- Lark Davis said that the market dip today is better than in 2021.

- Bitcoin saw more candlesticks below the 200-day SMA than this year so far.

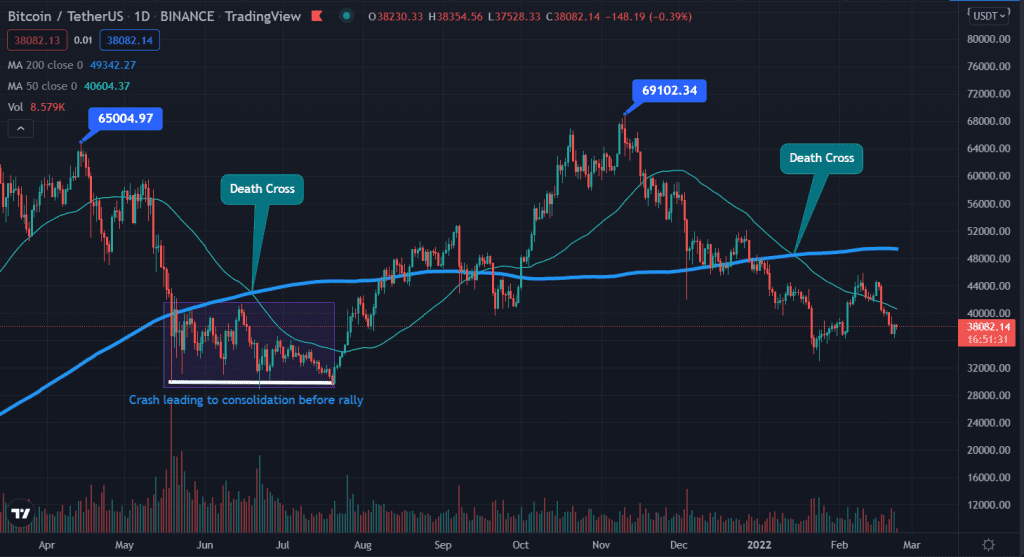

- The price movement this year is similar to the mid-2021 chart.

Amid multiple sources of FUD in the crypto market, price analyst and investor Lark Davis said that the situation today is relatively better than in 2021.

#bitcoin currently 56 days under the 200 day MA with a top to bottom of 51% at peak sell off, in 2021 we spent 82 days under with a 55% top to bottom.

Just some perspective for you. The 2021 crash was worse, and we survived. pic.twitter.com/guPrYHUgPM

— Lark Davis (@TheCryptoLark) February 23, 2022

For those who understand little about technical analysis, the tweet was saying that there were more days in 2021 when Bitcoin (BTC) traded below the 200-day Simple Moving Average (SMA). This is a tool used to indicate the asset’s trend based on the determined period (200 days in this case).

Lark also pointed out that Bitcoin had a top-to-bottom peak selloff of 51%. On the other hand, the market crash in 2021 saw a selloff of as much as 55%.

Meanwhile, Bitcoin price is still struggling to establish an uptrend momentum. Many believe this is due to many fundamental factors like taxation fears, political tensions in Canada, Ukraine, and Russia, and more.

At the time of writing, Bitcoin price is trading at $38,192.65, according to CoinMarketCap. While it appears to have escaped the pull until $33,000, the floor that it is walking on is unstable.

As seen on the chart above, Bitcoin saw a Death Cross in 2021 that caused a month-long bearish period. It took a couple of months before the 50-day SMA crossed the 200-day SMA again. Fast forward to 2022, and we see a similar pattern.

If the market experiences sustained FUD in the next few weeks, Bitcoin price may not be able to escape from bear territory anytime soon. Meanwhile, there appears to be a market indecision displayed by the low trading volume. Once the market sees more trading activity, Bitcoin may be able to regain its footing and begin its rally anew.