- Nomura Holdings, Japan’s largest brokerage, now offers bitcoin-based derivatives.

- Available derivative contracts are non-deliverable forward and options, as well as futures and options contracts.

- Nomura’s economic consulting arm Nomura Research Institute launched a crypto-asset index in 2020.

Nomura Holdings Inc, Japan’s largest brokerage and investment bank, began trading bitcoin derivatives contracts to its Asian clients after a rise in institutional demand “significantly” increased, according to a report from Bloomberg.

Tim Albers, head of forex structuring in Asia ex-Japan, reportedly said Nomura will offer non-deliverable forwards and non-deliverable options to be settled in cash, as well as bitcoin futures and options contracts, which are further explained below.

Nomura’s first trade was facilitated by CME Group Inc.’s platform with Cumberland DRW LLC serving as the market maker as they specialize in bitcoin and other cryptocurrency based financial derivatives. Nomura interestingly made this trade at a time when many are fearful of an impending bear market.

“There has been significant volatility recently,” Albers explained. “Once the dust settles, valuations will become more attractive for institutional clients. We’re pretty excited to get this off the ground,” noting that this offering “marks the start of our journey into the space.”

Albers explained Nomura expects the market to “mature” with time as regulators become more involved with the ecosystem making it more attractive to investors over the long-term. “As a result, volatility should reduce over time,” Albers stated.

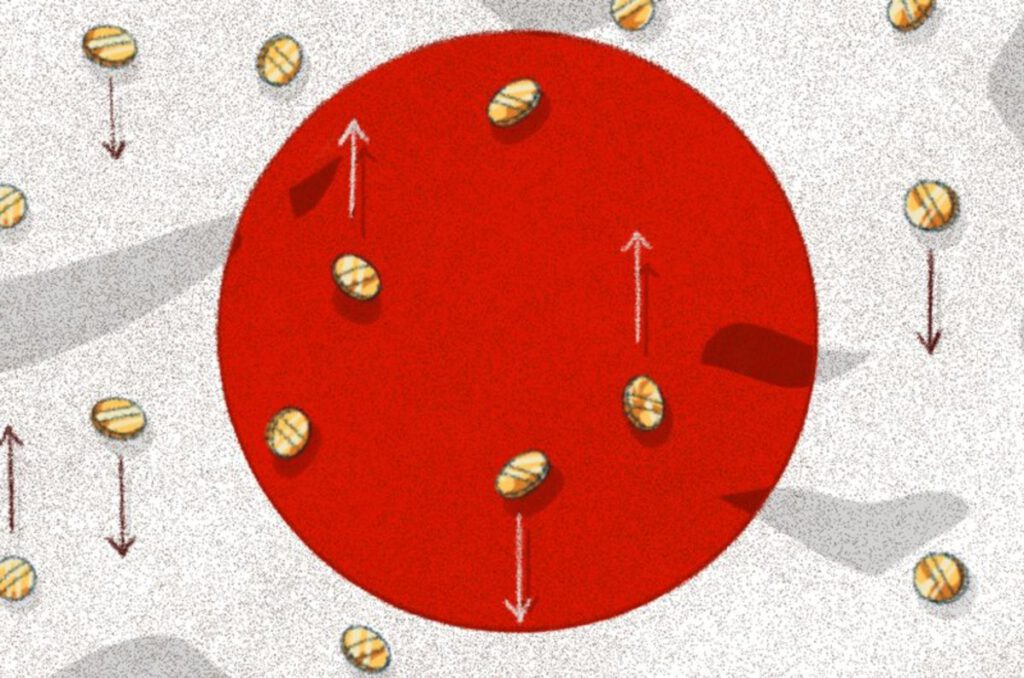

The term non-deliverable refers to the underlying asset, which in this case would be bitcoin. For these derivatives, the asset of bitcoin is never actually traded. Only the amount invested into the derivative is traded, hence the underlying asset becomes non-deliverable and settled in cash.

Options contracts give an investor the right, not the obligation, to purchase an underlying asset. Forwards create an obligation for the investor to buy or sell the underlying asset, while futures contracts are a binding agreement between two parties to buy or sell the underlying asset at a fixed price.

“Options enable investors to trade volatility directly and protect against downside risks,” Rig Karkhanis, the bank’s head of global markets for Asia ex-Japan reportedly said in a statement.