LTC price trades with significant gains from where an upswing is possible as per the technical setup. The prices rise from a vital support level that indicates that a short-term uptrend seems likely in the coming days for the asset.

- LTC price extends the gains for the second session in a row.

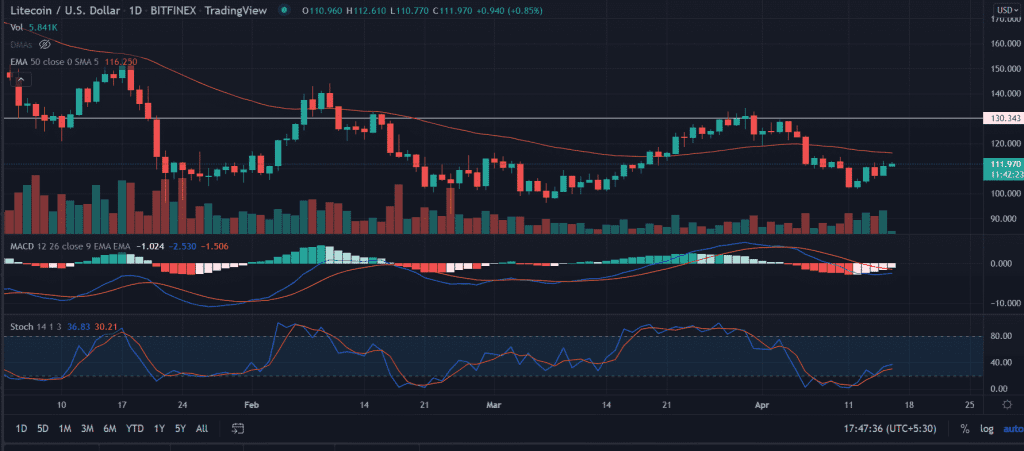

- Looking for an ascent of 16% after forming the double bottom near $100.0.

- However, immediate upside resistance is placed near the 50-day EMA.

LTC price looks for gains

LTC price rallied 36% from $8 from the lows to set the swing highs at $1.23. The upsurge in the price is expected to continue as supported by the above-average volumes.

After tagging the recent highs the price retraced a multi-week support level. Since then LTC’s price has appreciated in the past five sessions.

On the daily chart, if the LTC buyers are able to move beyond the 50-day EMA at $116.55 it will strengthen the upside arguments in the price as it will mark the cross of a significant upside barrier. The bulls will be tagging the April 6 highs at $123.24.

Furthermore, a daily close above the mentioned highs would attempt to take out the horizontal resistance line at $130.0.

Trending Stories

On the contrary, a move below the session’s low would invalidate the bullish outlook on the asset. On moving downside, the price could fall straight to the psychological $100.0 level. In addition, a daily close below the mentioned level would trigger another round of selling at the LTC price.

As of press time, LTC/USD trades at $112.20, up 1.02% for the day.

Technical indicators:

Stochastic oscillators: The momentum oscillator rises above the oversold zone with a positive bias.

MACD: The indicator is in the process to move above the midline supporting the bullish outlook.