The month of May witnessed the epic Terra, now Terra Classic [LUNC] collapse. This triggered massive liquidations in the crypto market. Many investors lost a significant portion of their earnings as tens of billions were wiped off the market in a matter of days.

Needless to say, crypto holders were perplexed over the future of Terra Classic [LUNC]. Even the respective stablecoin (UST, now USTC) suffered the same fate as it lost its $1 peg.

But now it looks like, the network is showing the path for investors/traders to return.

Classic(s) affair

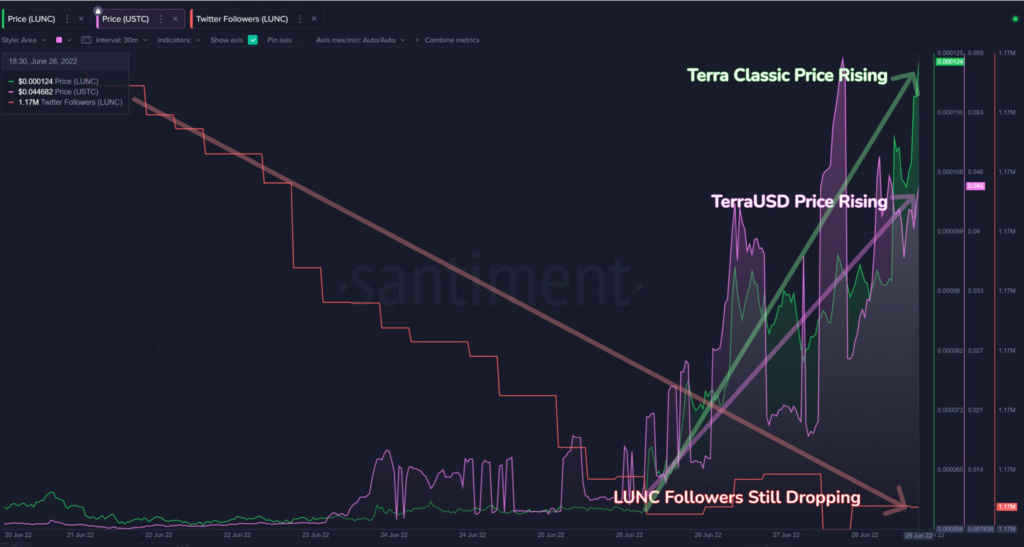

Terra classic [LUNC] witnessed an 80% surge while USTC showed around a 280% hike as per data from CoinMarketCap. However, at press time, the token traded at the $0.0013 mark while the stablecoin returned to the $0.08 mark.

Although still short of its $1 peg, both these tokens ‘have been all but abandoned by the crypto community over the past two to four months,’ as per Santiment.

The interest in Terra Classic might indicate that investors still believe the asset has a fighting chance in the crypto market. Additionally, Terra Classic received support from several cryptocurrency exchanges. For example, the crypto exchange service ChangeNOW enabled the trading of LUNA 2.0 and LUNC.

Moreover, the total number of unique addresses that hold assets in the Terra Classic chain increased by around 560% in the span of one month.

This so-called uptick even helped LUNC’s trading volume to register almost $1 billion. At the time of writing, the weekly volume stood at $901 million. The social volume and social dominance metrics saw some highs. It is, however, important to point out that these spikes could be attributed to the ephemeral pumps that the token recorded at these points.

Furthermore, the supply held by whales metric did not register an uptick. The retail traders are showing interest. But whales seem to be waiting cautiously as far as LUNC is concerned.

Anything fishy?

Well, LUNC‘s +107% and USTC‘s +320% respective rises in the past 55 hours are something that may merit increased attention soon- this includes the attention from the regulators as well.

As covered in the past, regulators didn’t quite see eye to eye with Terra’s founder- Do Kwon.