Ranked as the #20 cryptocurrency asset with the largest market capitalization, the past few months have been marked by a rally in the price of Litecoin [LTC], data from Santiment revealed.

According to the on-chain analytics platform, the LTC/BTC trading pair has seen a surge in its price in the past few months. Since bottoming on 12 June, its price has increased by over 51%.

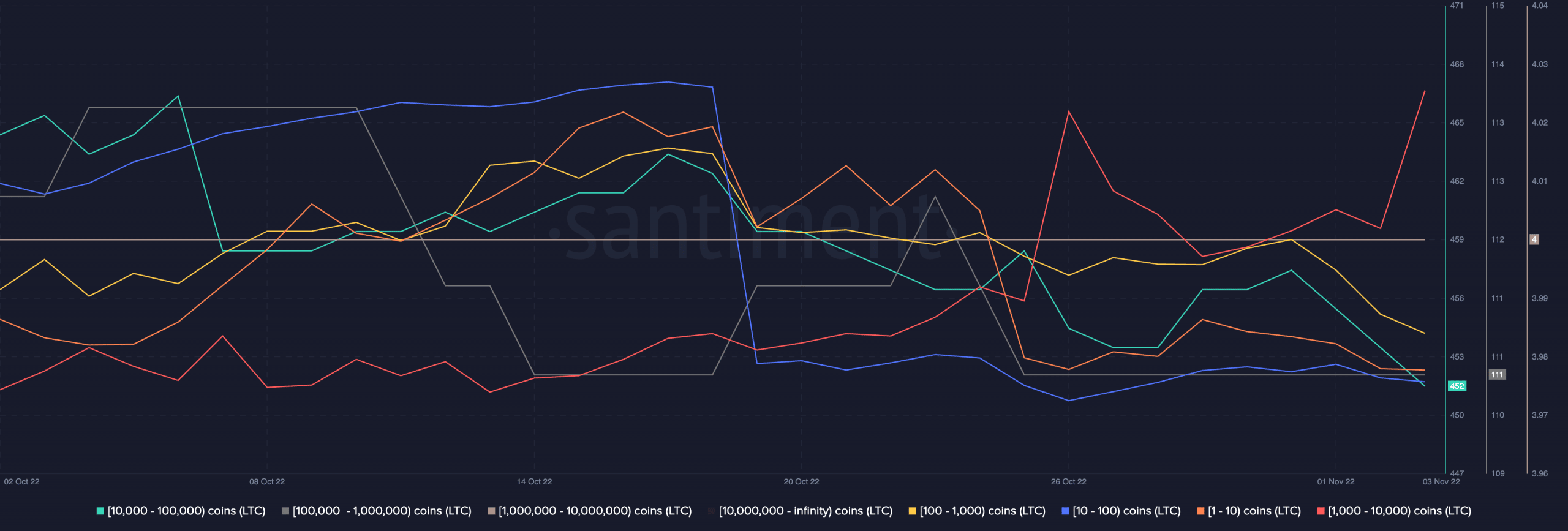

In addition, there has been a surge in whale activity on the network since mid-June, data from Santiment showed. 314 new “shark and whale” addresses have been created since 27 May.

⚡️🐳🦈 #Litecoin is currently on a nice run, and is temporarily decoupled from the #crypto pack. We have seen that the amount of addresses with 1,000 or more $LTC has grown rapidly since mid-June, and $LTC‘s price vs. $BTC has grown +51% since June 12th. https://t.co/uFXYNcnsRP pic.twitter.com/PASMdaezCD

— Santiment (@santimentfeed) November 3, 2022

LTC is on a rampage

Still, on its rally, LTC exchanged hands at $62.21 at the time of writing. According to CoinMarketcap, the altcoin’s price was up by 13% in the last 24 hours.

Within the same period, its trading volume surged astronomically by 398%. In the last 24 hours, over $2 billion worth of LTC tokens have been traded.

On a daily chart, the moving average convergence/divergence (MACD) revealed the commencement of a new bull cycle for LTC on 21 October. Since then, the asset’s price has gone up by 22%.

Buying pressure gained momentum at the time of writing as key indicators were spotted in uptrends. LTC’s Relative Strength Index (RSI) rested in the overbought region at 71.45, while its Money Flow Index made its way to the same zone at 69.99.

Further, the dynamic line (green) of the asset’s Chaikin Money Flow faced north at 0.14. In this position, the momentum of LTC accumulation continued to climb.

The Directional Movement Index (DMI) showed that buyers had control of the market and have been in control since 24 October. The buyers’ strength (green) at 35.74 was above the sellers’ (red) at 11.52.

This position was also proved by the asset’s Exponential Moving Average (EMA). At press time, the 20 EMA (blue) was right above the 50 EMA (yellow), indicating that buyers had forced sellers out of market control.

Shout out to these whales

Per data from Santiment, while LTC’s price grew in the last month, only the count of whales that held 1,000 to 10,000 LTC tokens increased. Other whales gradually let go of their LTC holdings to take a profit.

On a 30-day moving average, a sizeable number of LTC holders saw profit on their investments. The MVRV ratio, at press time, was 12.60%. Sentiment remained positive at 1.64 as LTC’s price continued to rally.