Terra delighted its more bullish investors when it showed them a tall green candle on 28 February that took LUNA above $90, while another green candle on 9 March briefly took the asset above $100. However, investors can use some wider context from the crypto industry to better inform their trading decisions.

LUNA’s place in the sun

Research from Messari revealed that out of the top 30 invested assets, Terra had the highest-circulating market cap. The results come after Terra spent the last quarter trailing behind better-performing assets such as Solana, Polkadot, and Avalanche.

3/ Of the top 30 invested assets, the highest-circulating market capitalization belongs to @terra_money.

This is significant for @terra_money considering they were fourth in market cap last quarter behind @solana, @Polkadot, & @avalancheavax. pic.twitter.com/kSH2jXiasb

— Messari (@MessariCrypto) March 10, 2022

At press time, however, Terra’s LUNA was the seventh biggest crypto by market cap, switching hands at $91.58. LUNA went down by 3.93% in the last 24 hours and rose by 12% in the past week.

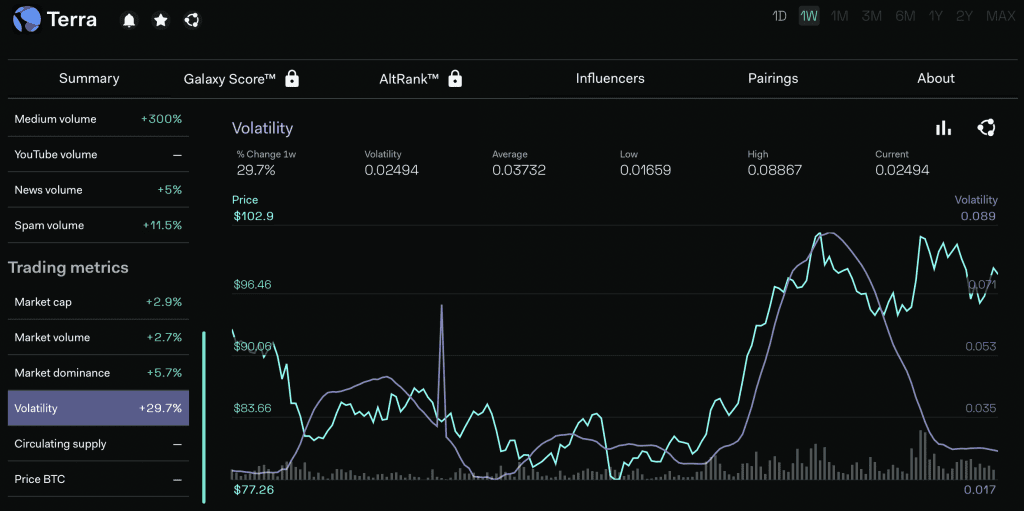

Other than the price, however, one thing that makes LUNA attractive to investors is that its volatility dropped by 55.5% in the past 24 hours of 11 March, even if it rose by 29.7% in the past week. This could serve as encouragement to new investors who want to get in on the rally.

Source: lunarcrush.com

You might expect LUNA investors to be on top of the world, but data from Santiment shows this isn’t exactly the case. Weighted sentiment was in the negative territory, at around -0.3 on 11 March. This came after a fall from highs of around 3.92. One reason for this could be a small dip in LUNA prices that came after the earlier rally.

Adding to that, investors might also be sensing that after such a dramatic run, corrections could be on the way.

Source: Santiment

Because you’re worth it

Messari’s data also showed the direction in which funds were flowing. While you might assume that GameFi and NFTs are heating up, it appears that most investors are gravitating towards smart contracts. When looking at the top 50 assets, smart contract platforms were a clear winner, followed by decentralized exchanges.

This, again, is good news for Terra and LUNA as the project offered a plethora of both smart contract and DeFi-related use cases.

4/ Funds are visibly steering towards smart contract platforms and decentralized exchanges.

Within the top 50 assets, smart contracts remain the most heavily invested category. pic.twitter.com/9x6ftVrrZ8

— Messari (@MessariCrypto) March 10, 2022