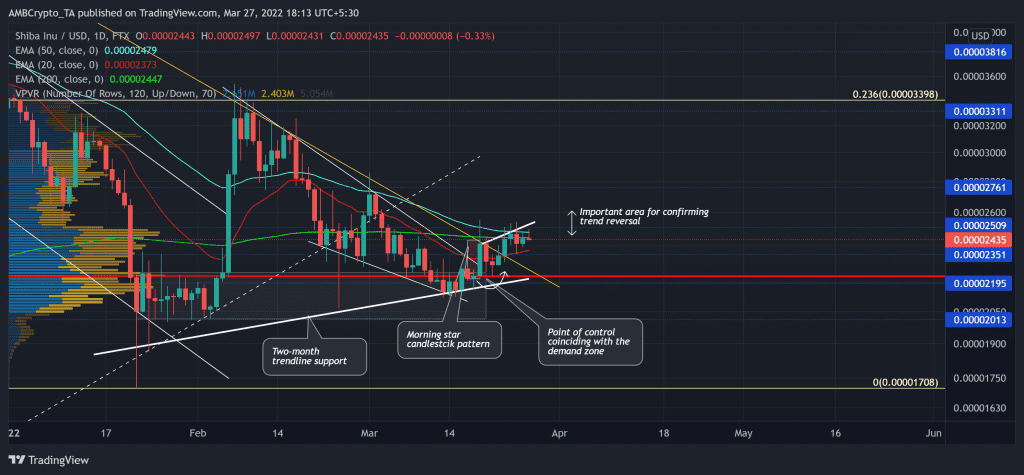

The meme token has been on a slump since its ATH last year. Shiba Inu (SHIB) steeply fell while marking its long-term trendline resistance (yellow, now support). (For simplicity, SHIB prices are multiplied by 1000 from here on).

If the bears continue to reject higher prices at the current level, SHIB could see a short-term pullback towards the $0.021-$0.023 zone before jumping above its EMAs. At press time, SHIB traded at $0.02435.

SHIB Daily Chart

After the plummet initiated, SHIB lost its liquidity range (POC) near the $0.022-level and fell below its 20/50/200 EMA. As the alt hit its three-month low on 22 January, the buyers took charge at the $0.017-mark, as they have for the last five months.

Then, the 23.6% Fibonacci resistance shunned a bullish rally in early February. Meanwhile, the bulls managed to propel a gradual recovery by marking trendline support over the last two months.

While the price has entered a tight phase, the bulls have started building up pressure as they kept testing the 50 EMA (cyan) multiple times in the last four days. With the recent falling wedge (white) breakout, bulls flipped to 20 EMA from resistance to support.

From here on, SHIB could see a slight pullback as the 50 EMA coincided with the $0.025-mark resistance. But with 20 EMA still looking north, the bulls would quickly display a comeback and aim to snap the above resistance.

Rationale

The RSI finally saw a close above the midline and swayed in favor of buyers. Its recovery could see a hindrance at its trendline resistance (white) before continuing its up-rally.

The MACD line displayed an impressive recovery towards the zero-line. A further close above the equilibrium would affirm the increasing bullish thrust. Nevertheless, the CMF bearishly diverged with price while witnessing lower peaks.

Conclusion

With the bulls overcoming the 20 EMA barrier, the momentum favored the buyers. But with the CMF divergence, a possible near-term pullback towards the $0.023 level before its continued up-rally seemed probable in the days to come.

Besides, the alt shares a nearly 58% 30-day correlation with Bitcoin. Hence, keeping an eye on Bitcoin’s movement with the overall market sentiment could be essential for making a profitable move.