Uniswap (UNI) recently outperformed every other crypto in the top-20 list in terms of market capitalization by registering figures of over 8% in seven-day gains. Interestingly, Messari’s data revealed that Uniswap has also consistently maintained a DEX market share of 75% throughout Q3. This, in many ways, is good news for the ecosystem.

@Uniswap remained consistently at ~75% of DEX market share throughout Q3.

Notably, @CurveFinance‘s volume share fell from 16% down to 8% despite continuing to issue higher incentives than the competition. pic.twitter.com/LqcUpnEvO2

— Messari (@MessariCrypto) October 2, 2022

However, while the aforementioned might seem promising, there have been several other developments across the crypto’s metrics too. These are worth looking at, especially since each might trigger a pullback soon.

At press time, UNI was trading at $6.39 with a market capitalization of more than $4.87 billion.

What do the metrics say?

A look at UNI’s metrics indicated that the altcoin’s good days might come to an end soon as several of them pointed to a possible downtick in the coming days.

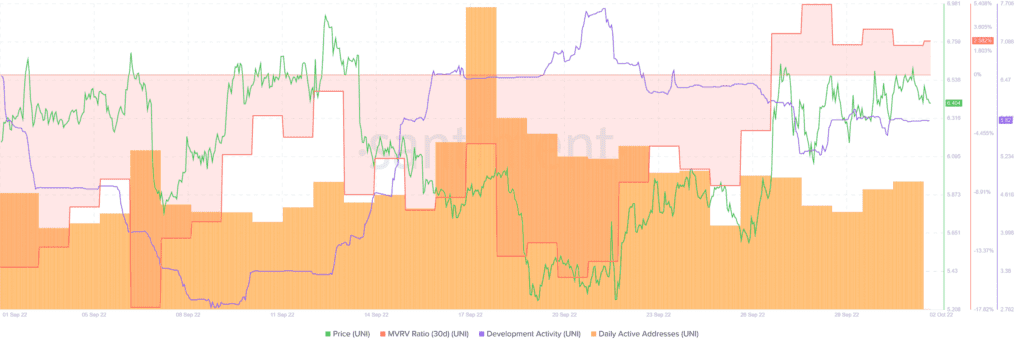

For instance, UNI’s development activity has fallen, having moved sideways of late – A negative signal as it reflects a decrease in developers’ efforts to improve the blockchain.

Moreover, Uniswap’s daily active addresses also fell significantly after registering a spike on 17 September, yet another red flag as it indicates a lower number of users on the network. Finally, CryptoQuant’s data revealed that UNI’s Relative Strength Index and Stochastic were at overbought positions, further increasing the chances of a price downfall soon.

Despite the negative implications of the metrics listed, however, a few developments might help UNI go up further in the days to come. Interestingly, UNI is now among the cryptos that the top-1000 Ethereum whales are holding. This is a positive signal as it represents whales’ trust in the altcoin.

🐳 The top 1000 #ETH whales are hodling

$139,221,567 $SHIB

$86,552,277 $BIT

$63,379,028 $UNI

$54,667,520 $LOCUS

$50,940,101 $LINK

$49,452,887 $MKR

$39,721,877 $MANA

$37,625,420 $BESTWhale leaderboard 👇https://t.co/jFn1zIOq03 pic.twitter.com/FJIEfMXKqw

— WhaleStats (tracking crypto whales) (@WhaleStats) October 1, 2022

That’s not all either, with UNI outperforming every other crypto in terms of social activity recently too. This development, again, is a positive signal as it pointed to greater popularity within the crypto-community.

⚡️Coin of the day by social activity – @Uniswap $UNI

1 October 2022 pic.twitter.com/sDLALSZbuk— 🇺🇦 CryptoDep #StandWithUkraine 🇺🇦 (@Crypto_Dep) October 1, 2022

Thanks to the mixed nature of the aforementioned metrics and their findings, it’s worth anticipating what’s in store for UNI and Uniswap in the weeks and months ahead.