at pricing, performance, and efficiency, Intel’s new BMZ2s’ could become the new top dog of crypto miners.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.