Major cryptocurrencies like Bitcoin and Ethereum can sometimes go up or down in double-digit percentages in a single day. As a result, most people associate cryptocurrencies with volatility. But some cryptocurrencies try to achieve the exact opposite. So-called stablecoins that are ideally pegged to fiat currencies like the U.S. dollar on a 1:1 basis at all times.

But what if that ratio is no longer uniform?

Who’s winning the tussle?

Terra‘s depegging and eventual collapse sent shockwaves across the crypto market. In the wake of its crash, other major stablecoins such as Tether (USDT) and USD Coin (USDC), and DAI witnessed changes as well. But looks like the largest stablecoin, USDT still couldn’t move on from the past despite a significant development.

On 9 June, Tether deployed the USDT stablecoin on Tezos, becoming the 12th blockchain on which the popular stablecoin is available.

Tether Token (USD₮) to Launch on Tezos

Read the Press Release ⬇️https://t.co/x5vR1lcrsC pic.twitter.com/qRD55VoX67

— Tether (@Tether_to) June 9, 2022

Indeed, it aided USDT reach a staggering market cap of $72.5 billion. But not for long. The largest stablecoin witnessed a fresh 0.1% correction as it stood the $0.99 level.

The largest stablecoin after tether, USD Coin, gained $5 billion in market value, while Binance USD, which became the third-largest stablecoin, accrued another $1.4 billion in value, according to CoinGecko. Both of which had maintained a $1 peg.

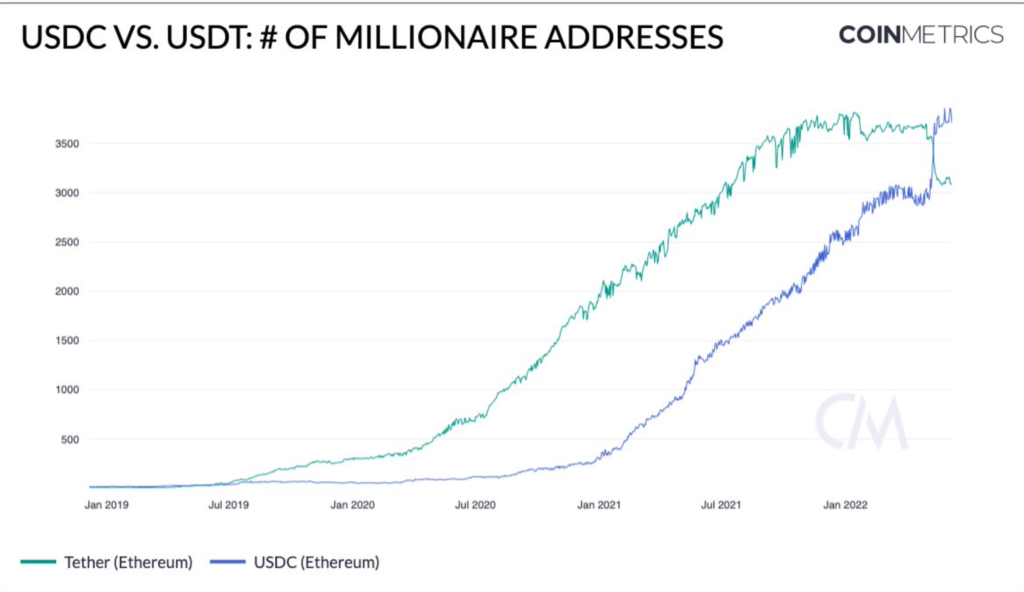

Since 9 May, more than 130 large cryptocurrency holders increased their USD Coin balance. These holders increased shares by at least $1 million and decreased their Tether balance by at least $1 million. Here’s the graphical representation:

Source: CoinMetrics

Well, Tether indeed suffered significantly in losses. To make things worse, in the past two weeks, investors have pulled more than $10 billion out of USDT. This has seen the market cap of the digital asset fall to $75 billion over the course. Between 9 May and the time of writing, USDT lost $11 billion in market cap as holders began swapping the stablecoin for USD along with UST.

Choose sides

Of course, USDT still remains the top player in the stablecoin market. But doubts have started to circulate over time. Tether claims to maintain its peg to the U.S dollar by an equivalent amount of reserves that includes commercial paper, bank deposits, precious metals, and government bonds.

However, Tether hasn’t disclosed its reserve investments in detail, which could potentially contain several illiquid or leveraged assets.

Based on the lack of knowledge and information about its reserves, Binance founder and CEO Changpeng Zhao said he regards tether as a high-risk stablecoin. “It’s a black box to most people, including myself,” he said.