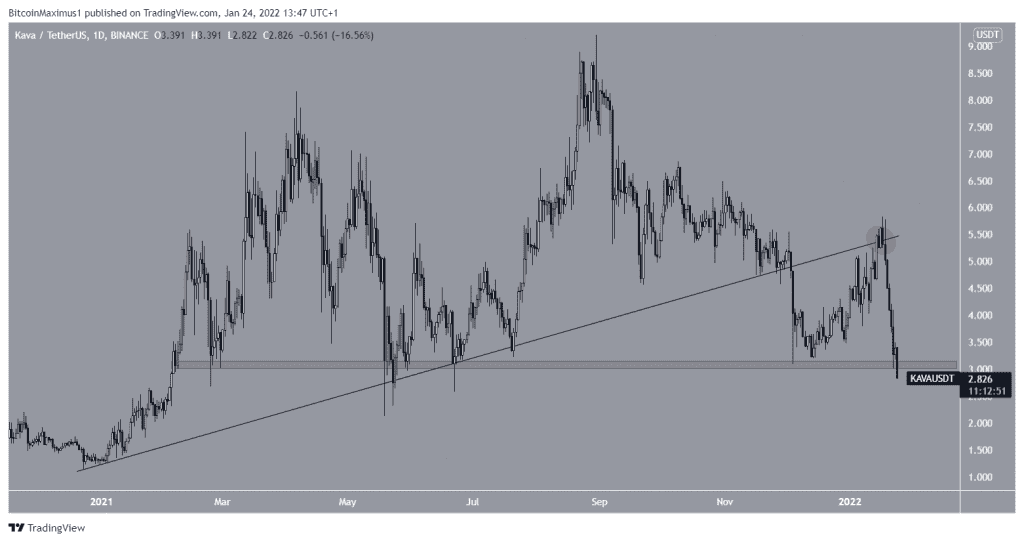

Kava.io (KAVA) has broken down from a long-term pattern and is at risk of breaking down below a crucial horizontal support area. This would have bearish ramifications for the future movement.

KAVA has been falling since reaching an all-time high price of $9.21 on Aug 30. On Dec 3, it broke down from an ascending support line that had been in place since the beginning of the year. Afterwards, it bounced and validated the line as resistance (red circle) on Jan 18. The token has been falling since.

Currently, it is attempting to hold on above the $3 horizontal area. If it were to break down below it, the next support would be all the way down at $1.40. Therefore, it is crucial that KAVA holds on above this level in order for it to have a chance of moving upwards.

Future movement

Cryptocurrency trader @Mesawine1 tweeted a KAVA chart, stating that the token has completed an ending diagonal and will fall considerably.

Since the tweet, KAVA has validated the line as resistance and resumed its downward movement. The support line coincides with the one we have outlined.

There was a very significant bearish divergence (green line) in both the RSI and MACD prior to the drop. Such divergences often precede bearish trend reversal, so they support the ongoing decrease.

If KAVA breaks down from the current support, the next support would be at $2.20 and $1.60. These are the 0.786 and 0.85 Fib retracement support levels, respectively.

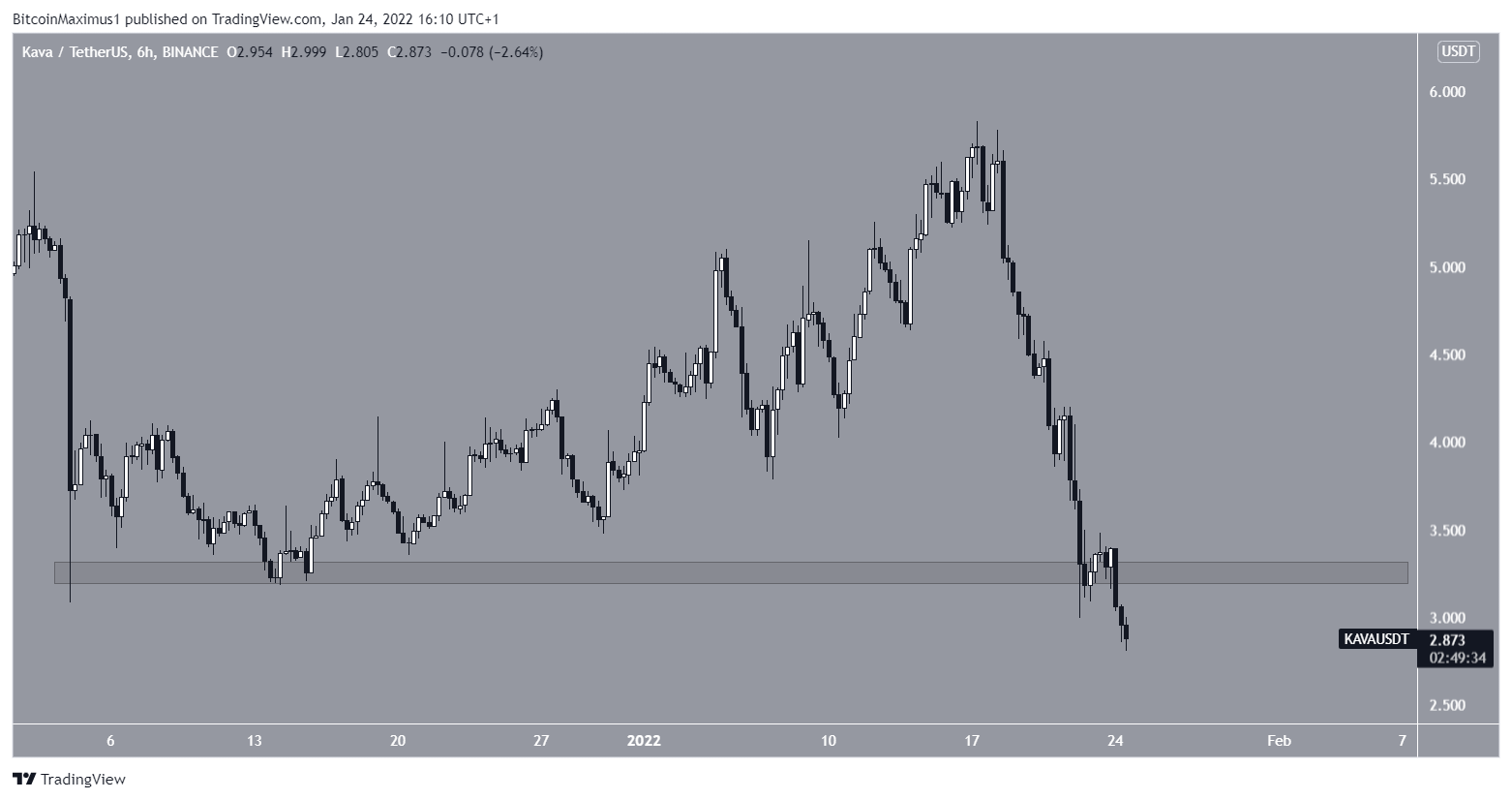

Short-term KAVA bounce

The six-hour chart provides a bearish outlook. Since Dec 3, KAVA had been holding on above the $3.25 horizontal support area. More recently, it validated it on Jan 18, initiating a bounce in the process.

However, the token has fallen below the area since, supporting the possibility that it will continue moving downwards.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.