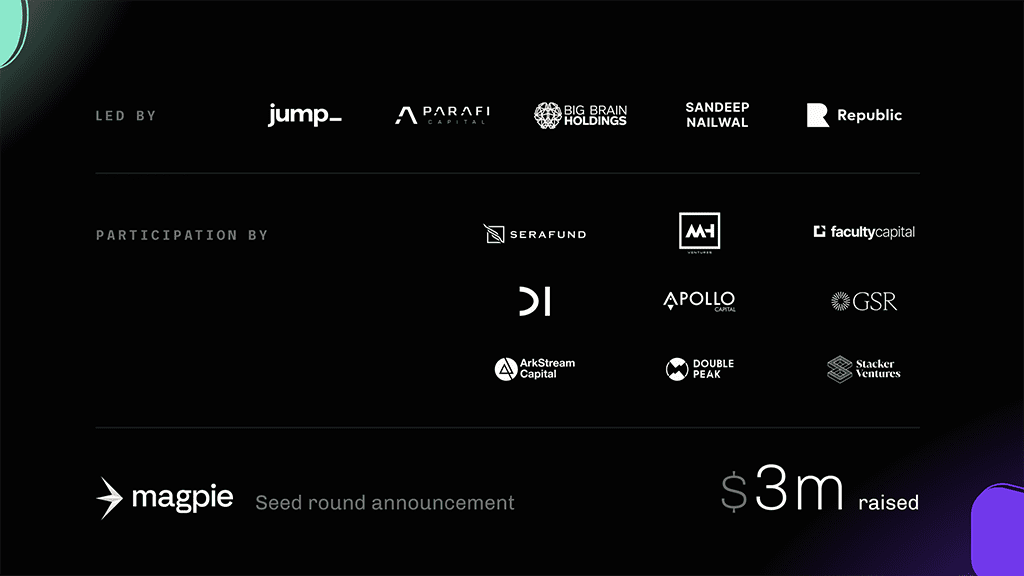

The team at Magpie Protocol is pleased to announce that our $3M Seed round has completed. With Jump’s assistance, Magpie Protocol is poised for success and is additionally supported by notable investors such as Sandeep Nailwal, GSR Markets, Parafi Capital, Republic Capital, Big Brain Holdings, Serafund, Faculty Group, MH Ventures, D1 Ventures, Arkstream, Apollo Capital, and more.

After seeing what Magpie Protocol is developing and offering to the crypto space, Jump Crypto, who looks for projects full of passion for DeFi and focused on innovation and is full of engineers, investors and traders consumed by building the future of DeFi, made the decision to cement itself as the lead investor in the project.

Saurabh Sharma, Head of Investments at Jump Crypto:

“As the crypto infra landscape expands multichain, Magpie’s cross-chain liquidity aggregation protocol and array of other cross-chain microservices offer the much needed abstraction layer and seamless execution for the end user.”

Next is GSR Markets, who partners with brave and brilliant entrepreneurs who are building the future of finance. GSR works with cryptocurrency projects at crucial points in their life cycle, providing robust liquidity that helps enable their technology. Together, we’re going to change the landscape of DeFi and the global economy. We’re very excited to be supported by them.

GSR Markets:

“We’re excited to be working with the Magpie Protocol team as they continue expanding decentralized liquidity provision to clients through bridge-less, cross-chain liquidity aggregation.”

Republic selects investments based on business fundamentals with a focus on unit economics, strategy and the opportunity to disrupt a market. All believe in Magpie Protocol to be a part of this changing of the future of DeFi and the global market.

Republic Capital:

“We are thrilled to be early backers of Magpie and its team. Interoperability is a key component of the crypto ecosystem, and we believe Magpie’s solution is one of the most elegant and easiest to use in the space.”

Magpie Protocol is a decentralized liquidity aggregation protocol for cross-chain swaps aiming to provide the best deal on any asset across top blockchains without the need to independently bridge assets. Instead, our novel architecture uses bridges primarily as a data transfer layer to communicate swap signals between chains. The result is an extremely fast and secure solution to cross-chain swaps.

Bridge security concerns are at the forefront of DeFi at this time, being a crucial component in promoting the trustless and inclusive foundations upon which DeFi is built. Most bridges are custodial, meaning users must entrust their tokens with the security of the bridge by locking assets in a smart contract. This centralisation of bridged assets creates single points of failure, which can put multiple ecosystems in danger if they are exploited. A recent report by Chainalysis, a blockchain data platform, estimates a total of $2 billion in cryptocurrency has been stolen from cross-chain bridges in 2022 alone. This goes to prove that creating a secure cross-chain bridge solution is a must in DeFi.

Mapgie is a project that was incubated by Saxon, who help idea-stage crypto entrepreneurs to launch game-changing DeFi and infrastructure projects. They provide holistic support, spanning from product market fit and business development to tokenomics and fundraising.

Ultan Miller, Saxon Managing Partner:

“It’s been a pleasure working with Ali and the wider Magpie team to bring this disruptive approach to cross-chain swaps to market. With the launch of a new generation of L1s (Sui, Aptos etc.) just around the corner, the timing could hardly be better.”

Magpie’s architecture uses bridges to communicate swap signals between chains, without the need to lock, burn, or mint assets on or within a bridge. By combining an off-chain liquidity network and bridge liquidity with a proprietary liquidity aggregation protocol, Magpie is chain-agnostic, meaning it is compatible and able to initiate swaps for the desired token on any chain, without limiting factors as other aggregation protocols, and whether or not the chain is EVM or not. Not only does this result in near instant finality for users, but it also enables Magpie to be fully non-custodial, by keeping assets in control of the user rather than a third party or bridge, which greatly improves security of users’ assets.

Dr. Ali Raheman – CEO & Founder:

“I’d like to personally thank all of our investors and team members for your support in Magpie. We’re all incredibly proud of the work the team has done thus far, but it’s only the beginning. Now the work begins for the next round of funding as well as preparing to launch our private and public alpha testing events in the coming weeks. It has been an amazing journey so far and we have a lot in store for us in the coming years.”

At the time of writing, Magpie Protocol is compatible with many established chains and DeFi protocols, including Ethereum, Polygon, Avalanche, and Binance Smart Chain. Additionally, we have announced plans to expand to Fantom, Solana, and other blockchains in the near future.

On the back of this successful raise, Magpie Protocol will continue expanding strategic relationships and partnerships once its private alpha testing has concluded..

For additional information on Magpie, check out our website and follow us on our socials: Twitter, Discord, Linkedin, Telegram, Medium.

Disclaimer: Coinspeaker is not responsible for the trustworthiness, quality, accuracy of any materials on this page. We recommend you conduct research on your own before taking any decisions related to the products/companies presented in this article. Coinspeaker is not liable for any loss that can be caused due to your use of any services or goods presented in the press release.

Subscribe to our telegram channel. Join