Litecoin (LTC) price continued to gain bullish momentum for over five days as whale accumulation and other on-chain metrics flashed buy signals.

Litecoin appreciated by over 12% in the last five days as bulls took control of the price action. The larger crypto market gains further aided LTC’s uptrend as the global crypto market cap finally tested the $1 trillion mark.

Litecoin Whales Aid Price Gains

For over five months, Litecoin’s price has moved in a range-bound trajectory below the $63 resistance mark. However, LTC price marked stunning gains at press time, presenting 6.54% gains on a daily basis.

The uptrend followed a price uptick above the 21-day simple moving average alongside daily RSI skyrocketing.

Litecoin price traded at $56 at the time of writing, charting a monthly price high on a one-day chart.

The bullish momentum was successful in eliminating bears as Coinglass’ Total Liquidations showed nearly $1.4 million shorts liquidated on Oct.25. Another $161,000 worth of shorts were liquidated on Oct. 26 by press time.

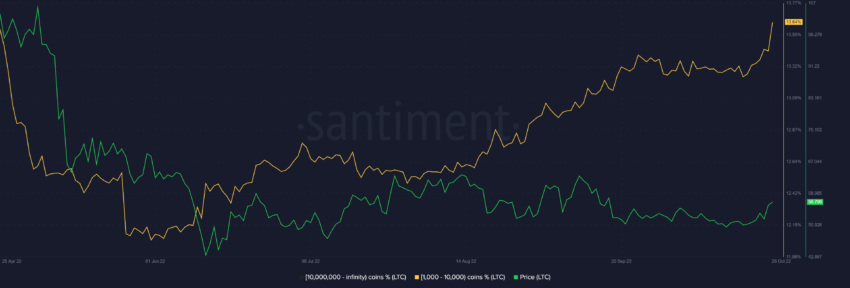

Another bullish trend for LTC price was the rise in addresses with one million to 10 million coins. This cohort was liquidated over the last six months, but seems to be accumulating once more.

LTC Price Flashing Buy Signal

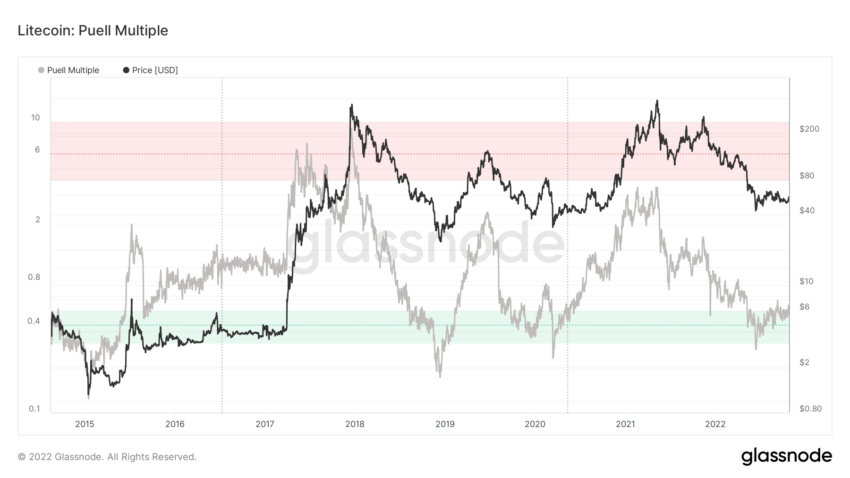

Puell Multiple for Litecoin showed that miner profitability was at the lowest level. Mining profitability is key in shaping market cycles and also helps establish macro price tops and bottoms.

The Puell Multiple suggests that Litecoin is in the historic buy zone. Historically, significant macro bottoms have been established at Puell Multiples less than 0.5, indicating miner profitability is 50% below the yearly average.

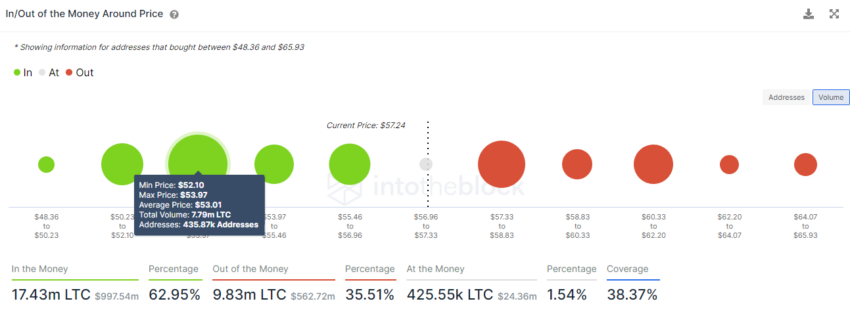

Finally, In/Out of Money Indicator presented a strong support level at the $52 mark, where 435,000 addresses hold 7.79 million LTC.

Nonetheless, going forward, Litecoin bulls will have to face the $61 resistance. If LTC price fails to establish above $61, a retest of the lower $52 support can be expected.

Disclaimer: BeIinCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.