When talks of the Ethereum [ETH] Merge became an irreversible focal point of the crypto community, Lido Finance [LDO] was mostly pointed out. Not just because it is the king in the ETH staking world but because it almost always took part in a price uptick.

In 2022 alone, LDO increased more than 150%, recording a 20% gain as of the previous week. Unfortunately, for investors, the profits could not make up for the current massive plunge.

Based on CoinMarketCap data, LDO was almost at a 50% drop from its value thirty days ago. As of 15 August, LDO was worth $2.82.

At the time of writing, it was trading at $1.79. With the earlier impressive performance, LDO investors may have anticipated a better momentum than the Lido DAO governance token currently shows.

A cry for help?

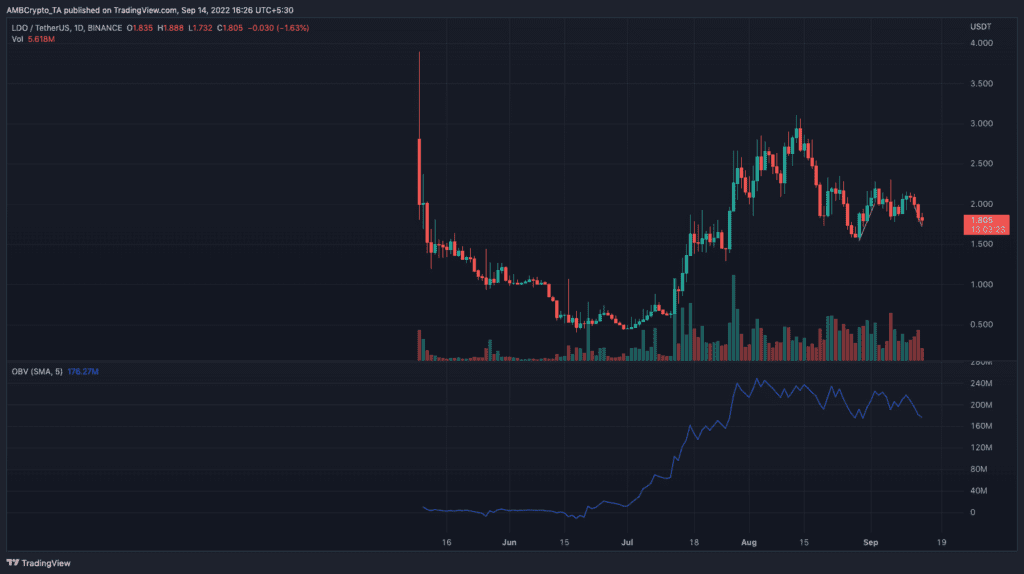

While there has been a 48.28% increase, the daily chart showed that the sustenance of a price decrease was more than a reversal.

As per the daily chart, LDO initially increased its support level—from $1.55, it went up to $1.99. However, it had become the opposite case as LDO was on the verge of losing its support zone of $1.79.

Additionally, the On-Balance-Volume (OBV) dropped from 218.64 million on 11 September to 174.85 million at press time. This could signal that some LDO investors were lowering their expectations and withholding liquidity.

While assessing the four-hour chart, the Exponential Moving Average (EMA) showed that the short-term momentum could go lower than the current tumble.

The 50 EMA (yellow) maintained a position above the 20 EMA (blue), although slightly different. Still, the bearish signs were most likely to continue even as the Merge happens.

We’re on top!

A look at the Beacon chain pool revealed that LDO deposits increased up until 9 September. According to Dune Analytics, the Lido ETH deposits were 4,161,440. This amounted to 30.4% of the total deposits, which was 13,708,440.

In agreement with the price movement, on-chain metrics had also declined. Santiment, the crypto analytic platform, showed that the supply on exchanges had decreased from 5.52% to 5.44% in three days.

The active addresses, which rose to almost 677 as of 11 September, had shrunk to 372. With this, LDO’s potential price movement currently stands sideways.

However, with transactions mostly on hold, recovering post-event is something LDO investors may want to bank on.