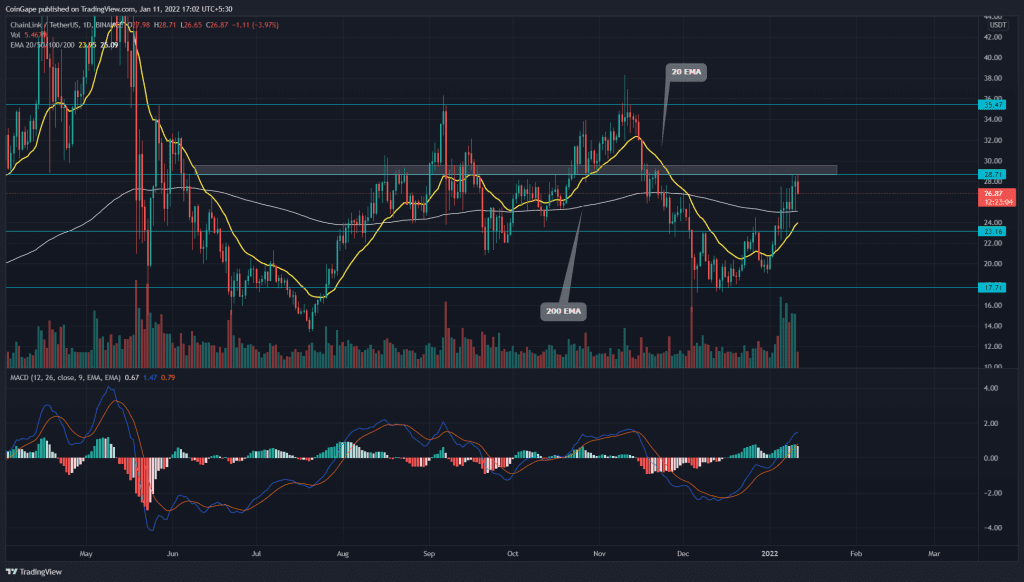

The Chainlink (LINK) token is one of the few crypto coins that are thriving during the ongoing crypto market correction. The LINK price chart shows several lower price rejection candles in the daily chart, indicating the instant recovery from the market buyers. The price is steadily moving up with the hope of challenging the next higher resistance(27.8).

Key technical points:

- The LINK price reclaim the 200-day EMA

- The daily-MACD indicator’s lines jumps above the neutral zone

- The 24-hour trading volume in the Chainlink token coin is $3.2 Billion, indicating a 6.2% gain.

Source- Tradingview

Chainlink (LINK) token on December 27th was about to breach the $23.16 resistance. However, before it could give a decent breakout from this level, the intense supply pressure demanded a minor correction.

On January 3rd, the coin managed to reclaim its overhead resistance and provided a proper signal for bullish recovery. The price started to march higher, and even though the crypto market was suffering from a bloodbath, the LINK token kept its recovery intact and reached the $28.7 mark.

The new rally in the ChainLink (LINK) token has crossover above the 200 EMA, providing an excellent edge to the long traders. Moreover, the chart also shows a bullish crossover of the 20 and 50 EMA, attracting more buyers for this token.

The Moving average convergence divergence indicator shows the MACD and signal lines have crossed above the neutral zone, indicating a bullish momentum in the price.

Upcoming Trendline Serves As Dynamic Support For LINK Token

Source- Tradingview

The LINK price is currently experiencing strong resistance from the $27.8. The price was rejected from this level with an evening star pattern, hinting at a bullish reversal. However, the technical chart shows an emerging trendline, which provides dynamic support to the price.

The crypto traders can maintain strong bullish sentiment, until the support trendline is intact.

As per the traditional pivot level suggest the overhead resistance levels for LINK price are at $30, followed by $33.3. As for the opposite side, the support levels are $25.8 and $23.