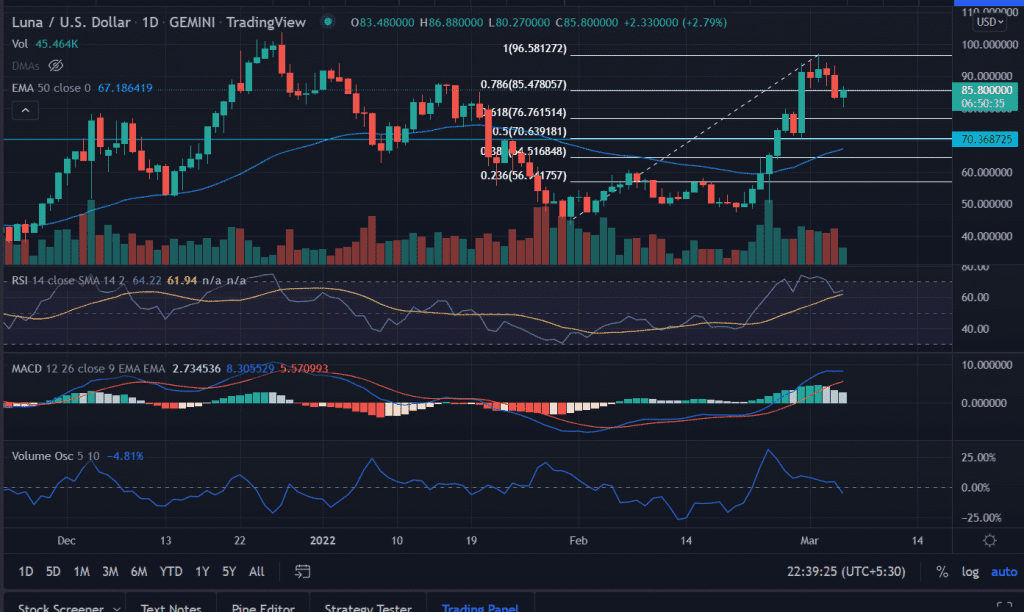

Terra’s (LUNA) price pauses losses on Saturday after testing the highs around $97.0. The formation of a ‘Doji’ candlestick near the lower levels suggest bulls keeping a steady foothold at a critical support level of $80.0

- LUNA price consolidates near the lower with modest gains on Saturday.

- Expect an upswing back to $97.0 as bulls contain reliable support.

- Momentum oscillators echo bullish outlook for the altcoin.

LUNA hovers just below the 0.78% Fibonacci Retracement level. A daily close above $85.0 will push LUNA price back into a higher trajectory with the first upside target at the previous session high of $97.0.

Next, the market participant will keep their eyes on the psychological $100.0 mark.

Technical Indicators:

RSI: The daily Relative Strength Index (RSI) trades at 64 after slipping below the overbought zone. It still reads above the midline with a positive bias.

MACD: The Moving Average Convergence Divergence hovers above the midline suggesting the continuation of the uptrend.

But trading volume is declining since February 4 as prices are moving higher. A spike in sell order could test 0.618% Fibonacci retracement level at $76.76.

Furthermore, a break below the mentioned level would next see test the horizontal support line at $70.0.

In the past month, Terra has outperformed the broader cryptocurrency market with extreme volatility in the market. Terra’s price has surged 93% from the lows of $47 to the swing highs of $91.

LUNA price has pierced above the 50-day Exponential Moving Average (EMA) at $58.29 since February 24.

As of writing, LUNA/USD is trading at $85.75, up2.78% for the day.