Lido DAO Token [LDO] is back to doing what it has done for its investors—make their profits. The altcoin, also the native token of crypto staking provider, has been on top of performance in the last 24 hours. At press time, LDO had registered a 35.57% price increase from its previous day’s high.

Besides its current situation, LDO has made its investors highly profitable since the start of July. According to CoinMarketCap, LDO traded at $0.47 on 1 July. Fast forward to 17 July, one LDO was worth $1.75.

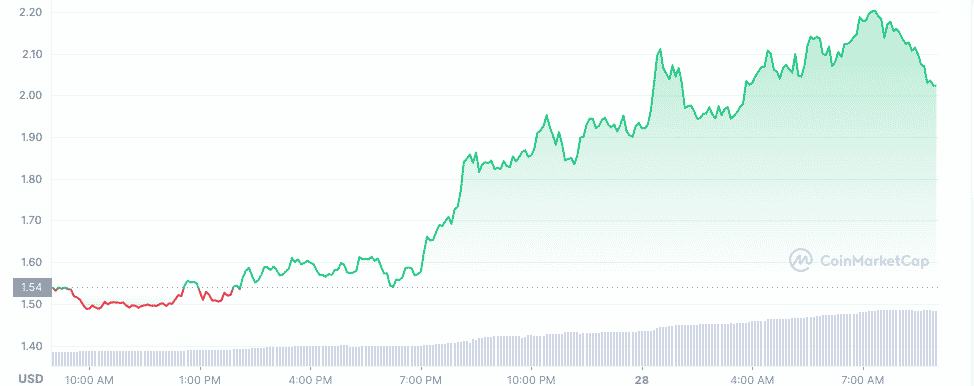

Despite the uptick, it dipped to $1.29 on 26 July. Now, the token has outperformed almost every cryptocurrency in the top 50. After starting on 27 July at around $1.42, the LDO price increased and was $2.14 at the time of this writing. So how has LDO bullied through in the face of an offer rejection?

Solid stance

Before the price uptick, cross-border investment firm Dragonfly Capital offered to buy 1% of LDO tokens. In exchange, Lido Finance was supposed to get $14.5 million worth of DAI. However, the Lido DAO community rejected the offer.

The Lido DAO has voted on a recent governance proposal to diversify the treasury, with the outcome being ‘No – Proposal needs more work’.https://t.co/RrahXqTbXM

— Lido (@LidoFinance) July 26, 2022

Some quarters would have expected the refusal to lead to an LDO downtrend. Interestingly, it was the other way around. Apart from the community’s belief in the project, some additional metrics have been vital in influencing the price uptick.

So much for one day

Data from Santiment showed that LDO had gained momentum in many aspects. Besides its price increase, the exchange supply had moved up significantly. At press time, it was 45.19 million.

It was even more impressive in terms of volume — increasing from 52.81 million on 27 July to 221.76 million in the early hours of today (28 July).

Where next?

Based on the four-hour chart, LDO seems strong in its hunt for more uptick. The Relative Strength Index (RSI) revealed that buyers were in control. However, LDO appears to be approaching the overbought level, which could lead to a short reversal.

Looking at the 20 EMA and 50 EMA, the projections of the RSI may be close to accurate. This is because the 50 EMA (orange) looks pretty close to meeting the 20 EMA ( blue).

If LDO draws back, it would certainly not be because of the proposal refusal. However, investors and Lido DAO at large may want to watch out for levels that could trigger a price fall.