El Salvador’s president Nayib Bukele announced on 1 July that his country added 80 Bitcoin [BTC] to its balance sheet. He also noted that the purchase was made at $19,000 per BTC, a price level that he described as cheap.

El Salvador bought today 80 #BTC at $19,000 each!#Bitcoin is the future!

Thank you for selling cheap 😉 pic.twitter.com/ZHwr0Ln1Ze

— Nayib Bukele (@nayibbukele) July 1, 2022

Many other crypto proponents share similar sentiments that Bitcoin is at a discount currently. MicroStrategy is among them, and the organization recently announced the purchase of 480 BTC worth roughly $10 million. There are multiple reasons why the $19,000 price level represents a healthy discount according to some of these high-profile individuals.

The current price level represents more than an 80% discount from its all-time high (ATH). Well, a major factor that contributes to the perception that BTC is cheap or discounted at $19,000 is that most of the institutional traders bought in at higher price levels.

What kind of demand is Bitcoin experiencing?

Bitcoin’s price action has been hovering above $19,000 after the recent crash. This confirms that it found support near this price level after experiencing strong selling pressure since 26 June.

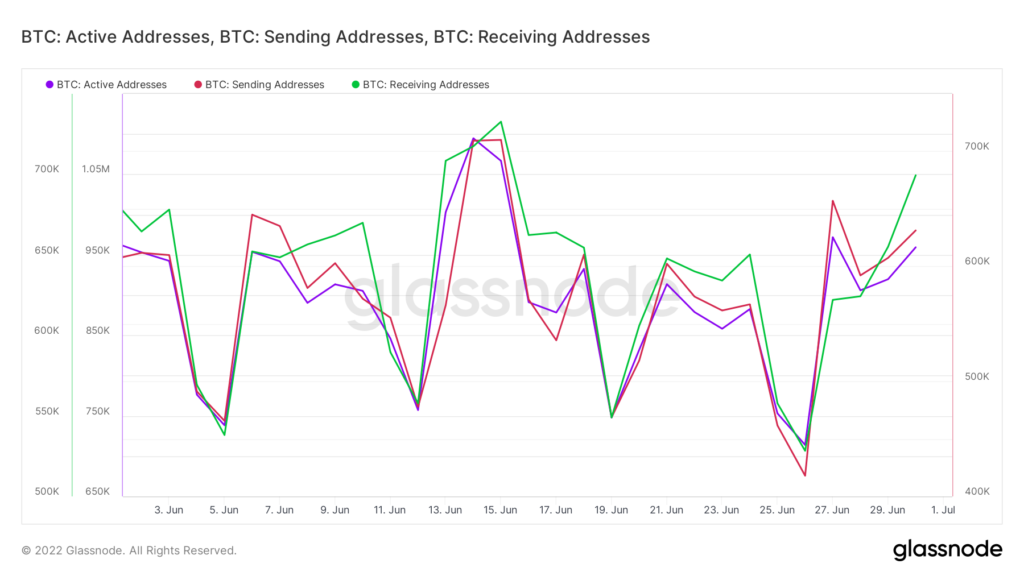

The number of active addresses increased significantly during the same period. However, latest statistics reveal that receiving addresses are higher than selling addresses.

Bitcoin had 699,440 receiving addresses and 631,248 sending addresses on 30 June. This confirms that more buyers are convinced that price levels near $19,000 attract more buyers than sellers. This observation is further enhanced by similar observations in Bitcoin’s supply distribution by balance on addresses.

Addresses holding between 1,000 and 10,000 BTC increased their supply from 26.43% on 29 June to 26.5% by 1 July. This category represents the biggest whale bracket that controls Bitcoin by supply. As a consequence, the category has had a substantial impact on price performance.

In contrast, addresses holding between 10,000 and 100,000 BTC dropped from 11.37% from 29 June to 11.23% on 1 July. Addresses holding more than 100,000 BTC maintained control of 4.08% of Bitcoin’s supply during the same time period.

Potential outcome if Bitcoin loses the $19,000 support

Although the $19,000 price level is currently holding as a strong support level, unfavorable market conditions may trigger more downside. Such an outcome was observed on 18 June when BTC dropped as low as $17,622. It bounced back quickly as buyers took advantage of the discount. However, prices may drop lower if unfavorable market conditions continue.

One likely outcome if Bitcoin falls below $19000 is an extended panic selling which may trigger a cascade effect. The liquidation of leveraged long positions may also contribute to more downside. The other likely scenario is strong accumulation as investors take advantage of discounted price levels.