As bitcoin briefly slid under $19,000 and the market weakness continues, JPMorgan sees light on the horizon.

Analysts at the banking giant believe that the current crypto deleveraging phase is at an advanced stage and might not be prolonged.

Citing the bank’s net leverage metric, a research note underlined “that deleveraging is already well advanced,” reported Bloomberg.

Deleveraging behind 3AC collapse, says JPMorgan

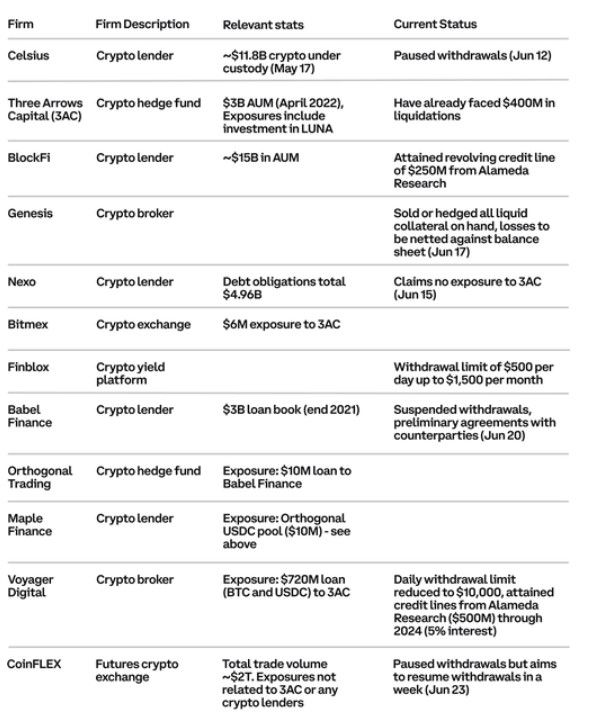

JPMorgan strategists, including Nikolaos Panigirtzoglou, wrote in this week’s note the liquidity crisis at Three Arrows Capital “is a manifestation of this deleveraging process.”

They added that the failure of businesses in the sector comes as no surprise, as the crypto prices have dropped massively. At press time, bitcoin is down almost 70% from its $69,000 peak in Nov 2021.

And with the Terra ecosystem collapse in May, which was one of the biggest financial crises in the crypto market, the global crypto market capitalization has remained weak.

In June, the cumulative cap remained under the $1 trillion mark since various crypto businesses halted withdrawals amid large sell-offs.

Crypto financial service provider Babel Finance halted withdrawals and redemptions soon after Celsius did the same, citing “liquidity pressure.”

CoinFlex also cited “extreme market conditions” and “counterparty uncertainty” as reasons to follow suit with other businesses in suspending withdrawals.

Withdrawals at record peak, but VCs save the day

Be[in]Crypto reported recently that on-chain data recorded the highest level of BTC withdrawals from exchanges in the crypto history.

However, JPM strategists said: “The current deleveraging cycle may not be very protracted given the fact that crypto entities with the stronger balance sheets are currently stepping in to help contain the contagion.”

They also remarked that venture capital (VC) funding is “an important source of capital for the crypto ecosystem, continued at a healthy pace in May and June.”

Data from Dove Metrics revealed that crypto businesses across five categories received over $3.8 billion in VC funding within the past month.

However, various factors are weighing on the crypto market at the moment. According to Yves Longchamp, head of research at SEBA Bank, “Bitcoin continues to be under pressure as other assets are. The mix of high inflation, rising interest rates, and recession weigh on cryptocurrencies.”

And while JPM predicts a scenario of an upcoming deleveraging, Longchamp told CNBC: “In this environment, pressure on bitcoin and other crypto-assets remain.”

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.