In what is the latest market update, LINK’s circulation supply has hiked from 470,099,970 to 491,599,970. This news has fueled quite a few speculations among many in the crypto-community, with some perceiving this to be a bearish sign. However, there is more to this development than meets the eye.

One of the reasons cited for the huge influx of supply has been the deployment of additional resources for achieving long-term growth of the Chainlink Network.

The additional supply is expected to help the Chainlink network with improving and supporting the ongoing oracle rewards provided to node operators.

Chainlink is not only improving upon the oracle’s functionality, but they are also going to be introducing staking and staking rewards for node operators and community members. Over time, Chainlink has claimed that this will contribute to higher degrees of crypto-economic security and user guarantees for Chainlink services.

Other than staking and oracle rewards,Chainlink has released these tokens to help them be the go-to Oracle solution for other blockchains as well, including both layer 1 and layer 2 networks.

Even though the intent of the Chainlink Network is to improve upon its technology, the news of the massive surge of supply has rattled some Chainlink holders.

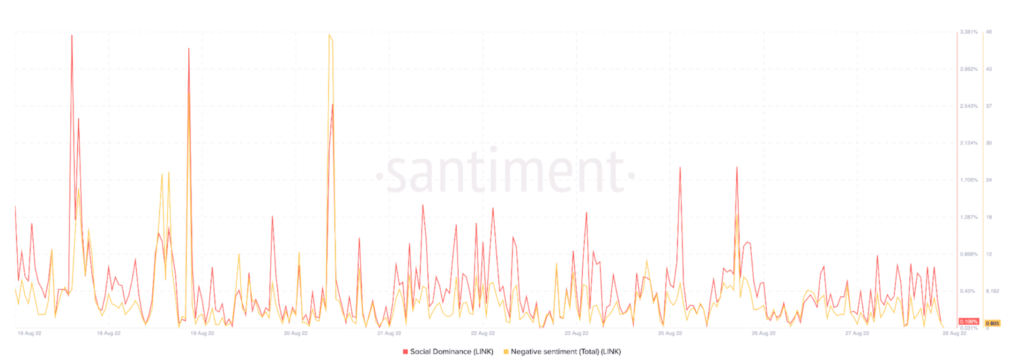

From the chart below, it can be seen that $LINK has been showing signs of high social dominance. However, all of the hype may necessarily not be in Chainlink’s favor. In fact, people have been criticizing the timing of this event as they feel like dumping these many tokens during the bear market may affect the price negatively. At least in the short term.

As far as price is concerned, it seems like $LINK’s price action in the last few days has echoed the sentiments of the people criticizing the recent token dump. The price has gone down by 30% after the 13th of August, with the same continuing its southbound trajectory, with no signs of hope.

The altcoin, at press time, was trading at $6.51, with the crypto’s downside being prevented by the $6.41 support level. With the RSI at 37, momentum was not with the buyers at the time of writing. The CMF has also been below 0, indicating a bearish future for the token in the short term.

Although the future seems bleak for $LINK in the short term, there is a possibility that if Chainlink keeps sticking to its plans, it may have a positive impact on the altcoin’s price.