The LTC/USDT technical chart indicates an overall bearish trend. The coin price has recently plunged to the July 2021 low of $105, indicating a 64% loss from the previous swing high of $297. However, a rising daily RSI slope bolsters the bulls to initiate a recovery rally above $120 resistance.

Key technical points:

- The daily-RSI signals an uptick in bullish momentum.

- The intraday trading volume in the LTC is $775.7 Million, indicating a 4.33% gain.

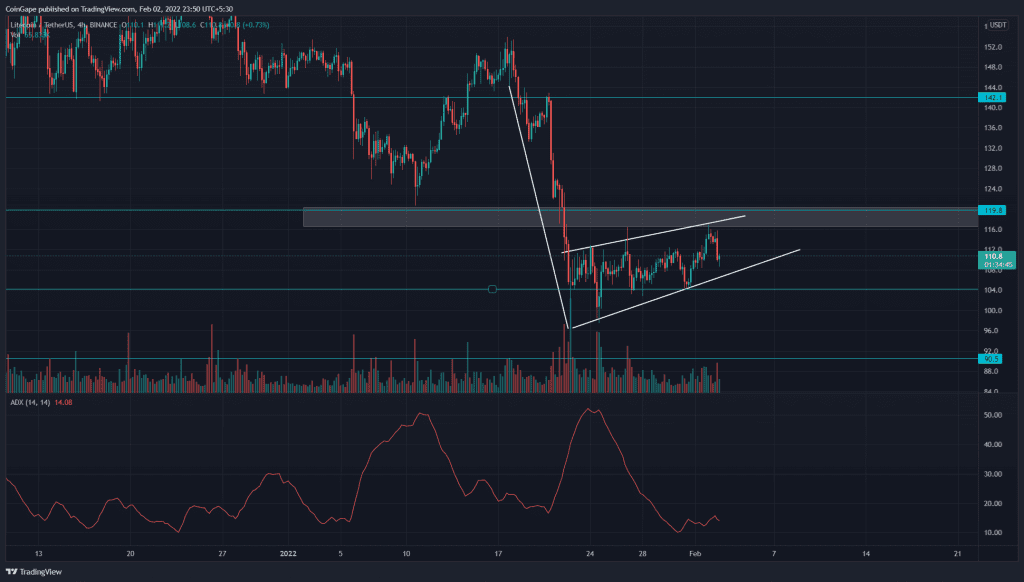

The LTC Chart Shows An Inverted Flag Pattern

Source- Tradingview

Contrary to the above assumption, the $4-hour time frame chart threatens the continuation of the downrally by forming an inverted flag pattern. This bearish continuation pattern provides an excellent short-selling opportunity when the coin price breakdown from the rising support trendline.

In conclusion, crypto traders should observe whether bulls reclaim $120 resistance first or if sellers complete their price pattern to take trade accordingly.

During the early third week of January, the cryptocurrency market suffered additional downside volatility, which tumbled the LTC price to the yearly support of $104. However, several lower price rejection candles show sellers faltering near the bottom support.

Source- Tradingview

The buyers might take this chance to pump the coin price to a higher level; however, the immediate resistance of $120 exerts intense selling pressure on the bulls. Since last week, the coin price has been wavering between the said levels, creating a narrow no-trading zone.

However, the LTC price trading below the trend defining 100 and 200 MA states a bearish outlook. Moreover, the coin shows the 20 and 50 MA line acts as a dynamic resistance during the bullish pullback.

Despite a sideways consolidation in price action, the Relative Strength Index(38) slope rallies higher, reclaiming the 14-SMA. The growing strength among buyers indicates a better possibility for an upside breakout.

- Resistance levels- $120 and $142

- Support levels- $104 and $90