The decentralized Loopring exchange is one of several layer two (L2) networks that have seen a surge in adoption as Ethereum transaction fees march ever higher.

Loopring is a layer two DEX that uses zero-knowledge rollups to scale Ethereum transactions. With gas prices at painful levels, it has seen a surge in usage over the past few months. Loopring claims to be able to settle up to 2,025 trades per second with an average transaction cost of 0.15-0.30% of that on Ethereum L1.

Chinese media outlet Wu Blockchain has observed the big uptick in Loopring adoption, commenting:

The cumulative trading volume recently exceeded $3 billion. The price of LRC has risen 10x the highest since October.

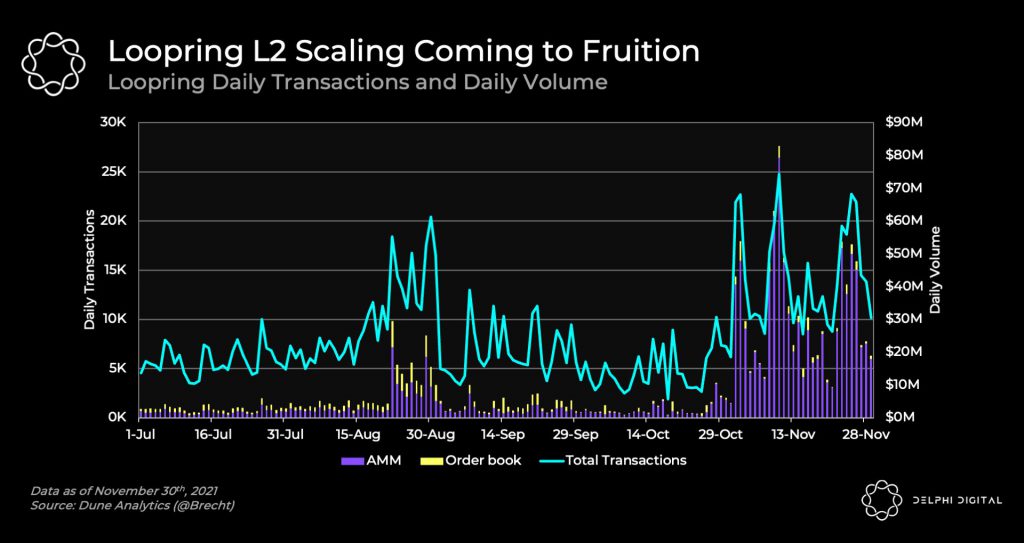

Citing a chart from Delphi Digital, Wu added that trading activities and volumes on the DEX have surged since October.

According to DappRadar, the total value locked on Loopring has surged 570% since mid-October to hit an all-time high of $765 million on Nov 25.

Loopring was in the news recently following a rumored partnership with gaming giant GameStop. There was no official announcement but a lot of speculation over the two working together on an NFT marketplace.

State of the L2 market

Loopring is not the only L2 scaling platform to have seen a massive influx in users and liquidity. According to L2beat, the TVL across the entire L2 ecosystem is near a record high at $6.9 billion. Loopring is currently the fourth largest L2 network with a 9.7% market share.

The leading layer two is Arbitrum, which favors optimistic rollups over zk-rollups. Arbitrum currently has a TVL of $2.74 billion giving it a market share of almost 40%. Arbitrum has been onboarding an increasing number of crypto platforms, the most recent being the Ethereum privacy protocol Tornado Cash.

Number two in terms of L2 TVL is the Boba Network which is a smart contract scaling protocol also using optimistic rollups. Boba TVL has surged 29% over the past week to $1.39 billion giving it a 20% market share.

Decentralized derivatives exchange dYdX is in third place, just above Loopring with a TVL of $933 million.

LRC price outlook

Naturally, this greater usage of Loopring has bolstered its native token price since it also offers yield farming incentives. LRC is currently trading at $2.80 which is flat on the day.

Over the past month, the token has made a whopping 345% though it has cooled 25% from its Nov. 10 all-time high of $3.75.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.