Ukrainian citizens were seen piling into crypto after the central bank suspended electronic cash transfers this week, as fighting with Russian forces spread into the capital Kyiv. With foreign exchange trade also blocked in the country, this has seen citizens seek dollar alternatives in crypto.

10% Premiums On Crypto Exchanges

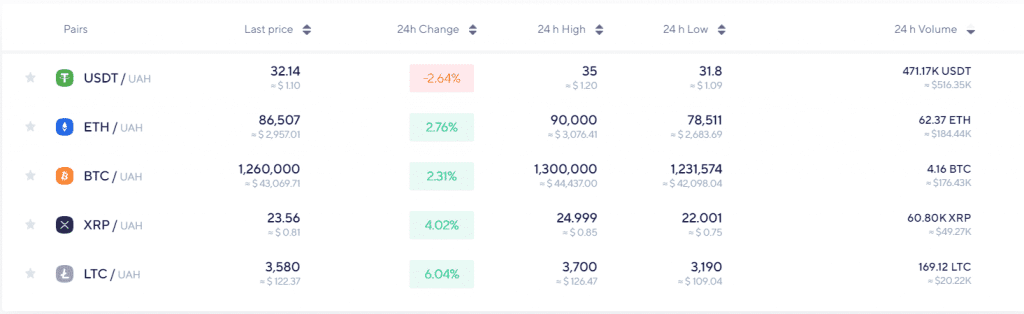

Data from popular Ukrainian crypto exchange Kuna shows trading volumes in Tether, the world’s largest stablecoin, have surged this week. Ukrainians also appear to be paying a 10% to 20% premium for the token, whose value is closely pegged to the U.S. dollar.

For instance, while the current hryvnia to dollar rate is around 30, tether is trading between 32 to 35 hryvnias. But the trade has been reflected on a much larger scale, with volumes in Tether having consistently outpaced those in Bitcoin since the beginning of the crisis.

Tether, and most stablecoins have seen increased demand in recent weeks, amid heightened market volatility. Their close relationship with the dollar has made them reliable safe havens.

Danish journalists currently in Ukraine said they had to purchase a car using bitcoin, due to cash being in such short supply. Bitcoin donations to Ukraine have also surpassed $4 million, Forbes reports.

Ukraine has always led crypto adoption

Crypto adoption in Ukraine is not a new event. The country recently passed a law to recognize and regulate cryptocurrencies, and had intended to open up the market to foreign investors before the Russian invasion.

Blockchain data firm Chainalysis ranked Ukraine as the fourth largest crypto adopter in the world, in a report released last year.

Despite widespread condemnation of Moscow’s actions, the Russia-Ukraine conflict has so far shown no signs of de-escalation.

Fears of the conflict have caused wild swings in financial markets, including crypto. Safe havens such as gold and the dollar have risen in value, while oil prices have also surged on bets of Russian supply disruptions.