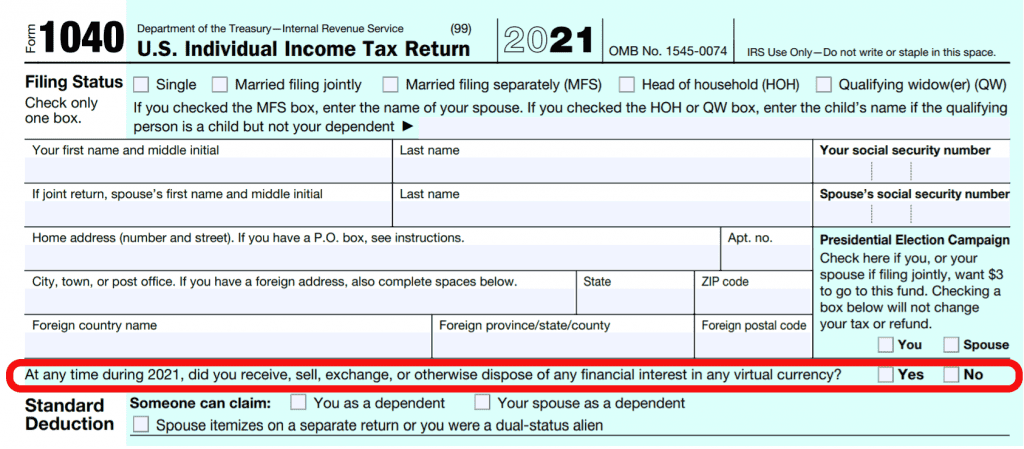

As 2021 comes to a close, the tax season is fast approaching, and now the US Internal Revenue Service (IRS) has turned its focus towards crypto investors. Form 1040, which all taxpayers use to file their taxes, has a question about cryptocurrency.

IRS looking at digital currency investors

Investors are required to report taxable transactions involving cryptocurrencies to the federal government. These transactions include compensation in crypto, rewards for crypto mining, and free coins. Requiring information on crypto transactions isn’t new to this tax year, but the IRS is increasing its emphasis on digital currency brokers. This news comes as Congress and President Biden’s team looks to crack down on tax cheats.

According to a U.S. Department of the Treasury report, the crypto-currency-driven economy has contributed to the tax gap in part to lax reporting requirements that facilitate tax evasion. This all comes as digital currencies have become more popular among investors.

The IRS first targeted crypto dealings in 2019, when they first asked taxpayers about their digital currency transactions for 2019 taxes. However, it was only on a Schedule 1 form, which not all taxpayers use. Schedule 1 forms report only a handful of types of income, including unemployment or rental income. Tesla CEO Elon Musk has said that Tesla would accept dogecoin as payment for some of their merchandise.

Congress looking to crack down on tax cheats

In 2020, the IRS placed the cryptocurrency on the 1040 form, which it has stayed for the 2021 tax year. According to CNBC, the question changed to, “At any time during 2021, did you receive, sell, exchange or otherwise dispose of any financial interest in any virtual currency?”

The only real change is that the question only asks about things that lead to taxable events. The new requirements aim to make it harder for cryptocurrency investors to hide activity. It’s still challenging to calculate profits and losses for every transaction. As the government continues to dig into the digital currency economy, tighter restrictions will follow.