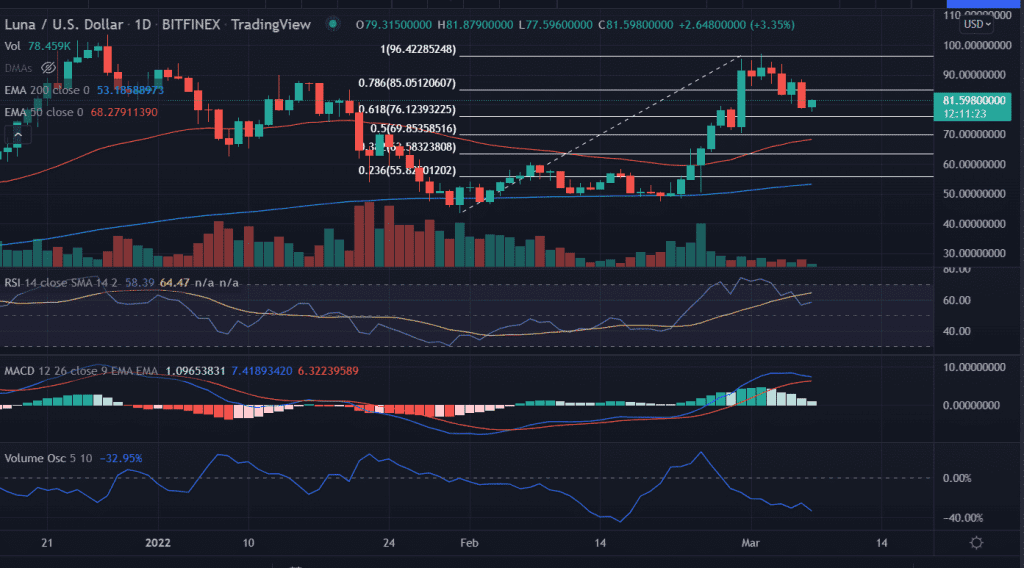

Terra’s (LUNA) price manages to trade in positive territory after falling more than 10% in the previous session. LUNA opened higher today and holds the gain on Monday. The formation of a ‘Doji’ candlestick near the critical 0.618% Fibonacci Retracement level at $76.0 is the key for the next leg up in the stablecoin

- Terra (LUNA) price bucked the broader crypto market trend on Monday.

- Expect, an upside toward $90.0 as holds near the 0.618% Fibonacci Retracement level.

- LUNA retraced 20% from the swing highs of $97.20.

On the daily chart, after a healthy retracement of 20%, LUNA’s price is preparing for another round of buying opportunities. An immediate upside hurdle is placed at 0.786% Fibonacci Retracement level at $85.30.

A daily close above the mentioned level could witness another extended rally toward the psychological $90.0 level.

Next, a resurgence in buying pressure would bring the ultimate target of March 2 highs at $97.20 in play.

Technical indicators:

RSI: The daily Relative Strength Index (RSI) reads at 55 although below the average line but with a positive tilt. This indicates price could shoot up in the coming sessions in short term.

MACD: The Moving Average Convergence Divergence (MACD) holds above the midline with a receding bullish momentum with a neutral bias.

VO: The volume oscillator hovers near the oversold zone.

Looking at the moving averages, LUNA price remains stable above the crucial 50-day and 200-day EMAs (Exponential Moving Average) at $68.26 and $53.18 respectively. It is a bullish sign.

On the flip side, a failure to hold the foothold above $76.0 will bring a 0.50% Fibonacci Retracement level into play that is placed at $70.0.

Furthermore, if the price sliced 50-day EMA then it will invalidate the bullish thesis for LUNA price.

As of press time, LUNA/USD is trading at $81.48%, up 3.35% for the day.