LUNA’s price shows an interesting setup after the recent Bitcoin-induced pullback on 31 March. The price action developed over the course of last month suggests that a massive run-up is around the corner.

An explosive rally awaits LUNA

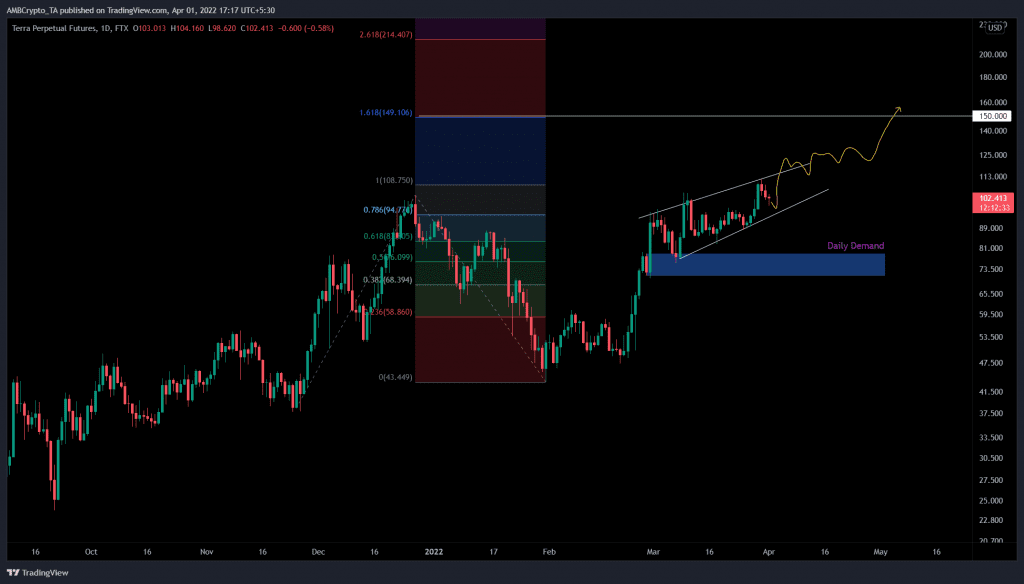

LUNA’s price has set up three higher highs and three higher lows since 28 February. Connecting these swing points using two trend lines reveals a rising wedge. This technical formation is a bearish setup, it forecasts a 20% downswing to $78.91. And, it is determined by adding the distance between the first swing high and swing low to the breakout point.

While this outlook is plausible, something completely opposite can also occur. Investors should expect LUNA’s price to break the upper trend line and continue moving north. Although the pattern should break out lower from a theoretical standpoint. However, in an excessively bullish market, rising wedges can breach the upside.

Using the Fibonacci extension tool, market participants can forecast probabilities of a new all-time high. On 29 March, Terra bulls pushed through the previous high and set a brand new high at $110.

Therefore, an uptick in buying pressure that breaches the rising wedge to the upside is likely to shatter the current ATH at $110 and make its way to a new one. Based on the Fibonacci extension tool, the 161.8% extension at $149 or roughly $150 could be where the LUNA price forms a local top.

While the technical outlook can sometimes be unnecessarily skewed to favor one camp, the on-chain metrics help balance out such biases. Well, the on-chain volume for Terra has shot up from 2.41 billion to 4.19 in less than four days.

The nearly 50% hike in on-chain activity suggests that investors are interested in LUNA at the current price levels. This paints a bullish outlook for LUNA’s price, further adding credence to the views expressed from a technical standpoint.

Regardless of a bullish outlook, In some cases, the price of LUNA could retrace to the daily demand zone, extending from $71.18 to $78.91 before surging higher. This move, while short-term bearish, could allow sidelined buyers to get a discount for their purchase and also provides a much higher return.

However, a daily candlestick close below $71.18 will invalidate the bullish thesis for LUNA and trigger a further descent to stable support levels.