So, you were hoping to see some tasty gains after scooping up some CAKE at its recent lows. Now you are wondering whether you made the right choice after it failed to cook up noteworthy gains.

CAKE is still trading within its narrow range between $4.15 and $5, where it has been stuck for more than 2 weeks. This, despite the bullish activity seen towards the end of May. While CAKE did register an uptick by as much as 15%, it was not enough to knock it out of the tight range.

Has cake turned stale?

A potential question that many CAKE holders might be asking themselves is whether it is still worth the investment. The price action has been very bearish since May 2021 and Pancakeswap DEX has been facing heavy competition. Newer and improved DEXs are now eating into its market share and this might affect long-term CAKE demand.

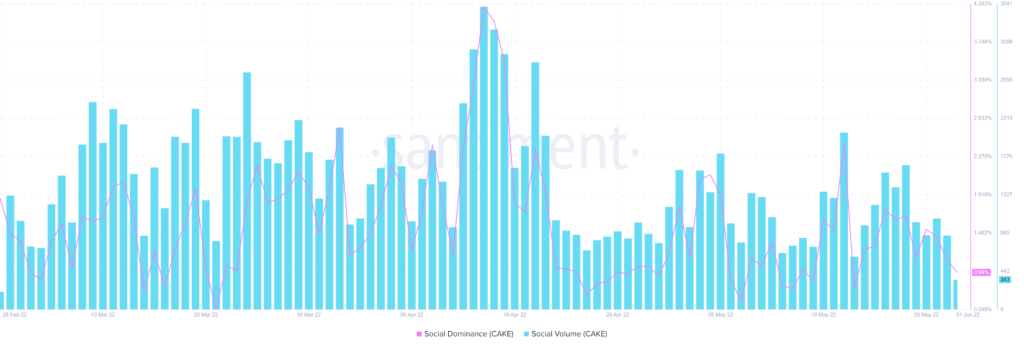

To make things worse, its social dominance and social volumes have taken a hit since mid-April.

One could argue that CAKE’s bearish performance is largely due to bearish market conditions over the last few months. The overall crypto-market sentiment has also leaned heavily on the bearish side, hence justifying CAKE’s massive price drop.

According to the Nomics crypto-index, PancakeSwap V2’s total trading volume dropped significantly in the last 4 weeks. It peaked at $1.04B during May’s market crash, but dropped to $106.85 million at press time.

At the time of writing, CAKE was trading at $4.59 after depreciating by 1.55% in 24 hours. It has been trading within the same ball-park for the second half of May, despite the accumulation and upside in its MFI and RSI indicators.

In CAKE’s defense, many of the top cryptocurrencies only registered a small price move and are still with the narrow 2-week range. The latest price pump towards the end of May seems to have cooled down, but it did register in CAKE’s price action.

The upside is that PancakeSwap is still among the top DEXs by volumes and was one of the pioneers in the segment. Perhaps, these factors may contribute to more utility over time. The end-of-May performance might have been a litmus test to see if there is enough demand in the market.

Perhaps Pancakeswap volumes will improve as markets recover from the latest crash. Such an outcome would likely breathe more life into CAKE, allowing it to recover to higher price levels.