Bitcoin’s (BTC) sharp rally in the second half of March appeared to be cooling off by Tuesday. But an important indicator of retail interest may point to more gains for the world’s largest cryptocurrency.

The token was last trading around $46,000, after rallying 17% in the past 30 days. It is now around its highest level in 2022, but is still trading 31% below a lifetime high of $46,784.

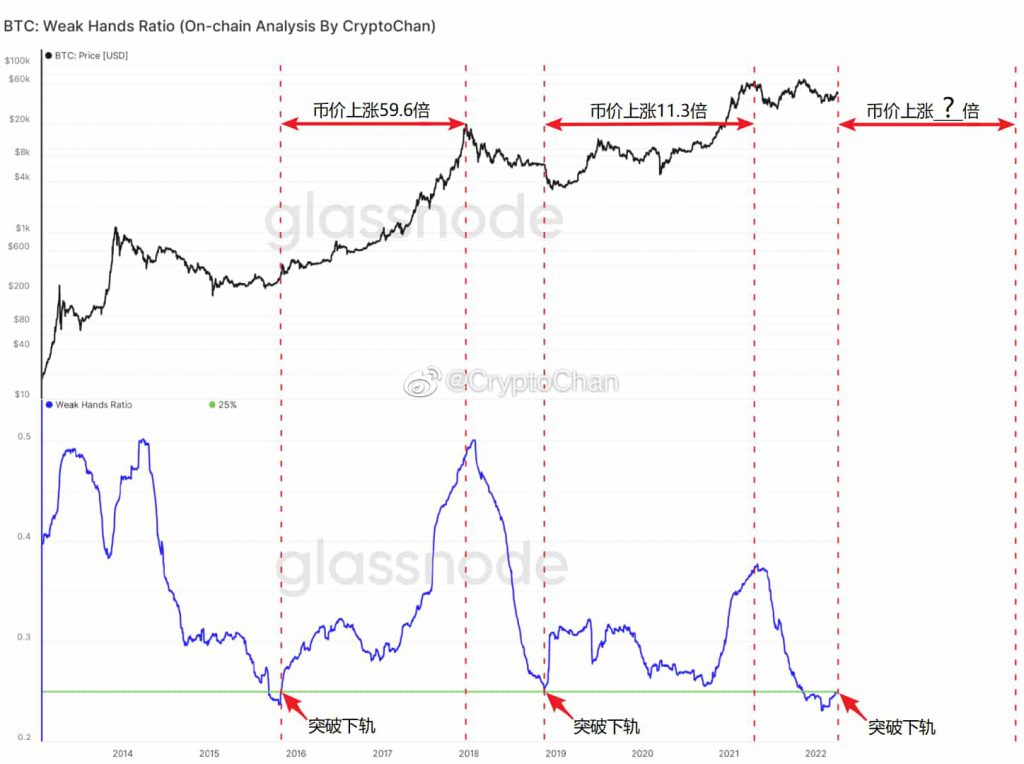

“Weak hands” could point to strong BTC gains

Twitter commentator @0xCryptoChan noted that the ratio of BTC tokens which have remained unmoved on the chain to the total BTC circulation was trending around record lows. The ratio is called the paper hands or weak hands indicator, and shows the level of retail interest in the market- which is currently at record lows of below 25%.

But the ratio’s retaking of the 25% level has always heralded a significant rally in BTC. The last time such an occurrence happened, BTC’s price jumped 11.3 times, between late-2019 to 2021. The time before that, BTC’s rate surged 59.6 times through early-2016 to 2018.

The paper hands ratio is currently poised to break back above 25%, which could spark another rally.

“Paper hands” refers to retail investors who are usually hesitant over trading, due to their limited liquidity. Such traders are usually the last to enter a bull run, or exit a bear market. Given that BTC rallied through March, April could mark the entry point of retail traders into the next bull run.

Without significant news in the cryptocurrency sector, BTC is again working as an indicator of global demand for risky assets. However, it will be possible to speak with confidence about the local victory of the bulls only after BTCUSD fixes above the 200-day moving average, which is now passing near $48300.

-Alex Kuptsikevich, senior financial analyst at FxPro

Institutions the main drivers of BTC’s rally

The weak paper hands ratio also highlights an important aspect of BTC trading, which is that large trading houses account for most of its volumes. The trend picked up in 2021, and was an important factor in BTC’s run to record highs.

Recent data also showed that more than 90% of BTC’s daily transactions have been consistently above $100,000 since 2020- a key indicator of large-scale trading in the token.