The current trend of the Bitcoin realized cap has formed a pattern that has historically been a bullish signal for the crypto’s price.

Bitcoin Realized Cap 30-Day Rate Of Change Has Turned Positive

As pointed out by an analyst in a CryptoQuant post, the BTC realized cap 30-day rate of change has just turned positive in value.

There are two very popular types of capitalizations for any asset: the market cap and the realized cap. The former is calculated by simply multiplying the supply of Bitcoin by its current price in USD.

The latter, on the other hand, is a bit more complicated. Instead of the current price, this cap multiplies each coin in the total BTC supply by the price it last moved at.

Related Reading | There Are Only 2 Million Units Of Bitcoin Left To Mine – Why Does It Matter?

For example, if 1 BTC moved at $60k five months ago, then its contribution to the realized cap will be 1*60,000. While under market cap, its value will be 1*46,000 instead (taking $46k as current price).

The advantage of the realized cap over the market cap is that some amount of the Bitcoin supply would be lost forever due to various reasons like lost keys, and so their contribution to the realized cap will be small (assuming the price has been increasing since the coins went dormant), while the market cap will take their value equal to any other coin, even though the lost BTC will never go into trading again.

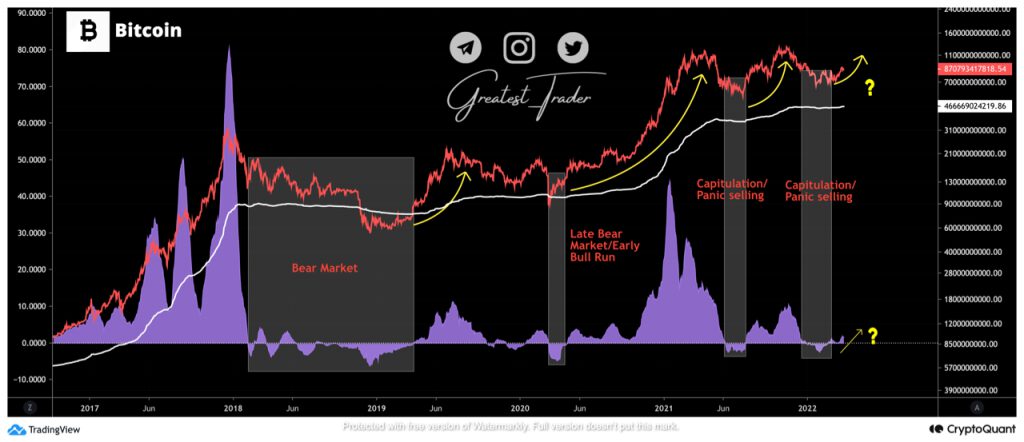

Now, here is a chart that shows the trends in the realized cap as well as its rate of change over 30 days:

Looks like the value of the rate of change has turned positive recently | Source: CryptoQuant

As you can see in the above graph, the Bitcoin realized cap RoC seems to have followed a pattern over the past few years.

It looks like whenever the indicator has assumed negative values, the price of the crypto has observed a bearish trend.

Related Reading | Bitcoin Vs. Ethereum: TIME’s “Prince of Crypto” And Why Satoshi Is King

On the contrary, positive values have historically marked an uptrend for the BTC price. Recently, the realized cap RoC seems to have shifted into such values again.

If the pattern from the last few years follows this time as well, then the trend right now may point towards a bullish outcome for Bitcoin at least for the short term.

BTC Price

At the time of writing, Bitcoin’s price floats around $45.9k, down 3% in the past week. The below chart shows the trend in the price of the coin over the last five days.

BTC's price looks to have moved sideways over the last few days | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com