Loopring (LRC) has decreased considerably since its all-time high price. However, it bounced at the previous all-time high resistance and could initiate a short-term bounce.

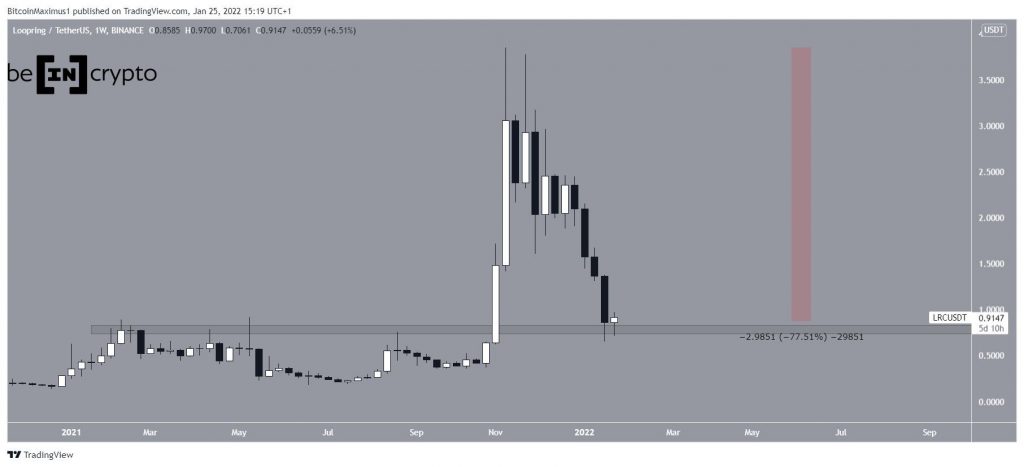

LRC has been falling since Nov 10, when it reached an all-time high price of $3.85. So far, it has decreased by 77.51%.

Despite the significant drop, the token bounced at the $0.80 horizontal area. This is a crucial level since it previously acted as the all-time high resistance, and is now expected to act as support.

Therefore, as long as LRC does not break down below it, the possibility of a considerable bounce remains in place.

Will a bounce follow?

Cryptocurrency trader @BullChain tweeted an LRC chart, stating that the token could break out from its current pattern.

Since the tweet, LRC has actually broken down.

However, technical indicators are showing extremely oversold conditions. This is especially visible by the daily RSI, which fell to a new all-time low of 19 on Jan 22. Values below 30 are considered oversold, suggesting that a reversal could be near.

The RSI has been moving upwards since and is currently at 28.

If the bounce continues, the closest resistance area would be at $187. This is the 0.382 Fib retracement resistance level and a horizontal resistance area.

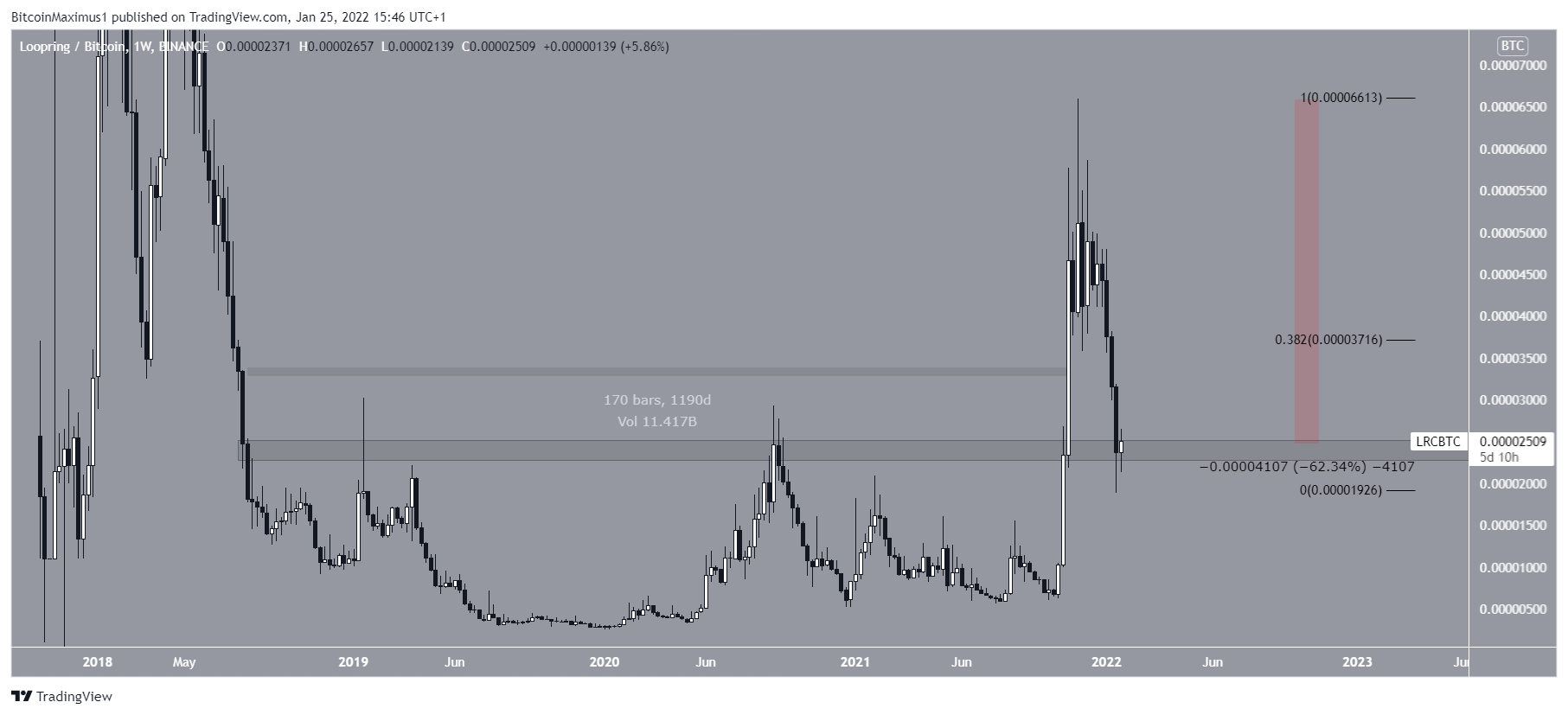

LRC/BTC

The LRC/BTC pair shows interesting similarities with its USD counterpart.

Firstly, the token has decreased by 62% since its all-time high price.

Secondly, the decrease served to validate the 2400 satoshi area as support. While this area did not act as the previous all-time high, it served as resistance for a period of 1190 days. Therefore, it would now be expected to act as support.

If a bounce transpires, the closest resistance would be at 3700 satoshis. This is the 0.382 Fib retracement resistance level.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.