Bitcoin ETFs had been seeing a lot of interest since they were first given the green light by the Securities and Exchanges Commission (SEC) last year, and while some of them have waned, they still remain a good option for institutional investors wanting to bet on the digital asset but not hold any of it themselves. Following the success of the futures bitcoin ETFs have come the short bitcoin ETFs which have now begun to dominate the market.

ProShares BITI Barrels Ahead

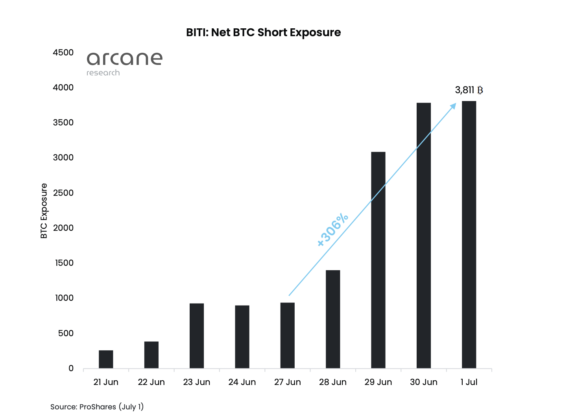

The ProShares BITI ETF, popularly known as the first short bitcoin ETF in the United States has been making waves since lits aunch. Only a little over a week old, the ETF has garnered the favor of institutional investors who have flocked to take advantage of it. This has led to one of the fastest growth rates in the history of bitcoin ETFs given how quickly inflows have poured in.

Related Reading | Is Coinbase Losing Its Edge? Nano Bitcoin Futures Sees Low Interest

The BITI was reported to have made a splash just four days after launch which saw it become the second-largest bitcoin ETF in the country. As its popularity has grown, so have the investors flocked to it. It would do even better in its second week, setting a new record with the amount of BTC flowing in.

As of early this week, BITI’s holdings have climbed to a total of 3,811 BTC. Most of the inflows had come into the ETF towards the end of June where 700 BTC and 1,684 BTC had flowed into the fund on June 29th and 30th respectively.

Short BTC ETF hits new record | Source: Arcane Research

With this, BITI has barreled forward, and although it still remains the second-largest BTC ETF in the region, it has put more gap between it and competitors such as Valkyrie and VanEck bitcoin futures ETFs.

Are Investors Bearish On Bitcoin?

With $51 million said to have flowed into short BTC ETFs for the past week and setting a new record, it does seem to point to the fact that institutional investors are bearish on the future of bitcoin. However, this is only the case when it is looked at from one point of view.

BTC trending at $20,000 | Source: BTCUSD on TradingView.com

Even with its massive growth, the BITI still pales in comparison to the ProShares BITO, a long BTC ETF. At 3,811, the short bitcoin ETF only makes up about 12% compared to the size of its long counterpart. This shows that although interest is growing in short bitcoin ETFs, the majority of investors still prefer to be long in bitcoin, and that points to more bullish sentiment.

Related Reading | Summer Inside Crypto Winter: Solana Steals The Lead From Ethereum

Nevertheless, the inflows into the BITI show that even if just in the near future, more investors are trying to take advantage of the perceived weakness in the market. Experts in the space have said they expect this to continue at least through the end of the year. As such, it is no surprise that investors are trying to profit off what they believe to be another six months of declining prices.

Featured image from Admiral Markets, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…