The crypto market activity dwindled after the recent crypto market crash in May-June, with traders in many countries losing interest in the market. However, crypto exchange traffic data from Arcane Research reveals crypto market participation still remains higher in most countries despite the crash.

Crypto Exchange Traffic from Global Visitors

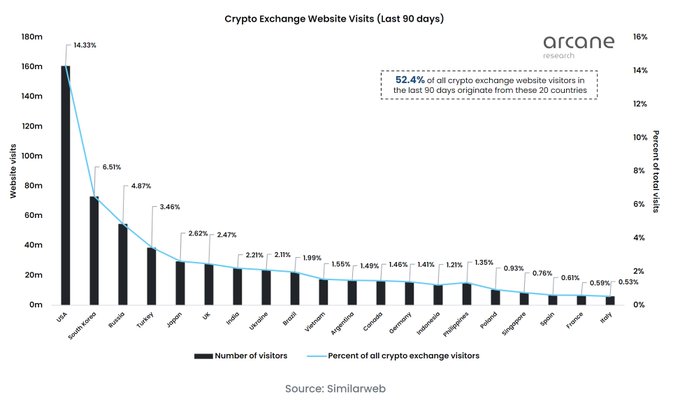

According to Arcane Research, the crypto exchange website visits data in the last 90 days reveals that traders from 20 countries contribute 52.4% of all crypto exchange visits. This also indicates a rising interest from traders as cryptocurrencies’ prices drop to lower levels.

The analytics firm tracked 35 global crypto exchanges’ website traffic for the research. Interestingly, U.S. traders dominate the crypto exchange website visits, accounting for 14.33% of all visits.

Traders from countries including the U.S., South Korea, and Russia record the largest participation in the crypto market in the last 90 days. While the U.S. accounts for 14.33% of traffic, South Korea and Russia account for 6.51% and 4.87%, respectively.

Other countries in descending order include Turkey, Japan, the UK, India, Ukraine, Brazil, Vietnam, Argentina, Canada, Germany, Indonesia, the Philippines, Poland, Singapore, Spain, France, and Italy.

Trending Stories

The U.S. dominance in the crypto market is backed by institutional adoption, crypto regulatory changes, stablecoins, and crypto mining. Major Wall Street banks and other financial institutions such as JPMorgan, Morgan Stanley, and Goldman Sachs have invested in Bitcoin and other cryptocurrencies.

Russia and Ukraine have witnessed increased crypto adoption after the Russian invasion of Ukraine, leading to sanctions against Russia. Ukraine received crypto donations from across the world to defer the Russian oppression.

European countries including France, Germany, Spain, and Italy saw rising crypto activity and crypto exchanges’ expansion. The move came as a result of the Markets in Crypto-Assets (MiCA) legislation by the EU.

Crypto Market Recovery in Sight?

Bitcoin (BTC) and Ethereum (ETH) prices are trending higher after a recent decline due to a market-wide selloff.

The Bitcoin (BTC) price is slowly moving upwards, with the current price trading at $21,468. However, it is still below the key 200-WMA at $23,000.

Meanwhile, the Ethereum (ETH) price is up 3% in the last 24 hours, trading near $1,650. The much-awaited Merge is the key reason behind the rally. Ethereum’s developers expect the Merge to happen on September 15. However, the price will be deflationary amid the anticipation.