Pantera Capital CEO Dan Morehead said that an increase in interest rates would not be “really that bad” for bitcoin (BTC), a proxy for the crypto industry. Relative to other asset classes, the rate hike might “actually [be] great for blockchain prices,” he says.

The U.S. central bank, or Federal Reserve, is preparing to raise interest rates to curb inflation and has indicated that it may raise rates three times in 2022, perhaps beginning as early as March. Investors have been watching the Fed’s next steps, worried that any policy changes will cause a decline in cryptocurrency prices.

In a Feb 16 letter to investors, Morehead agreed with an assessment by Pantera co-chief investment officer Joey Krug that the market had “priced in about five rate hikes” already. Krug said while “crypto definitely got hit” by news of the Fed’s planned rate hikes, this was “being overplayed.”

Krug forecast that crypto markets will decouple from traditional markets “over the next number of weeks”. He said that when conventional macro markets decline, crypto tends to correlate with them for a period of around 70 days before it breaks away and starts to trade on its own. The CIO explained:

“Crypto is still a relatively small market and so things like the federal funds rate being at 1.25% versus 0% doesn’t make a huge, huge difference for something that’s growing four to five times year over year, especially if you look at stuff like DeFi, where it’s already trading at fairly cheap multiples.”

Bitcoin, Ethereum prices have bottomed out

Krug asserts that ethereum (ETH) at $2,200 was “likely the bottom.” This may apply to the broader crypto market, which crashed on Jan 21, with more than $230 billion wiped off the total market capitalization. BTC slumped 7.1% to under $39,000 on the day. It tanked further to around $33,000 a few days later amid fears of a hike in interest rates.

Dan Morehead, the Pantera chief executive officer, said bitcoin as an asset class will flourish during periods of rising rates. He discussed scenarios involving different assets and how an increase in rates could impact them. Bond and stock prices will fall, he observed, as does real estate and other types of assets. Morehead said:

“Whereas blockchain isn’t a cashflow-oriented thing. It’s like gold. It can behave in a very different way from interest-rate-oriented products. I think when all’s said and done, investors will be given a choice: they have to invest in something, and if rates are rising, blockchain is going to be the most relatively attractive.”

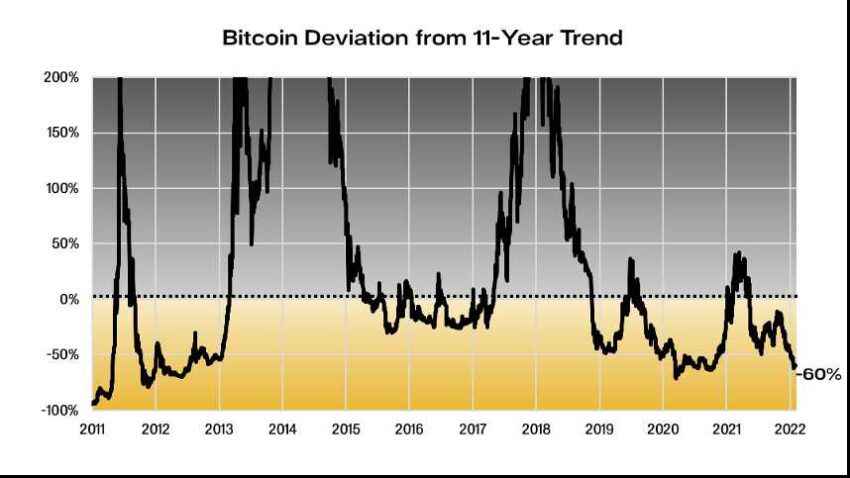

He showed that the price of bitcoin is currently trading at 60% below its 11-year trend, meaning “the odds are really high that the markets are at an extreme and will bounce back relatively quickly.”

Morehead predicted what he called the U.S. “bond bubble,” which will pop soon, and drive many people into crypto. He also said some of the recent declines in digital asset prices may have resulted from investors selling their holdings to pay tax, due by April 15 in the U.S.

U.S. inflation rose to 7.5% year-on-year in January, its highest level in 40 years. The Fed says it’s planning to raise its benchmark interest rate to contain inflation. Rates have remained near zero since March 2020.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.